The corporate has remade itself into extra of a cloud and AI firm.

Worldwide Enterprise Machines (IBM 1.68%) might lastly be prepared for a comeback. The inventory lastly surpassed its all-time excessive from 2013 this yr, and with its transformation right into a cloud and synthetic intelligence (AI) firm, buyers have taken an curiosity.

This has given IBM a market cap of round $205 billion. Given its trajectory, that determine will seemingly proceed rising, a lot in order that some buyers might speculate on whether or not it will probably turn out to be a trillion-dollar inventory by 2030. Whereas no person is aware of for sure whether or not it will probably attain that degree, it’s seemingly value taking a more in-depth look to gauge the potential for such an prevalence.

The state of IBM

First, buyers ought to notice that taking a $205 billion market cap to $1 trillion in six years would require a mean inventory value improve of 30% yearly for the following six years.

Within the earlier decade, reaching such a aim didn’t seem seemingly. Nevertheless, because of its metamorphosis, IBM has turn out to be a basically totally different firm over the past 5 years. The transformation started in earnest when Arvind Krishna, then the top of IBM’s cloud and cognitive software program division, spearheaded the $34 billion acquisition of Crimson Hat.

This buy meant a large improve in IBM’s whole debt. So massive was that debt {that a} failure would have seemingly led to doubts about IBM’s future.

Nonetheless, IBM appeared to imagine sufficient in Krishna’s imaginative and prescient that the corporate elevated him to the CEO function the next yr, and it seems the gamble has paid off. Krishna went on to amass quite a few smaller cloud corporations and spun off the managed infrastructure enterprise into Kyndryl.

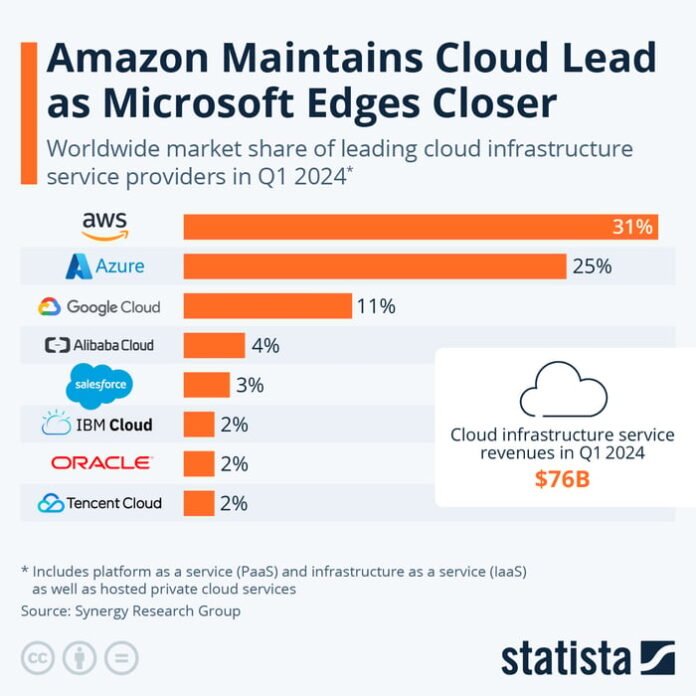

This has given IBM a 2% market share within the cloud infrastructure market, based on Synergy Analysis Group. Whereas this will not sound important, Grand View Analysis estimates the worldwide cloud market will develop to $2.4 trillion by 2030. Therefore, if it simply maintains that proportion, that would imply a large improve in income over that point.

Picture supply: Statista.

Moreover, IBM’s extra outstanding function within the cloud has made the corporate a participant within the rising generative AI market with watsonx. Within the yr because the firm launched watsonx, IBM’s ebook of enterprise in generative AI has grown to greater than $2 billion. Grand View Analysis estimates that the market will attain $109 billion by 2030, a compound annual progress price (CAGR) of 37%. This might bode nicely for IBM’s generative AI platform if it will probably come near matching this progress.

This isn’t to say that IBM has turn out to be solely a cloud and AI firm. Simply over half of its income comes from its consulting and infrastructure segments. Nevertheless, the most important section stays software program, which performs a important function within the trendy tech trade.

IBM’s financials

Sadly, the corporate’s total progress price might go away buyers questioning whether or not it will probably attain a $1 trillion market cap within the subsequent six years.

Within the first half of 2024, income was simply over $30 billion, and it rose simply 2% from year-ago ranges. Software program, which made up 42% of total income, elevated by merely 6%. Consulting and infrastructure, that are almost all the remaining income, didn’t expertise important will increase.

Nonetheless, its internet earnings for the primary two quarters of 2024 was $3.4 billion, a 37% yearly improve. An earnings tax advantage of $112 million (in contrast with a $543 million tax fee within the first half of 2023) gave IBM a important break on earnings taxes, permitting the corporate’s revenue to rise considerably.

Sadly, that profit is unlikely to repeat in future years. Whereas IBM raised income progress steering to mid-single-digits for the yr, it might not be sufficient to encourage a speedy improve within the inventory value.

Furthermore, the inventory value has risen by virtually 60% over the past yr, taking its inventory value to its aforementioned report excessive. That brings its P/E ratio to the 25 vary. Whereas that may seem affordable, IBM has not usually seen larger valuations besides in occasions of falling earnings. This may increasingly not bode nicely for its prospects for speedy progress.

Will IBM be a $1 trillion inventory by 2030?

Given the present trajectory of IBM’s financials, a $1 trillion market cap over the following six years seems unlikely.

Regardless of that modest prediction, IBM is again in motion — no less than from a technical perspective. Due to its cloud presence and watsonx, it’s once more a serious pressure within the tech trade, and that bodes nicely for the inventory.

Nonetheless, even with income will increase rising to the mid-single-digits, it might expertise slower progress than a few of its trade friends.

Moreover, the earnings tax profit that ignited the 37% internet earnings progress is a one-time occasion. With profitability prone to backslide as soon as earnings tax funds resume, IBM might be going to wrestle to generate the revenue progress wanted to succeed in $1 trillion within the subsequent six years. Large Blue’s buyers ought to set their sights slightly decrease.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, Oracle, Salesforce, and Tencent. The Motley Idiot recommends Worldwide Enterprise Machines and Kyndryl and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.