Decrease charges might lastly be on the horizon.

The most important information of the week wasn’t earnings — it was a lower-than-expected studying of inflation. In response to the Bureau of Labor Statistics, shopper costs rose 3.3% from a 12 months in the past in Might, however that was down from 3.4% in April and was beneath expectations.

Hypothesis ran rampant the Federal Reserve would reduce rates of interest on account of decrease inflation to stimulate the economic system and stave off what might turn into a deflationary atmosphere in some components of the economic system. Fee cuts have not occurred but, however these market indicators elevated the percentages they’ll occur this 12 months.

In response to knowledge supplied by S&P International Market Intelligence, shares of Zillow (ZG -1.10%) jumped as a lot as 14% on the inflation information, Nextdoor (KIND 1.20%) jumped 17.2%, and Sunnova Vitality (NOVA -2.56%) rose 12.7% at its peak. The shares closed the week up 12%, 14.5%, and eight.6% respectively.

Will housing make a comeback?

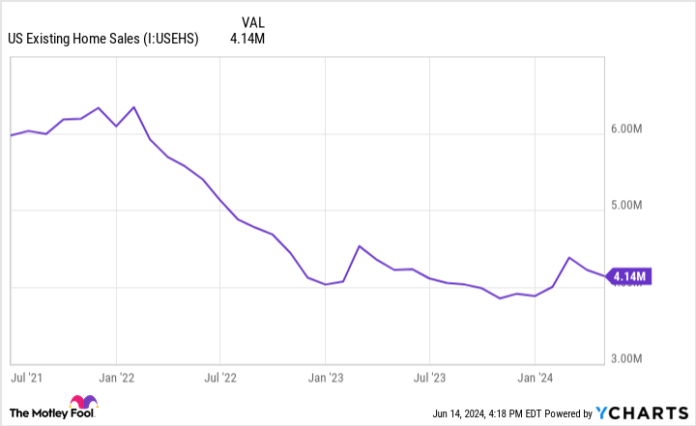

All three shares are finally depending on the housing market, which has been in a funk for a lot of the final 12 months. Greater rates of interest make it tougher to afford properties and finance photo voltaic tasks. The influence on all three firms is oblique however clear.

US Current Dwelling Gross sales knowledge by YCharts

Whereas the short-term hypothesis is that charges will come down, we have not seen a giant transfer in that route. The 1-year Treasury yield dropped barely this week, and there are indicators mortgage charges are beginning to come down, however that may take time.

1 Yr Treasury Fee knowledge by YCharts

The influence of decrease charges

Charges are necessary for homebuyers as a result of decrease ones make month-to-month funds extra inexpensive. And extra quantity by way of the actual property system is finally how Zillow makes its cash.

Sunnova is extra instantly impacted as a result of it strains up financing for photo voltaic tasks, and prospects can merely select to not set up photo voltaic if the numbers do not make sense. Greater charges led to an enormous decline in photo voltaic installations in 2023, and any reprieve can be welcome.

Nextdoor’s huge transfer

The rationale Nextdoor is up could also be just a little extra puzzling. Shares dropped sharply late final week, and this week its CEO was named CFO of OpenAI.

I additionally suppose traders are in search of any cause to bid up an organization that is been shedding cash like loopy since coming public. Will decrease charges assist? In all probability not, nevertheless it’s high-risk, money-losing shares that usually react first when charges fall.

KIND Income (TTM) knowledge by YCharts

Quick-term strikes and long-term influence

I do not suppose any of those strikes have been significantly significant to the long-term trajectory of those firms. Decrease rates of interest might finally assist revive the housing market and drive extra photo voltaic installations, however one inflation studying is not sufficient to trigger a turnaround.

An actual restoration in these companies will take years, and if that is the form of timeframe you have got, this is usually a good shopping for alternative. However the short-term transfer is noise and is not what long-term traders ought to be targeted on. I am going to look forward to extra earnings progress to be a purchaser, particularly within the photo voltaic restoration anticipated in 2024.

Travis Hoium has positions in Zillow Group. The Motley Idiot has positions in and recommends Nextdoor and Zillow Group. The Motley Idiot has a disclosure coverage.