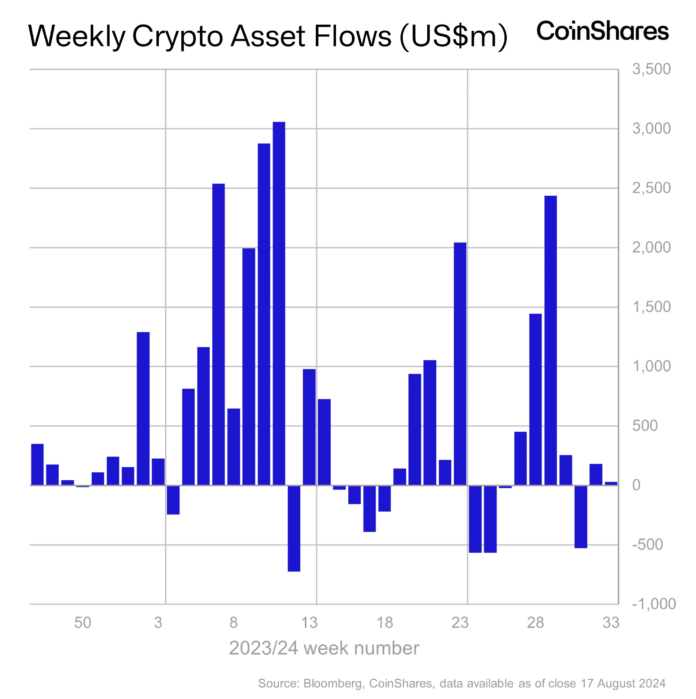

Digital belongings supervisor CoinShares says that institutional crypto traders poured solely minor inflows of capital into digital asset funding merchandise final week.

In its newest Digital Asset Fund Flows report, CoinShares says that Ethereum (ETH) competitor Solana (SOL) institutional crypto funding merchandise noticed file outflows final week amid an obvious lack of curiosity in memecoins.

“Solana noticed outflows of US$39m, the most important on file, because it confronted a pointy decline in buying and selling volumes of memecoins, on which it closely depends.”

In line with CoinShares, final week marked an enormous drop in buying and selling volumes for institutional funding merchandise because of a change in expectations of the Federal Reserve’s subsequent transfer.

“Weekly buying and selling volumes on funding merchandise fell to almost 50% of the week prior at US$7.6bn, as current macroeconomic knowledge implied the FED have been much less more likely to minimize rates of interest by 50 foundation factors in September.”

Regionally, the Americas, together with the USA, Canada, and Brazil, introduced in $78.4 million in inflows whereas Switzerland and Hong Kong mixed for $44 million in outflows.

The main crypto by market cap, Bitcoin (BTC), led funding merchandise with probably the most inflows at $42 million.

Whereas ETH and XRP merchandise introduced in $4.2 million and $0.2 million respectively, multi-asset funding autos noticed $21 million in inflows.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/tykcartoon/WhiteBarbie