The corporate has a $100 billion asset that may pave the way in which for higher earnings.

With practically $650 billion in consolidated income throughout its fiscal 2024, Walmart (WMT -0.51%) is already one of many largest and Most worthy corporations on earth. As of this writing, its market worth is sort of $560 billion.

May Walmart attain a market valuation of $1 trillion by 2030? On one hand, it definitely appears attainable. In any case, that solely requires a 79% achieve from right here. Then again, 2030 is simply six years away. And a 79% achieve in six years will possible be difficult for a corporation as mature as Walmart.

Nevertheless, whereas it is true that Walmart is a mature, slow-growing enterprise on the floor, beneath the floor is a budding new enterprise alternative that would certainly carry the corporate over $1 trillion if issues go proper.

Walmart’s shiny new toy

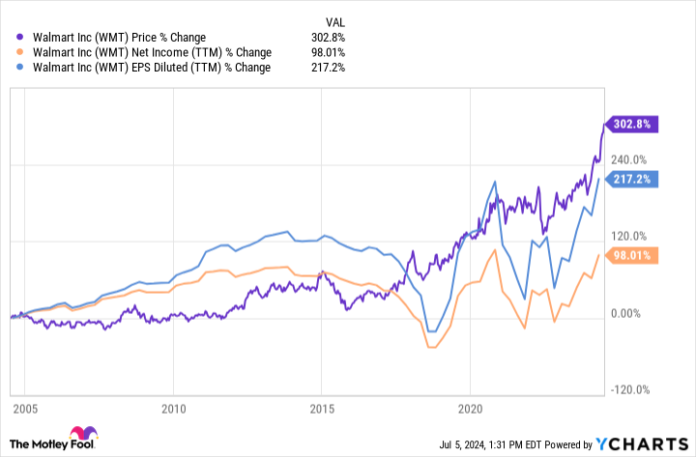

Earlier than I clarify Walmart’s potential path to $1 trillion, I ought to present ample context. The corporate is the world’s largest retail enterprise, sure. However its retail gross sales are very low-margin. Consequently, Walmart’s internet revenue has solely doubled during the last 20 years.

By way of share repurchases, Walmart’s earnings per share (EPS) have grown greater than internet revenue. However the chart beneath reveals that worthwhile development has been onerous to come back by over the past twenty years.

If Walmart had a solution to leverage its monumental scale right into a high-margin alternative, that might be enormous. And because it seems, the corporate does have a card up its sleeve that almost all buyers have ignored: e-commerce.

Walmart had over $100 billion in e-commerce gross sales in its fiscal 2024 (the interval that resulted in January), and that grew by 23%. Granted, what administration contains in its e-commerce quantity could be a little deceptive — shopping for on-line and choosing up on the retailer remains to be thought of e-commerce, for instance. However these are nonetheless digital gross sales nonetheless, and that is the important thing element right here.

Now that Walmart has so a lot of its clients transacting digitally, it could lean into two high-margin alternatives. The primary alternative is digital promoting. And the second alternative is third-party gross sales.

Take into account that Amazon‘s promoting enterprise remains to be comparatively younger, and it is generated practically $50 billion in income from promoting providers in simply the final 12 months. And in the newest quarter, promoting income was up a wholesome 24%.

For its half, Walmart’s promoting enterprise additionally grew by 24% in its most up-to-date quarter. Administration did not present a greenback quantity. However contemplating it had $3.4 billion in advert income in its fiscal 2024, it is possible now approaching $1 billion in advert income quarterly.

Turning to third-party gross sales, some buyers might not notice that impartial sellers can listing merchandise on Walmart’s e-commerce platform, similar to they will with Amazon. This does go hand in hand with digital promoting as a result of sellers will pay to advertise their listings. However Walmart additionally earns commissions when third-party merchandise promote, which is just about pure revenue.

Many retailers are out of the blue seeing potential with Walmart’s market. In its fiscal first quarter of 2025, sellers on Walmart’s market have been up 50% 12 months over 12 months. This brings extra merchandise onto the platform and doubtlessly extra consumers. If these merchandise promote efficiently, Walmart will revenue from commissions and from elevated promoting as sellers compete extra.

What it means for buyers now

For the needs of this text, let’s assume that Walmart inventory is fairly valued now and has the identical valuation in 2030. In different phrases, if the corporate reaches a valuation of $1 trillion, let’s assume that it is the firm’s earnings that get it there.

On this state of affairs, Walmart’s earnings would want to go up about 80% over the following six years. Proper now, the corporate has about $19 billion in trailing-12-month internet revenue. Due to this fact, it might want to search out an extra $15 billion in annual revenue.

The dimensions of Amazon’s promoting enterprise means that Walmart has loads of room to develop there. And with the speed that sellers are becoming a member of its market, commissions from third-party gross sales might additionally growth in coming years.

To be honest, Walmart solely expects round 6% development for its working earnings this 12 months — that is behind the tempo it might must develop its earnings 80% by 2030. Due to this fact, Walmart is not assured to grow to be a trillion-dollar firm inside the subsequent six years. However given the energy and development of its digital enterprise, I additionally would not take the opportunity of stronger development in future years off of the desk.

Walmart is among the largest retail companies on the earth. And it could grow to be a trillion-dollar firm because it leverages its digital platform for increased earnings.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Walmart. The Motley Idiot has a disclosure coverage.