Nvidia (NVDA -0.75%) is without doubt one of the greatest names within the synthetic intelligence (AI) semiconductor area. It’s the dominant participant out there for information heart graphics playing cards, and the excellent news for potential buyers is the inventory has been below stress in 2025.

Nvidia has misplaced 12% of its worth yr to this point regardless of delivering strong fiscal 2025 leads to late February, together with steerage that implies its spectacular progress is right here to remain. Let’s check out the the reason why Nvidia might bounce again and clock wholesome good points within the subsequent yr.

Nvidia’s management over the AI chip provide chain ought to translate into extra progress

Cloud computing giants and governments throughout the globe depend on Nvidia’s graphics processing models (GPUs) for AI mannequin coaching and inference. The corporate’s dominance within the information heart GPU market is so sturdy it has left little or no enterprise for rivals akin to Intel and AMD.

That is evident from the $115.2 billion in information heart income it generated in fiscal 2025 (ended Jan. 26). In the meantime, AMD bought $12.6 billion of information heart chips in 2024, and Intel’s information heart and AI section reported $12.8 billion of income final yr.

With such a giant lead over its rivals, Nvidia has additionally been capable of declare a big chunk of the business provide chain. In accordance with Taiwan-based Financial Every day Information, Nvidia has cornered 70% of Taiwan Semiconductor Manufacturing‘s superior chip packaging capability for this yr.

On condition that TSMC’s chip capability is predicted to greater than double in 2025, adopted by one other enhance of 80% in 2026, Nvidia ought to be capable of churn out sufficient AI chips to satisfy the terrific demand for its newest era of Blackwell AI GPUs.

Third-party checks point out the demand for Blackwell chips is exceeding provide, so an improved provide chain will assist the corporate fulfill orders and ship stronger progress within the coming quarters.

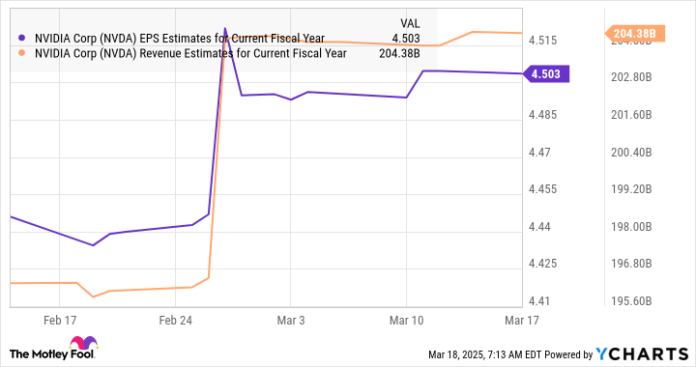

Not surprisingly, there was a bump in analysts’ progress expectations for Nvidia within the present yr after it launched its fiscal 2025 outcomes.

Information by YCharts.

The consensus estimates above indicate a minimum of 50% income and earnings progress in fiscal 2026. Nevertheless, Nvidia says its gross margin will begin heading increased as soon as it completes the manufacturing ramp-up of its Blackwell processors. The corporate is at the moment prioritizing output to satisfy demand, and throughout the newest earnings name, CFO Colette Kress famous Nvidia will “have many alternatives to enhance the price” as soon as manufacturing is in full swing. In consequence, gross margin ought to bounce from the low-70% vary within the earlier a part of the fiscal yr to the mid-70% vary within the latter half.

Analysts predict a pleasant bounce within the coming yr

Of the 67 analysts protecting Nvidia, 93% have rated it a purchase. What’s extra, its 12-month median worth goal of $175 is 52% increased than the place the inventory trades as of this writing.

Nvidia might certainly method that worth goal if profitability improves because the yr progresses. The inventory’s ahead price-to-earnings a number of of 26 can be close to its lowest level previously yr.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends the next choices: brief Might 2025 $30 calls on Intel. The Motley Idiot has a disclosure coverage.