26 Jan Bitfinex Alpha | Within the Absence of Spot Demand, BTC Is Drifting

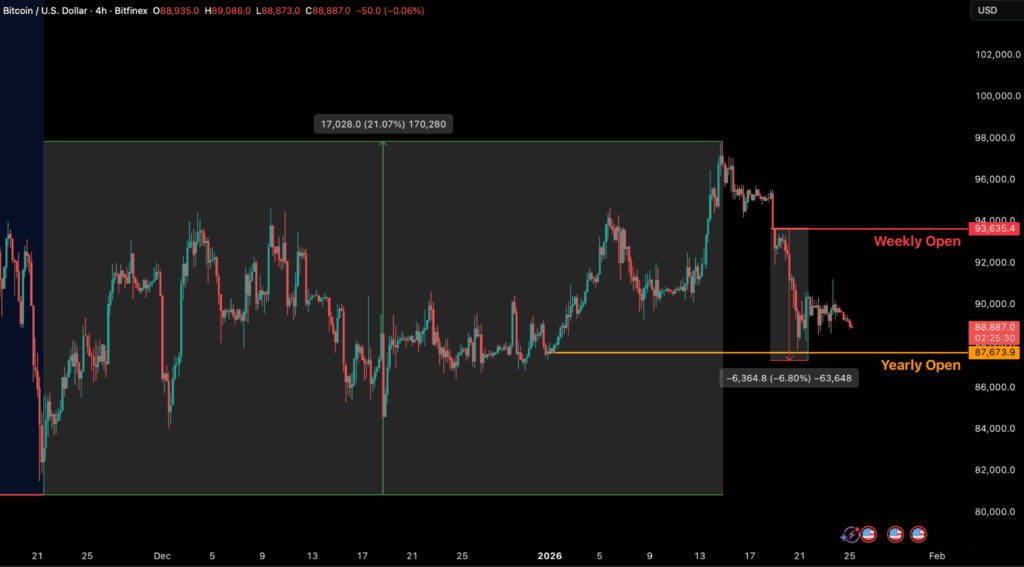

Bitcoin’s try to interrupt larger has stalled, with the value failing to carry above the $95,000–$98,000 resistance zone and slipping again into its established vary. After peaking at $97,850 in mid-January, BTC retraced greater than 10 p.c, falling beneath the yearly open as spot shopping for momentum light and ETF outflows intensified. The rejection of any upward positive factors has taken place close to the short-term holder value foundation, highlighting a fragile equilibrium, the place draw back continues to be absorbed however upside progress is constantly met by distribution from prior-cycle consumers. Derivatives positioning has reset in an orderly method, and the volatility response stays confined to the very quick finish of the curve, suggesting event-driven warning relatively than a broader regime shift. Within the absence of renewed spot and ETF demand, Bitcoin is more likely to stay range-bound, with consolidation prevailing till a clearer demand catalyst emerges.

Geopolitical uncertainty has contributed to market volatility, most notably throughout the current escalation, after which subsequent de-escalation, of US strategic ambitions in Greenland. Whereas tariff threats briefly triggered a risk-off response throughout equities and noticed volatility spike, the fast pullback in coverage rhetoric restored near-term stability. Nevertheless, investor positioning means that markets view current rebounds as stabilisation relatively than a return to expansionary circumstances.

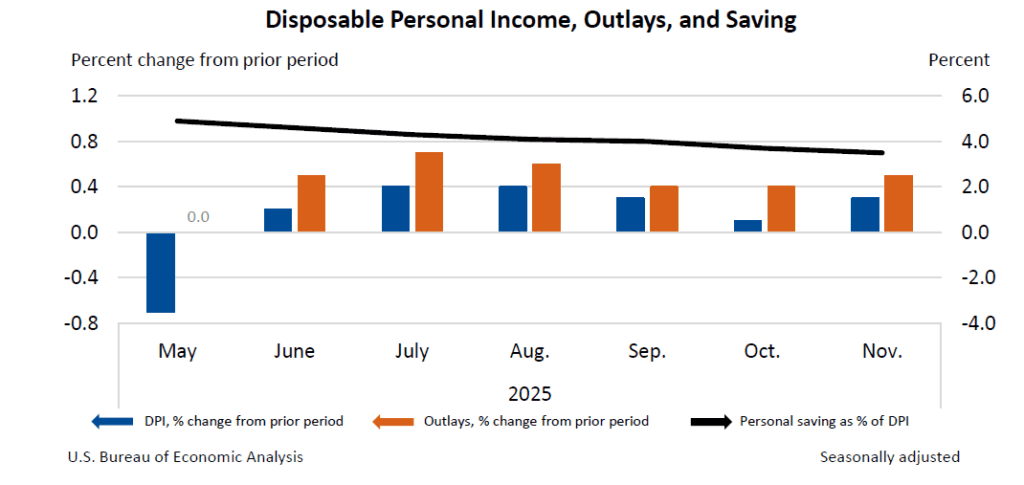

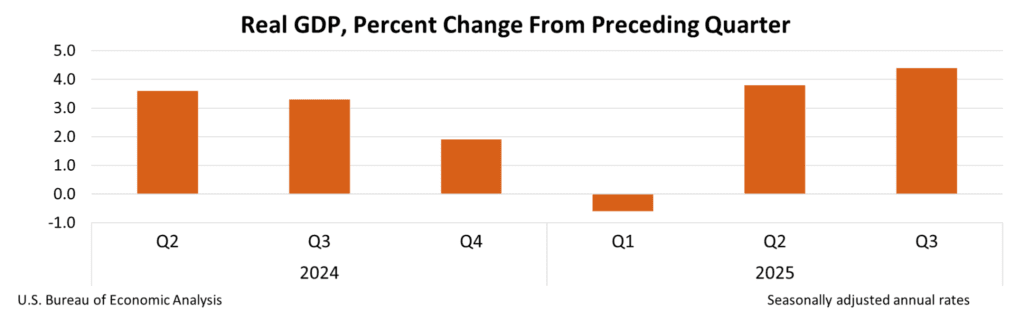

US financial development, alternatively, stays resilient, supported by sturdy shopper spending, however the enlargement is more and more constrained by persistent inflation, weakening family financial savings, and tightening monetary circumstances. Whereas demand has stored output above pattern, earnings development has lagged, forcing households to rely extra closely on credit score. Elevated costs, notably for important items, proceed to weigh on lower- and middle-income households, limiting the Federal Reserve’s means to ease coverage regardless of indicators of cooling within the labour market. Because of this, financial circumstances are more likely to stay restrictive till clearer and broader-based disinflation emerges.

Monetary markets are reinforcing this warning via a broad repricing of danger. Rising long-term yields, a better time period premium, and the weird mixture of US greenback weak spot alongside bond market stress sign rising concern round fiscal sustainability, coverage stability, and geopolitical danger. Capital has steadily rotated towards defensive property, indicating that monetary circumstances are tightening in apply whilst coverage charges ease on the margin.

Inside this setting, longer-term structural shifts proceed to take form. The New York Inventory Alternate, through its mother or father Intercontinental Alternate, is launching a blockchain-enabled, 24/7 buying and selling venue for tokenised equities, reflecting the gradual integration of digital infrastructure into conventional markets. On the similar time, company adoption of digital property continues, with perennial consumers Technique and Bitmine Immersion Applied sciences increasing bitcoin and Ether holdings as long-term strategic reserves.