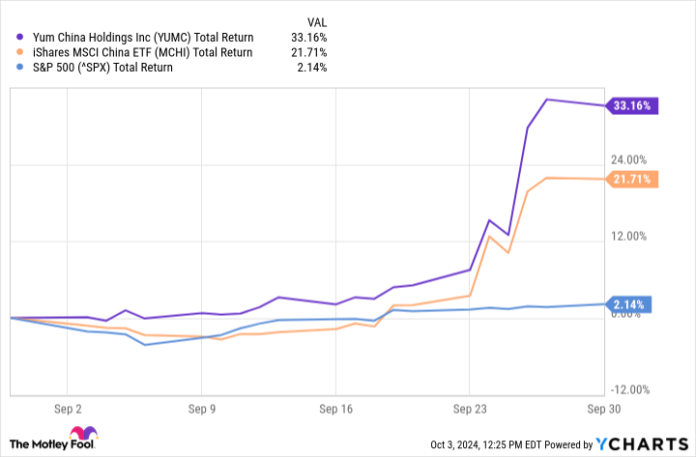

Shares of restaurant firm Yum China Holdings (YUMC -3.47%) soared 33.2% in September, based on knowledge supplied by S&P World Market Intelligence. It was a welcome growth for shareholders who’ve been enduring a multiyear downtrend. However what’s fascinating right here is that Yum China did not report any information throughout the month.

Zooming out somewhat, traders can see that Yum China inventory wasn’t alone final month. On the contrary, many corporations that do enterprise in China noticed their inventory costs surge. The iShares MSCI China ETF (NASDAQ: MCHI) is a fund holding a basket of Chinese language shares. And its returns side-by-side with Yum China inventory reveals the broader pattern.

YUMC Complete Return Stage knowledge by YCharts

Why had been China shares up throughout September? Rates of interest in China had been minimize late within the month, sparking a the inventory rally. Typically talking, central banks decrease rates of interest after they’re attempting to stimulate development in an economic system. Subsequently, shares have a tendency to reply favorably when charges go down.

With over 15,000 restaurant areas in China — largely Pizza Hut and KFC — Yum China would definitely be a beneficiary if China’s economic system grew at a sooner fee.

Rates of interest apart…

Lauded investor Peter Lynch mentioned, “No person can predict rates of interest,” which is true. And this is the reason traders ought to usually keep away from speculating on this topic. It is higher to concentrate on Yum China’s enterprise no matter rates of interest. If it will get assist finally from charges, then that is a pleasant little bonus. Nevertheless it should not be the central focus of traders.

For its half, enterprise is usually good for Yum China. It is same-store gross sales are somewhat weak in the meanwhile — they fell 3% yr over yr within the first half of 2024. However gross sales are up general because of the brisk tempo of latest restaurant openings. And the corporate’s second-quarter working revenue of $266 million was its greatest because it spun off from Yum! Manufacturers in 2016.

There’s room for enchancment. However for probably the most half, these are robust numbers from Yum China.

A few issues to remember

Yum China is a high-growth firm. Administration plans to open between 1,500 and 1,700 new areas in 2024, which is a robust development fee. Its working margin of about 10% is fairly good for a restaurant firm. And administration is giving $1.5 billion again to shareholders this yr by dividends and share buybacks, which is an efficient quantity for an organization this measurement.

Buying and selling at about 24 occasions earnings, I consider Yum China inventory is fairly pretty valued at present. If it may maintain opening new restaurant areas, incomes a revenue, and returning capital to shareholders, then this might be a quiet compounder over the long run, similar to its former mum or dad firm, Yum! Manufacturers, has been.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.