Analyst worth targets may help traders uncover shares which have numerous potential upside. In some circumstances, nonetheless, that perceived upside might solely seem excessive as a result of the inventory has fallen closely in worth. And if it has fallen on account of hostile outcomes or a extra troubling outlook for its future, downgrades could possibly be inevitable, which can cut back these worth targets.

That is why it is at all times necessary for traders to do their very own evaluation when investing resolution. One inventory that as we speak seems to have numerous upside primarily based on analyst worth targets is UiPath (PATH 0.32%), with an implied upside of round 42%. However with the inventory struggling this yr, is it actually a great purchase proper now, or may analysts merely be overdue in trimming their worth targets for UiPath?

Why has UiPath been a nasty purchase in 2024?

UiPath offers firms with robotic course of automation software program, which may help companies expedite their day-to-day processes and enhance total effectivity. At a time when services associated to synthetic intelligence (AI) are in excessive demand, it could be stunning to see that shares of UiPath are down round 50% this yr.

An enormous downside is that there are lots of related providers on the market that companies can make the most of to automate on a regular basis duties. And whereas UiPath is rising, its development price hasn’t been accelerating.

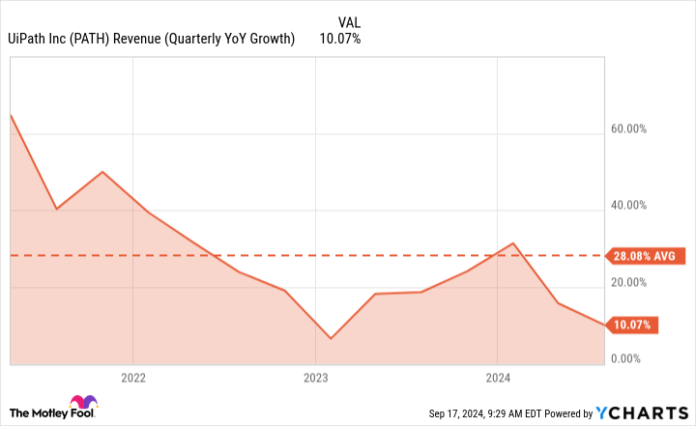

PATH Income (Quarterly YoY Development) information by YCharts

Whereas there was a slight uptick in 2023, the general trajectory is downward.

One other concern is that amid rising its operations, UiPath’s losses have been growing. Over the previous two quarters, the corporate has incurred a internet lack of $114.8 million — 24% increased than the $92.3 million loss it incurred over the identical interval final yr. This does not give traders numerous hope that it is on a path to profitability.

Why extra downgrades could possibly be coming

Lots of the extra bullish analysts, which had priced the inventory at greater than $20, trimmed their worth targets again in Might to beneath the $20 mark. Lots of the newer worth targets for UiPath are actually throughout the $14 to $16 vary. Nonetheless, there are some nonetheless far increased than that and that could possibly be overdue for downgrades.

Given UiPath’s lack of profitability and its slowing development price, it appears possible that analysts may proceed to reduce their expectations for the inventory. Ought to UiPath’s development price fall beneath 10% subsequent quarter, that might result in a flurry of downgrades.

Plus, with a doable recession coming within the not-too-distant future, a extra troubling outlook for the economic system may end in companies spending much less on automation software program, which may additionally make analysts extra bearish on UiPath’s enterprise. Whereas it nonetheless might have long-term potential, with analysts focusing their worth targets on the place a inventory would possibly go within the subsequent 12 months or so, a extra worrisome financial image may weigh on their outlook for its share worth.

Must you put money into UiPath?

UiPath is a inventory that ought to be doing properly this yr however is not, and that is a giant crimson flag. If demand for the corporate’s services is not taking off when situations are ultimate (i.e., hype round AI is powerful), it leads me to query simply how helpful companies are discovering the software program to be, particularly amid a rising variety of AI-related choices to select from.

And that is in the end why I would keep away from the AI inventory for now as there’s little purpose at this level to be optimistic that it may well flip issues round. And not using a higher development price or not less than a stronger backside line, shares of UiPath may proceed to say no.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends UiPath. The Motley Idiot has a disclosure coverage.