Warren Buffett, the CEO of Berkshire Hathaway, is adopted with virtually spiritual zeal on Wall Avenue. When he overtly backs an organization, it typically leads others to purchase that inventory with out query. Occidental Petroleum (OXY -1.35%) has acquired Buffett’s assist. However most buyers in search of power publicity would most likely be higher off with one among these two oil giants (one among which is owned by Berkshire Hathaway, too).

What Buffett did for Oxy

It might look like a lifetime in the past at this level, however in 2019 Chevron (CVX -0.34%) was trying to purchase Anadarko Petroleum. Occidental Petroleum, typically simply often called Oxy, stepped in with a counteroffer. Ultimately, Oxy received out due to Buffett and Berkshire Hathaway offering it with the monetary help it wanted to outbid Chevron. Chevron selected to stroll away as a substitute of getting right into a bidding struggle that may result in overpaying for Anadarko.

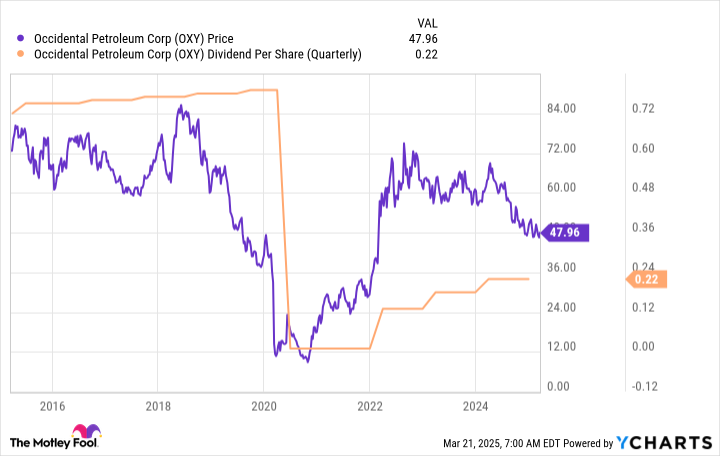

The deal left Oxy closely in debt, and when oil costs plunged through the early days of the coronavirus pandemic in 2020, the corporate minimize its dividend. The dividend just isn’t but again to its pre-cut stage. This is not to counsel that Oxy is a nasty power firm. In actual fact, it has been engaged on increasing its enterprise and doing a fairly good job of it. It just lately purchased CrownRock, for instance, additional increasing its place within the U.S. market. However many long-term buyers will not be effectively served by the corporate’s method, significantly if making a dependable and resilient revenue stream is a part of the objective of shopping for an power inventory.

A long time of proof from ExxonMobil and Chevron

Earnings buyers who care about dividend consistency will discover ExxonMobil (XOM -0.18%) and Chevron rather more enticing. ExxonMobil has elevated its dividend yearly for 42 consecutive years, whereas Chevron’s streak is as much as 37 years. A notable distinction between Oxy and these two built-in power giants is discovered on the steadiness sheet.

OXY Debt-to-Fairness Ratio information by YCharts.

Whereas Oxy’s debt-to-equity ratio has fallen dramatically because the post-Anadarko spike, it’s nonetheless multiples of the degrees of leverage at ExxonMobil or Chevron. That is vital as a result of ExxonMobil and Chevron tackle debt throughout trade downturns to assist each their companies and their dividends. Having ample leeway to do that protects their shareholders. Oxy would not have as a lot leeway.

Additional including to the attractiveness of ExxonMobil and Chevron are their dimension and diversification. With operations spanning from the upstream (power manufacturing) by the midstream (pipelines) and into the downstream (chemical and refining), their enterprise fashions assist to melt the conventional peaks and valleys of the power cycle. Add in international footprints and market caps of $500 billion for ExxonMobil and $290 billion for Chevron, they usually have a scale and attain (business-wise and financially) that $45 billion-market-cap Oxy actually cannot match.

Then there’s the merely modest revenue stream you will generate with Oxy and its 2% dividend yield. The typical yield for an power inventory is 3.1%. ExxonMobil’s yield is 3.4%, and Chevron’s yield is 4.1%. Add all of it up, and for each income-focused buyers and conservative buyers, Oxy ought to most likely get replaced by both ExxonMobil or Chevron.

There’s another Buffett wrinkle

In one thing of an fascinating twist, Occidental Petroleum is not the one oil inventory that Warren Buffett owns in Berkshire Hathaway’s portfolio. He additionally owns Chevron. So, if you need an power inventory with Buffett’s assist, going with Chevron over Oxy would not truly lose you something. That mentioned, if you happen to want to stay with trade giants, then ExxonMobil ought to be your decide. Both one will probably be a more sensible choice for buyers centered on security and revenue.

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and Chevron. The Motley Idiot recommends Occidental Petroleum. The Motley Idiot has a disclosure coverage.