Decrease rates of interest gave a lift to the true property platform.

Shares of Zillow (Z -1.69%) (ZG -1.71%) had been shifting larger final month together with a number of actual property shares because the sector benefited from expectations of falling rates of interest.

In truth, Zillow inventory soared when the Federal Reserve stunned some buyers by chopping the Federal Funds fee by 50 foundation factors, kicking off a brand new rate-cutting cycle.

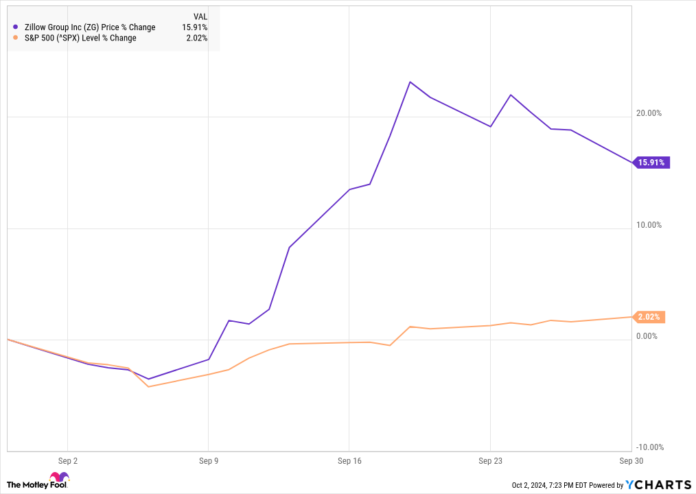

Although the inventory gave up a few of these good points later within the month, pleasure over a rebound within the housing market, pushed by falling mortgage charges, appeared to be the first motive for the inventory’s good points in September. In keeping with knowledge from S&P International Market Intelligence, Zillow completed the month up 16%.

As you possibly can see from the chart beneath, the inventory peaked after the Fed reduce rates of interest.

Is Zillow poised for a rebound?

As you possibly can see, Zillow trended with the S&P 500 for the primary week of the month earlier than actual property shares started to interrupt out in anticipation of a fee reduce.

Zillow acquired a positive observe from Citigroup to kick off the month as the massive financial institution stated it was “incrementally optimistic” on the inventory after assembly with administration. It famous that its newer services and products are scaling, and stated its base of 230 million month-to-month distinctive customers was a bonus.

Later within the month, Wedbush upgraded the inventory to outperform with a value goal of $80 because it stated decrease mortgage charges can be a key catalyst for the corporate and likewise credited its software program and companies initiatives.

Lastly, the inventory jumped on excessive quantity because the Federal Reserve slashed rates of interest by 50 foundation factors, a extra aggressive reduce than anticipated.

The inventory rose 8% over a two-day span on excessive buying and selling quantity as falling rates of interest ought to assist drive a restoration within the enterprise as the corporate’s success is intently linked to the broader actual property and housing business.

Picture supply: Getty Photos.

Can Zillow preserve gaining?

Zillow has the main place in on-line actual property listings, however the firm hasn’t all the time been capable of capitalize on that place. Its enterprise is primarily advertising-driven, and the corporate faces some dangers from the Nationwide Affiliation of Realtors settlement, which did away with the standard fee system.

It is unclear how that may have an effect on Zillow, although decrease commissions would seemingly impression promoting demand, and it may result in fewer realtors within the business, which might even be a headwind for Zillow.

Nonetheless, falling mortgage charges are clearly a optimistic for the inventory. Zillow seems pretty valued after final month’s good points, however it may transfer larger because the housing market reawakens.

Citigroup is an promoting accomplice of The Ascent, a Motley Idiot firm. Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Zillow Group. The Motley Idiot has a disclosure coverage.