The chief government of a outstanding crypto analytics agency believes that the Bitcoin (BTC) bull market has sufficient gasoline to witness extra rallies.

CryptoQuant CEO Ki Younger Ju tells his 401,300 followers on the social media platform X that demand for Bitcoin spot market exchange-traded funds (ETFs) continues to be going robust, indicating that deep-pocketed traders are positioning for extra BTC rallies.

Ki notes that he thinks BTC will print a market cycle high as soon as demand for Bitcoin ETFs tapers off.

“The Bitcoin bull cycle isn’t over.

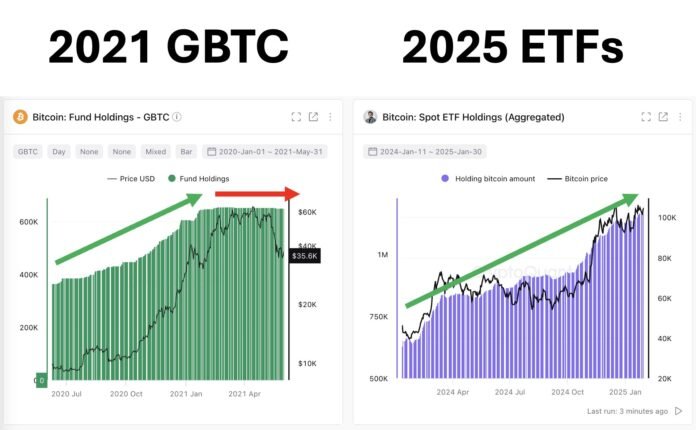

The shopping for engine for paper Bitcoins continues to be operating. In 2021, the downturn got here two months after GBTC (Grayscale Bitcoin Belief) inflows dried up.

No must rush calling the cyclical high till ETFs, MSTR (MicroStrategy), and institutional shopping for decelerate.”

At time of writing, Bitcoin is buying and selling for $99,669.

Turning to altcoins, Ki believes that traders will see alts in a distinct mild in 5 years. In keeping with the analyst, most altcoins will cease serving as speculative belongings as he believes traders will worth them based mostly on their earnings – very like how they worth shares.

“The period of altcoins present solely as a measure of web consideration span can be over inside 5 years. Meme cash will persist as playing merchandise…

Past these, altcoins which can be really constructing will evolve into employment contracts for web data staff. It’s plain future that these altcoins will evolve into an web financial framework that permits compensation for the worth generated within the processes of data creation, distribution, and acquisition.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in online marketing.

Generated Picture: DALLE3