Digital belongings supervisor CoinShares says that institutional crypto buyers are pouring record-breaking inflows into crypto exchange-traded merchandise (ETPs) in 2024.

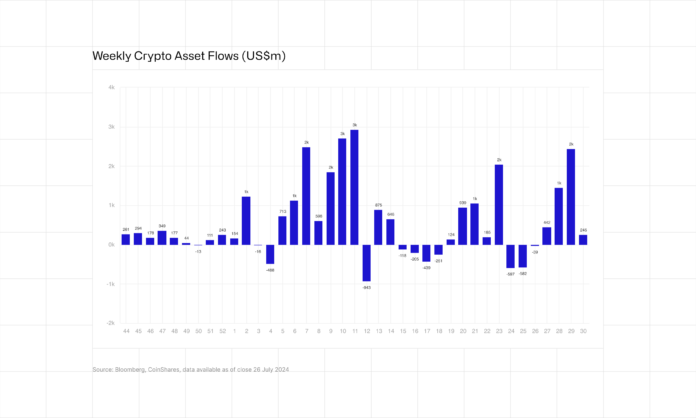

In its newest Digital Asset Fund Flows report, CoinShares says that regardless of a muted week of $245 million internet inflows, digital asset funding merchandise reached a brand new year-to-date report final week.

“Digital asset funding merchandise noticed a comparatively muted US$245m of inflows final week, though this obscures a combined image for numerous digital belongings. Buying and selling volumes rose to the very best ranges since Might at US$14.8bn for the week, helped by the current Ethereum ETF launches. Current value appreciation has introduced whole belongings underneath administration (AuM) to US$99.1bn whereas whole inflows year-to-date (YTD) are at a record-breaking US$20.5bn.”

Bitcoin (BTC) funding autos loved $519 million in inflows.

In accordance with CoinShares, Ethereum’s (ETH) flows reacted to ETH’s exchange-traded fund (ETF) launch similarly to how BTC’s flows reacted to the BTC ETF launch in January 2024.

“The launch of the US spot-based Ethereum ETFs noticed a number of the largest inflows since December 2020, with newly issued ETFs seeing US$2.2bn inflows, whereas buying and selling volumes in ETH ETP rose by 542%. This determine is considerably controversial as Grayscale seeded its new Mini Belief ETF (the week prior) with capital from its incumbent closed-end belief (~US$1bn), which can assist clarify the regular stream of outflows lately.

Additional, this week noticed continued outflows from Grayscale’s incumbent belief of US$1.5bn as some buyers money out, resulting in a internet outflow of US$285m final week.”

Whereas multi-asset crypto funding autos noticed $8.7 million in inflows, Cardano (ADA), Litecoin (LTC) and XRP loved inflows of $1.2 million, $0.6 million, and $0.5 million, respectively.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney