Extra is best with regards to these dividend giants.

Dividend shares aren’t in excessive demand now that investments like CDs are paying fatter yields than most high dividend performers. You may nonetheless get no-risk yields of over 4% with bank-issued CDs, in spite of everything, which is greater than twice the present yield on the S&P 500 index.

Paradoxically, that scenario would possibly set traders up for some wonderful long-term returns in the event that they concentrate on shopping for these two dividend shares whereas Wall Road is trying elsewhere for features.

You may probably have heard of those firms earlier than and would possibly even have them in your portfolio. But listed below are some good causes to contemplate boosting your positions in Costco Wholesale (COST 0.48%) and Apple (AAPL 1.23%).

Costco’s money movement

Wall Road is giddy about a number of elements that might push Costco shares greater in 2025. The most recent buyer visitors surge is proof that the retailer stays standard with its members on this inflationary setting. Comparable-store gross sales have been up 9% by way of early October.

Costco is seeing greater demand for discretionary merchandise, which bodes nicely for gross revenue margin. And do not low cost the latest hike in membership charges that is working its method by way of the subscriber base proper now.

However the most effective cause to love Costco inventory is perhaps the least acquainted amongst traders. The chain’s annual money movement has risen to $12 billion, that means it may well simply fund its progress initiatives whereas leaving loads of extra money for shareholders.

Dividend traders won’t be thrilled that Costco’s dividends arrive in sporadic one-time sums. However when you can abdomen unpredictable earnings funds, then this inventory affords a fantastic steadiness between progress and dividends.

Apple’s product refresh

Apple is ready to announce its fiscal fourth-quarter leads to late October, however traders haven’t got to attend till then to personal a bit extra of this monetary juggernaut. Three months in the past, Apple introduced that internet gross sales declined barely by way of the primary 9 months of the yr, primarily due to sluggish demand within the core iPhone enterprise.

Most Wall Road analysts predict a dramatic shift within the fourth quarter because the iPhone 16 lineup helps income rise 13% to $94 billion.

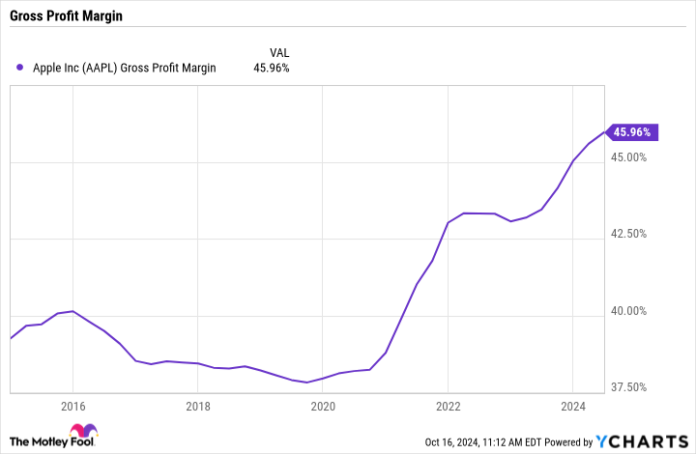

The corporate’s revenue margins have been already enhancing throughout this contractionary interval, which implies shareholders would possibly see surging earnings as soon as gross sales tendencies decide up once more into 2025. The hovering providers enterprise is one other issue driving profitability towards new highs.

AAPL gross revenue margin, information by YCharts.

Apple’s dividend yield is comparatively low at 0.4%. Most of its earnings are headed towards high-return investments, in spite of everything, together with the spending on analysis and improvement that helps preserve the corporate on high of the patron tech business. One other knock in opposition to this dividend inventory is the truth that it’s buying and selling close to an all-time excessive, which raises the chance that you’re going to overpay for shares.

But Apple checks almost the entire packing containers that an investor would possibly need from a long-term holding. Buyer loyalty charges are incredible, revenue margins are unusually excessive, and money movement has been increasing towards a report $120 billion per yr. Paying a bit extra for that form of enterprise is smart when you’re the kind of earnings investor who does not thoughts patiently ready whereas the mix of dividend progress plus inventory buybacks produces greater yields within the years to return.

It is price remembering that you just probably have a lot of publicity to Apple inventory, even when you do not personal many shares. The corporate accounts for an enormous proportion of the broader market’s earnings, which makes it an enormous a part of many index and mutual funds. So long as you are conscious of this publicity, you may think about amplifying your portfolio returns by investing a bit extra in Apple proper now.