A Wells Fargo analyst just lately raised the corporate’s value goal for RTX (RTX 0.98%) inventory to $151 from a earlier goal of $140 and maintained an “chubby” ranking on the inventory. As such, it represents a 31% premium to the present value, however is the brand new goal warranted?

The case for RTX inventory

The Wall Road consensus has RTX producing $8.4 billion in free money stream (FCF) in 2026, which, primarily based on the present market cap of $153 billion, would put RTX on a price-to-FCF a number of of 18.2 instances 2026 FCF — the Wells Fargo analyst makes an identical argument primarily based on earnings.

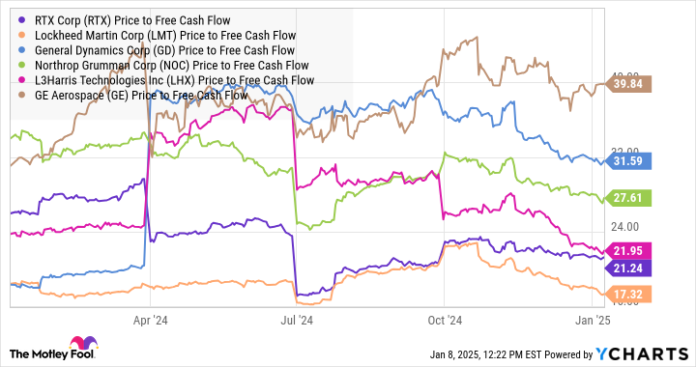

As you possibly can see beneath chart, a few of its aerospace and protection friends commerce on considerably increased multiples proper now, and hitting the worth goal of $151 would put RTX on a price-to-FCF a number of of slightly below 24 instances FCF in 2026.

RTX Value to Free Money Circulation information by YCharts.

The bullish case is supported by a superb yr for RTX because it largely overcame the GTF engine inspections subject, and wonderful aftermarket gross sales helped overcome weak point in unique tools (OE) gross sales because of disappointing airplane manufacturing at Boeing and Airbus. As well as, RTX’s protection enterprise Raytheon improved adjusted working revenue margins in each reported quarter of 2024 up to now.

Picture supply: Getty Photos.

Is RTX inventory a purchase?

That stated, relative valuation arguments are harmful if the entire sector is overvalued and protection inventory valuations look stretched. The trade stays challenged by the U.S. authorities’s try and pressure fixed-price growth applications onto protection corporations, and there is no assure that the present elevated spending ranges will proceed in an trade historically seen as a low single-digit grower.

In the event you imagine there’s nothing elementary to vary the view that RTX’s protection enterprise will return to a low single-digit progress charge, then the above valuations are usually not low-cost sufficient to justify a $151 value goal.

Wells Fargo is an promoting companion of Motley Idiot Cash. Lee Samaha has no place in any of the shares talked about. The Motley Idiot has positions in and recommends L3Harris Applied sciences. The Motley Idiot recommends GE Aerospace, Lockheed Martin, and RTX. The Motley Idiot has a disclosure coverage.