TRON’s token TRX has barely budged regardless of a flurry of on‑chain motion. Merchants noticed a 5% acquire over the previous week and a measly 0.50% uptick within the final 24 hours. However behind these delicate value strikes, there’s a storm of exercise that might form how TRX fares within the days forward.

Surge In On‑Chain Exercise

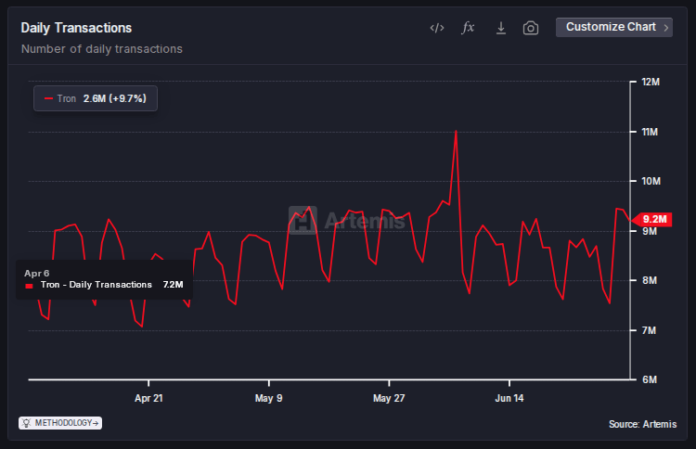

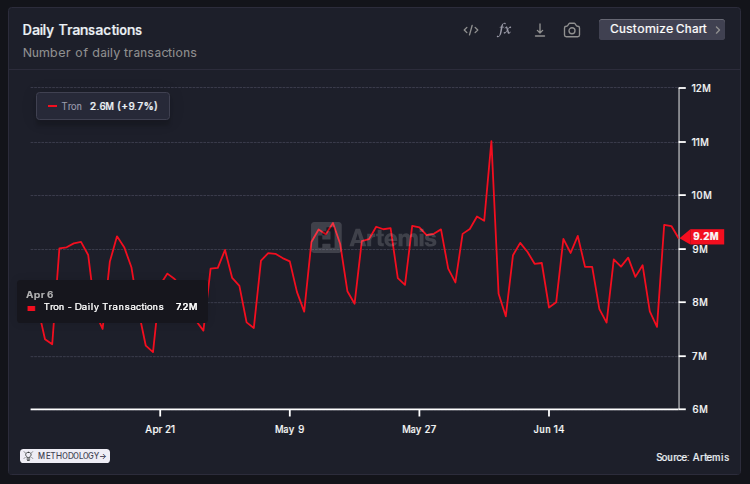

In line with information from Artemis, day by day transaction counts shot as much as over 9 million, up from 7.5 million the day earlier than. That leap in numbers despatched energetic addresses hovering.

On‑chain contributors climbed to 2.7 million, marking the best degree since June 6. Based mostly on stories, a lot of this site visitors seems tied to stablecoin transfers relatively than new customers or recent funding.

The spike in transaction quantity doesn’t match TRX’s value motion. That hole hints at wallets shifting funds out of exchanges, routing funds, or chasing yield elsewhere.

Customers aren’t speeding to carry TRX for its personal sake. They’re utilizing the community as a freeway after which driving off into different chains.

Stablecoin Outflows Hit Report Excessive

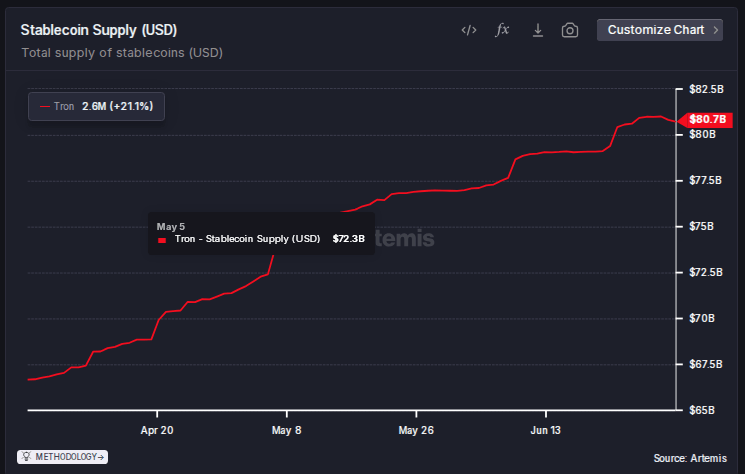

In line with Artemis, TRON’s stablecoin provide hit $80 billion in June, setting a brand new milestone for the community. Since then, about $185 million value of stablecoins have fled the chain.

That outflow marks a pointy reversal in person habits. Individuals who as soon as parked their USDT and different tokens on TRON look to be shifting them to new locations.

The pullback follows a broader rotation in crypto markets the place traders chase higher charges or decrease charges. TRON as soon as drew crowds for its low transaction prices. Now, competing chains and Layer 2 platforms are undercutting its edge. That has lower into TRX’s function because the community’s workhorse token.

Income And TVL Take A Hit

Artemis figures present that TRX’s whole income plunged to simply $114,000 in a single day. That quantity sits at a 4‑yr low. Community charges in TRON come from “bandwidth” and “power,” so when customers batch transfers or change to zero‑payment bridges, payment earnings collapses quick.

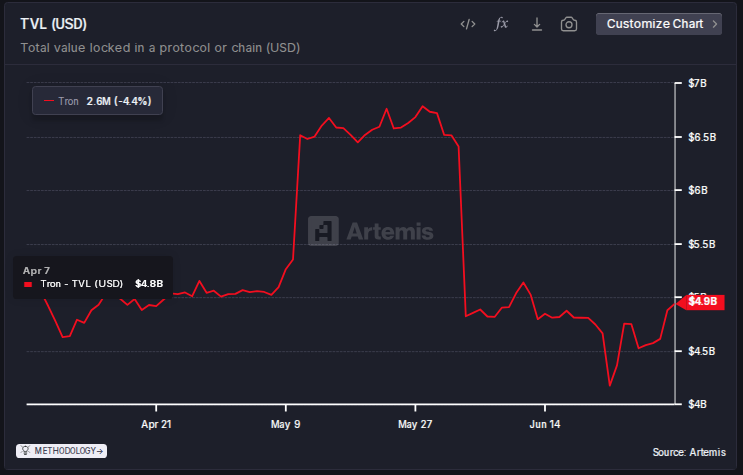

Based mostly on information from DeFiLlama, whole worth locked on TRON protocols fell by 0.50% in 24 hours, a drop from $4.80 billion to $4.85 billion. That’s about $26 million strolling out the door.

Whereas a half‑p.c transfer would possibly look small, it underlines a development. Each million {dollars} that leaves makes it more durable for lending swimming pools and yield farms to maintain their charges up.

Regardless of the outflows, TRX hasn’t damaged key assist ranges but. It nonetheless trades above areas that consumers defended in late spring. But when TVL retains sliding and stablecoins proceed to exit, we may see extra stress on the token’s value.

Featured picture from P2P.org, chart from TradingView