These two Buffett shares are too good to cross up for affected person, long-term traders.

Need to assist your portfolio? Watch what Warren Buffett is shopping for. His inventory picks have, on common, crushed the market over the long run. And proper now, two of his high holdings look too good to cross up.

This can be a firm you should buy and maintain without end

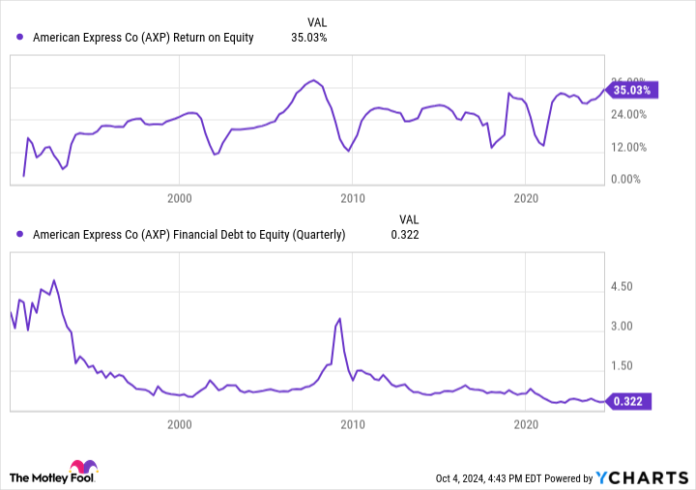

Nice corporations can determine generate spectacular returns for shareholders with out resorting to taking over extra debt. For many years, American Specific (AXP -0.59%) has finished a terrific job at doing this. Even whereas conserving its debt ratios low, it has persistently been capable of generate double-digit returns on fairness (ROE). Extra not too long ago, ROE has exceeded 35% — a determine solely essentially the most worthwhile corporations can obtain with such low debt ranges.

Spectacular profitability metrics have resulted in market-beating performances for the inventory. Over the past 12 months, its shares’ return has crushed that of the S&P 500 index by greater than 50%. However it’s not simply short-term outperformance. Over the previous decade, for comparability, American Specific shares have crushed the market by round 11% — a slimmer, however nonetheless spectacular margin.

It must be no surprise, then, that American Specific is certainly one of Buffett’s longest-tenured holdings. He is owned shares within the firm for greater than twenty years. Following a number of extra purchases, to not point out the acute development in worth for his preliminary stake, American Specific is now the second-largest place in Berkshire Hathaway‘s publicly traded portfolio.

Trying forward, American Specific nonetheless retains some of the iconic manufacturers within the U.S. no matter trade. And its commanding bank card market share for high-net-worth customers is not going away anytime quickly. Shares aren’t clearly low cost at 21 occasions earnings — simply above its trailing-three-year common — however that is a good value to pay for a bona fide blue chip inventory with the backing of Buffett, arguably one of the best investor of our time

AXP Return on Fairness knowledge by YCharts

Need extra draw back safety? Purchase this Buffett inventory

On an earnings foundation, it is not apparent that Mastercard (MA -0.41%) — one other Buffett inventory — is extra enticing than American Specific. Mastercard shares presently commerce at 38 occasions earnings, a wholesome premium to American Specific’ 21 occasions earnings a number of.

May the distinction be related to larger earnings development charges? Not likely. Over the past 5 years, American Specific has generated common annual earnings development of round 15%. And over the following 5 years, analysts count on that to develop to round 25% per 12 months. Mastercard, in the meantime, has averaged EPS development charges of round 17% in recent times, with roughly that determine anticipated over the approaching 5 years.

If earnings cannot clarify Mastercard’s premium valuation, what can? Doubtless, it is because of variations of their enterprise fashions. Whereas Mastercard’s enterprise is basically depending on transaction charges, American Specific has a way more capital-intensive enterprise mannequin. Simply check out their worker bases. Regardless of Mastercard having a market valuation greater than twice as massive as American Specific, it employs round half as many individuals.

Not solely does American Specific supply extra providers to its buyer base, nevertheless it additionally exposes itself to considerably extra credit score danger contemplating it underwrites its prospects’ debt. Mastercard, for comparability, usually solely affords entry to its cost community, with different monetary establishments assuming the credit score danger.

Throughout a recession, American Specific would — not less than on paper — have far more draw back potential than Mastercard. And regardless of sturdy jobs knowledge this month, some recession indicators are beginning to sign potential bother forward.

Are you paying a premium for Mastercard’s enterprise versus American Specific’? Completely. However is it the inventory you’d need to personal if markets flip bitter? Once more, completely.

However why choose one over the opposite? Buffett owns each, and the reply right here might merely be to diversify your funding by splitting $1,000 evenly between the 2. That manner, you personal two high-quality companies backed by Buffett. And in case your holding time horizon is lengthy sufficient, any upfront valuation premiums will be unfold out throughout a few years, and even many years.

American Specific is an promoting companion of The Ascent, a Motley Idiot firm. Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and Mastercard. The Motley Idiot recommends the next choices: lengthy January 2025 $370 calls on Mastercard and brief January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.