Investing is rarely about sooner or later, however sooner or later could be thrilling.

One other quarter, one other extremely anticipated earnings report from Tesla (TSLA -0.09%).

The corporate shall be giving an replace on its monetary statements to shareholders on Oct. 23, protecting the three months ending in September. Buyers shall be watching how income, revenue margin, and money circulate have modified and what it means for Tesla’s enterprise well being.

After the hyped-up “We, Robotic” occasion earlier this month fell flat and tanked the inventory, traders are on the lookout for Tesla to provide a win with this newest earnings launch. The inventory is off 46% from all-time excessive set in 2021, with income progress slowing down for the electrical automobile (EV) and renewable vitality big. Maybe it is a shopping for alternative for these centered on the long run.

Ought to traders purchase Tesla inventory earlier than its earnings report on Oct. 23?

Slowing deliveries progress, shrinking earnings

In the previous couple of quarters, Tesla has seen slowing progress in deliveries for its EV product strains. Deliveries had been 463,000 within the third quarter, up from 435,000 within the year-ago quarter however off from an all-time excessive quarterly determine of 485,000 reported in December final 12 months. The corporate has struggled to develop after reaching such a big scale as a consequence of how costly its automobiles are. It additionally would not assist that its solely new mannequin launched in the previous couple of years — the Cybertruck — is an costly area of interest product.

In an effort to transfer metallic, Tesla has enormously diminished the common promoting value of its automobiles. You may see this straight on its web site but additionally downstream in used automotive costs. Used Tesla automobiles value a mean of $32,000 immediately vs. over $50,000 at first of 2023.

Declining promoting costs have impacted Tesla’s gross margin and subsequently its bottom-line revenue margins. Gross margin was simply 18% final quarter in comparison with shut to twenty-eight% firstly of 2022. Working margin has adopted the identical route and was simply 8.73% final quarter.

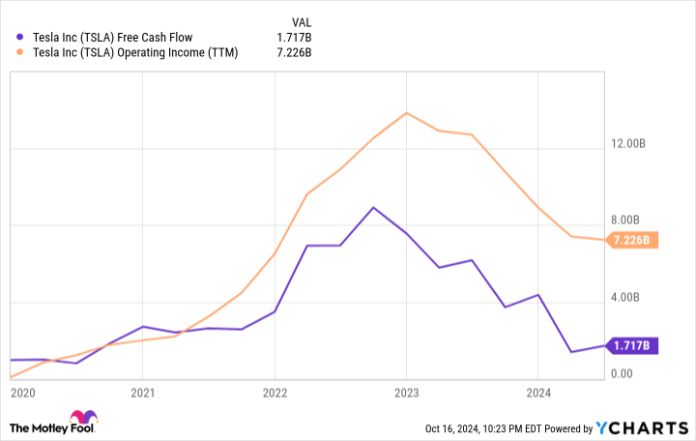

Shrinking margins have put Tesla’s free money circulate in reverse. Free money circulate was over $7.5 billion lower than two years in the past. Over the past 12 months, it has fallen to $1.7 billion and was unfavorable within the first six months of 2024. If the corporate is not cautious and lets this development proceed, it should start to burn lots of money quickly.

What about robots and self-driving automobiles?

With its “We, Robotic” occasion on Oct. 10, Tesla basically introduced a pivot from specializing in conventional automotive manufacturing to robotics and autonomous automobiles. It’s investing in a product referred to as the Cybercab that can act purely as a taxi however with no driver. It’s constructing a humanoid robotic referred to as Optimus to deal with menial duties. It’s constructing synthetic intelligence (AI) infrastructure and software program with its Dojo laptop. These appear to be the corporate’s primary focus as a substitute of updating its automobiles.

However an issue could happen. Deliveries for automobiles aren’t exhibiting a lot progress, which can affect Tesla’s free-cash-flow era, and this free money circulate is what’s fueling the investments into AI, robotics, and autonomous automobiles.

These initiatives are nowhere close to near business viability. In a best-case state of affairs, they are going to be profit-accretive to Tesla inside a couple of years, and a decade-long timeline is extra probably. CEO Elon Musk has been saying self-driving automobiles are only a few years away for the final decade and has continued to be unsuitable about how lengthy it should take. It could be unwise to wager on his optimistic timelines but once more.

If Tesla pushes all of its sources into these three cutting-edge applied sciences and so they take longer to come back to market than traders anticipate, we may see additional deterioration within the firm’s financials.

TSLA Free Money Movement information by YCharts.

There aren’t any indications that the EV division is able to take the subsequent step ahead, particularly as a result of we already noticed weak supply numbers but once more in Q3.

Stick with what the numbers inform you

Relating to Tesla, there are lots of competing narratives. The corporate has its arms in lots of pies and likes to placed on present for its product reveals, however traders are finest served by ignoring the flash and sticking to the numbers.

Tesla trades at a market cap round $700 billion. It generated $1.7 billion in free money circulate and $7.2 billion in working earnings over the past 12 months. Which means it is buying and selling at 400 occasions its trailing free money circulate and 96 occasions its trailing working earnings. Regardless of how formidable the corporate is, that is a lot too costly a value to pay for a inventory pushing a market cap of $1 trillion.

Most shares commerce at under 30 occasions earnings. Even the most effective progress shares sometimes solely commerce at 40 to 50 occasions earnings. Tesla is buying and selling a lot greater than this and simply posted underwhelming automobile supply figures.

There isn’t any motive to purchase Tesla inventory forward of its Q3 earnings report on Wednesday.