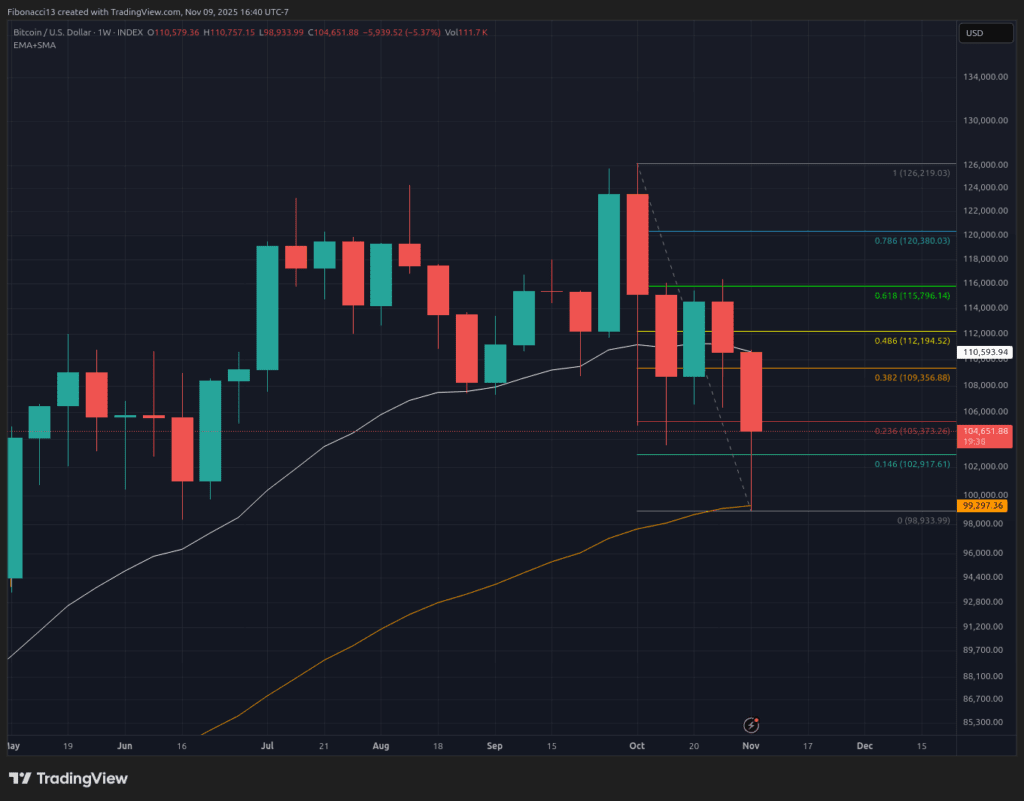

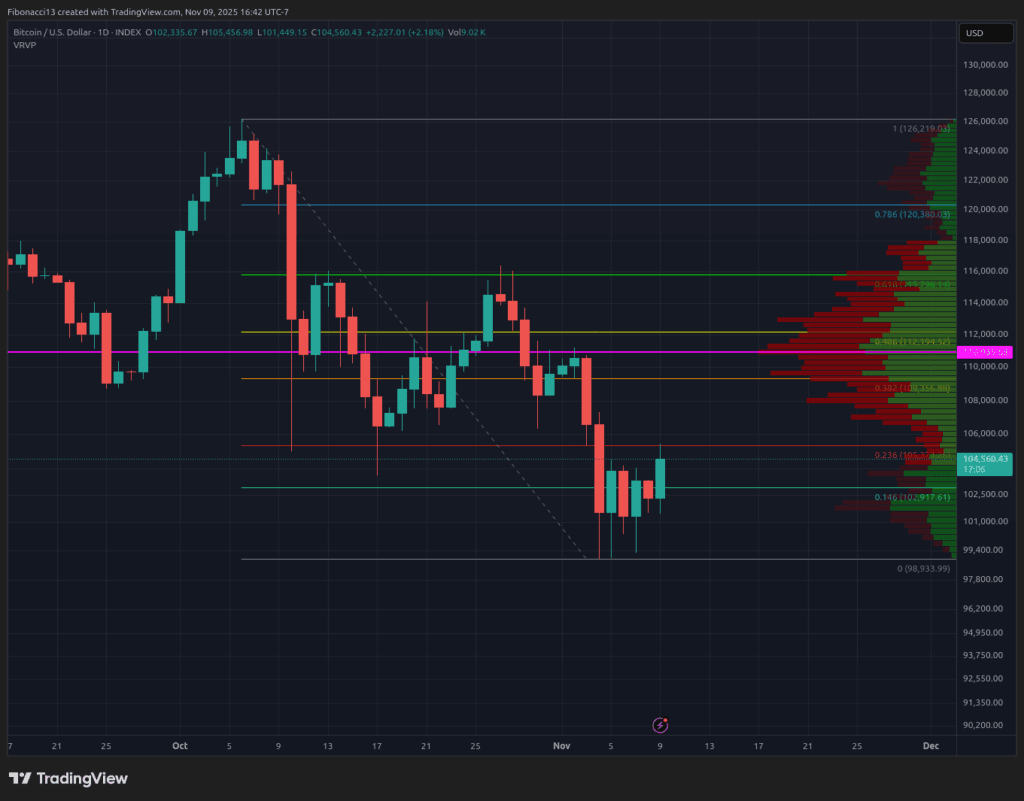

Whereas the bears dominated worth motion early final week, the bulls managed to indicate robust help beneath $100,000. Bitcoin worth dropped briefly beneath $100,000 on Tuesday, Wednesday, and Friday, however patrons stepped in every of these days to push the value again above $100,000, avoiding a day by day shut beneath this key degree. A small weekend rally allowed the bitcoin worth to reclaim the $104,000 help, closing at $104,700. Heading into this week, search for the $109,400 resistance degree to maintain a lid on issues, with $111,000 wanting like robust resistance if the value can transcend there.

Key Assist and Resistance Ranges Now

The weekly 55 EMA at $99,000 supplied robust help every time the value misplaced $100,000 final week. Bulls stepped up at this degree, front-running the $96,000 bull market help degree. Going ahead, bulls will search for the 55 EMA to carry as help after such a big transfer off of this degree final week.

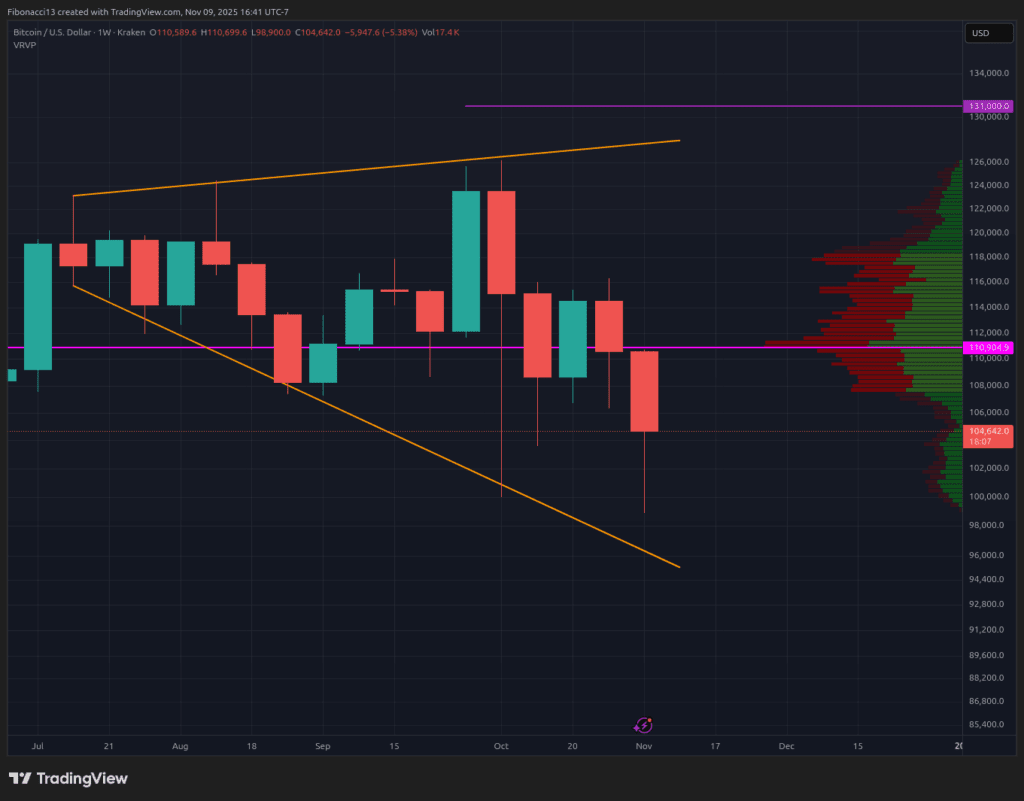

Because the bulls try and barge onward, the 0.382 Fibonacci retracement at $109,400 ought to present some resistance. Above right here, bears will search for the day by day level of management at $111,000 on the quantity profile to carry again the bulls. Past this degree, $116,000 sits as a gatekeeper for the bears, as closing above this degree will flip bias again over to the bulls. Market construction seems decisively extra bullish if the 0.618 Fibonacci retracement at $116,000 will be transformed to help. Bulls might even see a bit resistance at $129,000 on the high of the broadening wedge sample in the event that they handle to reclaim $116,000 as help, however I might not anticipate $129,000 to carry for lengthy if worth does certainly attain it.

Outlook For This Week

Rumours of the US federal authorities shutdown ending this week are prevalent. If each events can handle to kind out the filibuster, markets might get a lift this week. Bulls will search for the 0.146 Fibonacci retracement at $102,900 to carry as help on the day by day chart early this week, to take care of upward motion. The day by day chart might wrestle to shut above the 0.382 Fibonacci retracement at $109,400 even when it positive aspects some extra momentum. Dropping $100,000 this week can be very bearish and sure result in a take a look at of $96,000 at minimal, with potential for the value to crash even decrease to $93,000 and presumably even $84,000 beneath that.

Market temper: Bearish – Regardless of the energy proven by the bulls final week, the outlook continues to be bearish if we’re being sincere right here. A big crimson weekly candle shut continues to be bearish.

The following few weeks

The broadening wedge sample we have now been anticipating weeks right here just isn’t damaged but. So there’s nonetheless an opportunity the bulls can carry the value again to the highest pattern line round $129,000. Bias continues to be in favor of the bears right here, although, as presently, this sample continues to be more likely to break to the draw back. $116,000 is the important thing degree bulls must re-establish as help to get the value shifting again to new highs. Whereas the federal government shutdown was not overly bearish on markets initially, the lengthy period of it’s beginning to take a toll. If the US federal authorities can certainly get again to work quickly, it ought to present a lift to the Nasdaq, and in flip, this could assist present supportive circumstances for the bitcoin worth to reclaim some key resistance ranges. Any main macro bearish occasions incoming possible put an finish to bitcoin’s bull market, so total circumstances want to stay secure to foster extra upside.

Terminology Information:

Bulls/Bullish: Consumers or traders anticipating the value to go larger.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Assist or help degree: A degree at which the value ought to maintain for the asset, not less than initially. The extra touches on help, the weaker it will get and the extra possible it’s to fail to carry the value.

Resistance or resistance degree: Reverse of help. The extent that’s more likely to reject the value, not less than initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the value.

EMA: Exponential Shifting Common. A shifting common that applies extra weight to current costs than earlier costs, decreasing the lag of the shifting common.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Quantity Profile: An indicator that shows the full quantity of buys and sells at particular worth ranges. The purpose of management (or POC) is a horizontal line on this indicator that reveals us the value degree at which the best quantity of transactions occurred.

Broadening Wedge: A chart sample consisting of an higher pattern line performing as resistance and a decrease pattern line performing as help. These pattern traces should diverge away from one another with a purpose to validate the sample. This sample is a results of increasing worth volatility, usually leading to larger highs and decrease lows.