Shares of Ulta Magnificence (ULTA -3.07%) have been climbing greater final month after the wonder superstore chain posted better-than-expected ends in its third-quarter earnings report, displaying enchancment on the underside line, and that the worst of its market-share losses appeared to be behind it.

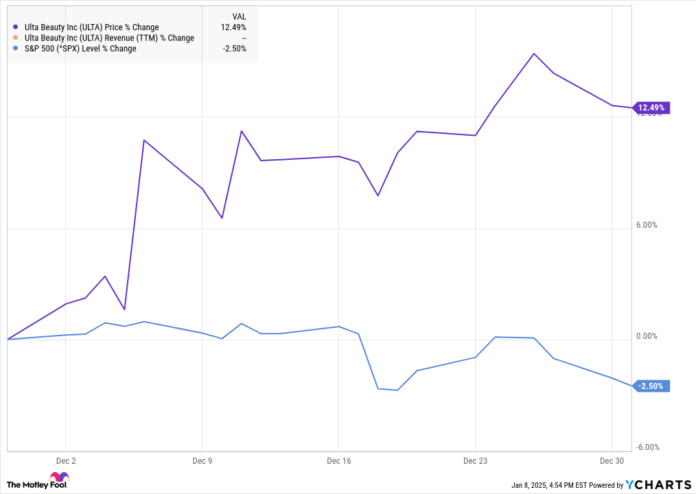

In keeping with information from S&P World Market Intelligence, the inventory completed the month up 13%. As you’ll be able to see from the chart, the inventory jumped early within the month on the earnings report and managed so as to add on positive factors later within the month, even because the broad market pulled again.

Ulta exhibits indicators of a comeback

Ulta’s third-quarter earnings report wasn’t precisely stellar, however confirmed the corporate shifting previous earlier challenges and doing a greater job of managing prices. The inventory jumped 9% on the information.

Comparable gross sales within the quarter rose 0.6%, lifting income up 1.7% to $2.53 billion, which beat estimates at $2.5 billion. Comparable gross sales have been pushed by a 0.5% enhance in transactions, indicating that visitors was barely improved.

Web earnings was down barely from $249.5 million to $242.2 million, although earnings per share rose from $5.07 to $5.14 as the corporate’s diminished shares excellent by greater than 4% over the past 12 months from share buybacks. That was significantly better than estimates at $4.52, displaying that traders have been pleased with mainly flat progress.

Ulta additionally raised its full-year steering. The corporate now expects income of $11.1 billion to $11.2 billion, up from a earlier vary of $11 billion to $11.2 billion, and sees adjusted earnings per share of $23.20 to $23.75, in comparison with its earlier forecast of $22.60 to $23.50.

The replace appears to mirror the success of its turnaround plan, which incorporates bettering its product assortment and buyer expertise, and leveraging its loyalty program.

Wall Road usually cheered the earnings report, elevating its worth targets on the inventory, and it constructed on that momentum over the remainder of the month — even after the market was rattled by the Federal Reserve’s higher-for-longer rate of interest forecast.

Picture supply: Getty Pictures.

What’s subsequent for Ulta?

The sweetness chain dealt traders one other shock in January, asserting on Jan. 6 that CEO Dave Kimbell is retiring, to get replaced by Kecia Steelman, who beforehand served as COO.

The corporate additionally gave a bullish replace on the fourth quarter, saying that it now expects comparable gross sales to extend modestly in This autumn and working margin will probably be above its beforehand forecasted vary of 11.6% to 12.4%, sending the inventory briefly greater.

Based mostly on the momentum in This autumn, the cosmetics inventory could possibly be in retailer for a powerful restoration in 2025.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Ulta Magnificence. The Motley Idiot has a disclosure coverage.