What’s in retailer for IonQ within the subsequent three years? Try three very completely different attainable situations before you purchase that quantum computing inventory.

Quantum computing could change the way you consider computer systems sometime. The expertise guarantees to resolve issues a digital pc merely cannot deal with, whereas additionally rushing up very sluggish computing duties. In principle, quantum computer systems must be nice at discovering patterns in unstructured knowledge, which is useful for a lot of real-world makes use of. The expertise could flip many industries the other way up and inside out, together with healthcare analysis, monetary providers, and cryptocurrencies.

However that is a long-term promise. Quantum computer systems are cumbersome and costly to date, and their number-crunching powers aren’t terribly spectacular but. Many of the proposed use instances and algorithms for this new class of computing {hardware} require a whole lot, hundreds, or tens of millions of so-called qubits (readable quantum entanglements) earlier than they’ll outperform old-school digital machines.

Researchers have cracked the 1,000-qubit barrier however these experimental programs depend on costly superconductors and include problematic charges of information error. In the present day’s high {hardware} for business use solely have a few dozen qubits.

IonQ (IONQ 0.78%) is an early chief in quantum computing programs. The corporate lately shipped its first worldwide order, adopted by a $54.5 million analysis contract with the U.S. Air Power. However these achievements already occurred, and buyers are extra concerned about what’s subsequent.

So, what function will IonQ play within the quantum computing market 3 years from now? Is that this the very best quantum computing inventory to purchase at the moment?

Let’s make an informed guess.

Why you must take note of IonQ

There’s rather a lot to love about IonQ at the moment. Here is a small pattern of investor-friendly occasions:

- The corporate has exceeded Wall Road’s bottom-line expectations within the final two quarters. The streak of constructive income surprises stretches all the best way again to the spring of 2023. In different phrases, IonQ buyers are getting used to stable earnings stories.

- Analysis and growth is the lifeblood of the quantum computing trade proper now, and IonQ makes heavy investments in that essential operate. R&D budgets rose 57% year-over-year within the second quarter, amounting to 52% of the entire working bills.

- The costly analysis is bearing fruit, too. IonQ has achieved 99.9% accuracy in a two-qubit system, paving the best way to a 99.999% goal by the top of 2025. The corporate additionally hopes to construct commercial-grade programs with 100 qubits or extra at that time.

That essential R&D dedication is not low cost

However IonQ is not excellent. Listed here are a number of of the problems that discourage me from shopping for its inventory at the moment:

- That R&D finances additionally works out to 274% of IonQ’s income in the identical quarter. It reported a web lack of $37.6 million within the second quarter, primarily based on $11.4 million of top-line revenues in the identical interval.

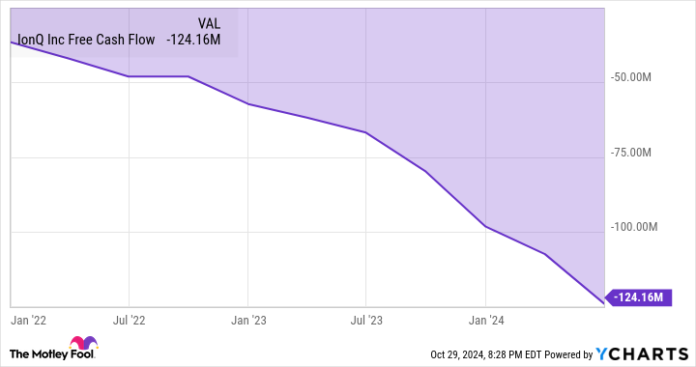

- The corporate raised $573 million when it joined the general public market in 2021, merging with a particular function acquisition firm (SPAC). It had $370 million of money equivalents three years later, having burned via one-third of its money reserves at an accelerating charge. How lengthy will it take earlier than IonQ has to signal debt papers or run a big inventory sale to maintain the lights on within the laboratories?

IONQ Free Money Movement knowledge by YCharts

- I am speaking about an early chief within the commercialization of quantum computing, however it’s removed from the one identify within the enterprise. IonQ is up towards deep-pocketed competitors, led by tech giants IBM (IBM -2.63%), Alphabet (GOOG 2.92%) (GOOGL 2.82%), and Microsoft. Outperforming that brutal lineup will not be straightforward, and any of them may merely purchase IonQ if the corporate turns into too profitable.

The place IonQ may stand in 2027

The best way I see it, IonQ could possibly be both an enormous winner or a cash-strapped underdog in three years. It may also have develop into a small subsidiary of a a lot bigger firm, maybe giving early buyers a beneficiant buyout premium.

I would want a complicated quantum pc to determine the percentages of every attainable situation. Till these programs develop into secure, commonplace, and inexpensive, I would as nicely flip a three-sided coin or roll some cube to make that funding choice.

And that is why I do not personal IonQ inventory but — it is extra of a chance than an funding at this level.

For now, I am comfortable to look at the quantum computing area from a premium seat on the sidelines, sponsored by my holdings in IBM and Alphabet. These giants are no less than as seemingly as IonQ to dominate this newfangled trade in the long term, they usually’re already giants of different fields at the moment. I will preserve a detailed eye on IonQ’s progress, however it’s too dangerous for my style proper now.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet and Worldwide Enterprise Machines. The Motley Idiot has positions in and recommends Alphabet and Microsoft. The Motley Idiot recommends Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.