Two key uncertainties make the prospect of shopping for it at this time riskier than is fascinating.

DexCom (DXCM -1.08%) just isn’t a inventory that buyers needs to be speeding to promote. It has a couple of totally different alternatives to proceed pursuing to generate development, it has loads of recurring income, and the valuation of its shares is cheap. However you continue to should not purchase it proper now.

The percentages are good that it will proceed to be a good performer transferring ahead. Nonetheless, it is dealing with two key points that must be navigated efficiently for the inventory to be value shopping for as soon as once more. Let’s have a look to know why it is a a lot riskier play than it was earlier than.

Why it is an important inventory and an important firm

DexCom has a handful of issues going for it that make it the type of enterprise which buyers would normally prefer to personal. First, its key product — steady glucose displays (CGMs) — assist present it with a constant stream of recurring income. Individuals with diabetes put on its CGMs, that are connected to the physique, for a few weeks, then discard them and purchase extra.

The entire level of a CGM is to assist sufferers regulate their blood glucose ranges, which they in all probability might want to do for the remainder of their lives, and so onboarding new prospects will possible drive earnings development for years to come back. Even when buyer acquisition prices are on the upper finish, in the long term, repeated spending and the chance to upsell prospects on new merchandise, or software program companies associated to their CGMs, make the method fairly profitable.

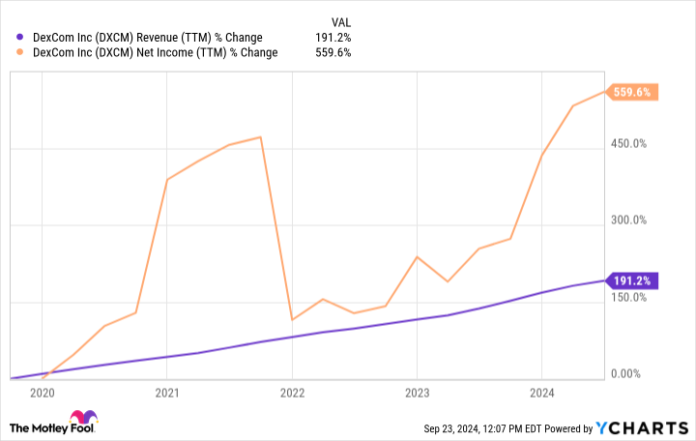

In consequence, DexCom’s trailing 12-month (TTM) income and internet earnings have grown steadily over the previous 5 years, reaching gross sales of $3.9 billion and internet earnings of $666.9 million. Check out this chart:

DXCM Income (TTM) knowledge by YCharts.

What’s extra, the enterprise is pursuing new avenues for development by coming into into worldwide markets just like the U.Ok., Germany, Japan, Spain, Bulgaria, Romania, and past. It is not carried out penetrating the U.S. market, both.

In late August, it launched the first-ever over-the-counter glucose sensor, thereby decreasing the barrier to sufferers shopping for its merchandise even additional. It is onerous to examine DexCom not persevering with so as to add to its income over the subsequent few years and past, particularly as increasingly more persons are recognized with diabetes.

So why not purchase it?

The aggressive panorama is shortly shifting in opposition to it

There are two large explanation why this inventory just isn’t an important alternative for many buyers in the mean time. Competitors is changing into a extra necessary issue, and a few of DexCom’s friends are tremendously highly effective.

Specifically, Abbott Laboratories and its FreeStyle Libre line of CGMs pose a definite menace to DexCom’s market share, as does Medtronic‘s Guardian Join machine. At some fashionable distributors, one among Abbott’s CGMs is about one-third as costly as DexCom’s. There’s solely a lot that the businesses can do to distinguish their merchandise from each other. This makes competitors on worth a potent means of stealing market share, particularly when the hole between choices is so giant.

So the enterprise will possible have to spend extra on advertising and marketing and analysis and improvement (R&D) to distinguish itself as a lot as potential, drive down the unit costs it provides prospects, and market its merchandise extra aggressively. That’ll put stress on its earnings, and probably income development too. These pressures are delicate now, however they’re solely going to extend over time as extra gamers enter the area.

The opposite large cause why it is considerably dangerous to spend money on DexCom’s inventory is that the demand for CGMs is probably not as giant sooner or later as it’s at this time. That is due to the proliferation of latest and extremely efficient medicines that deal with sort 2 diabetes and weight problems, which is a significant danger issue for creating diabetes. Eli Lilly and Novo Nordisk are each making blockbuster medication that would head off the necessity for a lot of tens of millions of individuals to make use of CGMs in any respect.

Whereas DexCom and Abbott see their CGMs as bettering blood glucose management together with use of those drugs, the scientific profit might not but be totally clear. Extra knowledge might make clear that time within the firm’s favor, however for now it could add additional uncertainty.

With a little bit of time and a few extra spending on advertising and marketing and R&D, it is rather potential that DexCom will proceed onward as vigorously because it ever has, enriching its shareholders and disproving the arguments laid out right here. However in distinction to its extremely dependable development prior to now, now’s a time of nice uncertainty, and that is why you should not purchase the inventory till a minimum of a number of the uncertainty is resolved.

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Abbott Laboratories. The Motley Idiot recommends DexCom, Medtronic, and Novo Nordisk and recommends the next choices: lengthy January 2026 $75 calls on Medtronic and brief January 2026 $85 calls on Medtronic. The Motley Idiot has a disclosure coverage.