The corporate served up one other glimmer of hope that it may possibly navigate its method out of its present mess.

Simply when it seems to be just like the inventory’s rally is out of gas, Spirit Airways (SAVE 18.80%) finds a approach to ship its shares even greater. In the present day’s near-20% leap is being pushed by one other spherical of reports that the struggling airline might but discover a approach to sidestep a possible chapter.

One other step in the correct course

It has been a storied week for the corporate to say the least. Final Friday its bank card processor (U.S. Financial institution Nationwide Affiliation) granted Spirit an further two months to refinance its debt, offering the airline with much-needed room to enhance its present fiscal scenario earlier than approaching lenders.

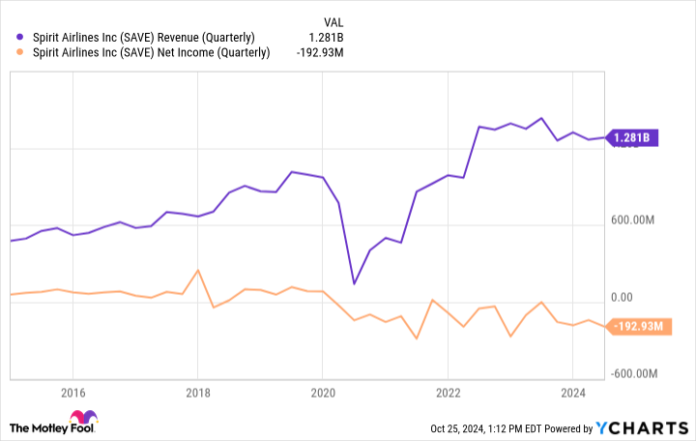

Then on Wednesday, whispers of an acquisition resurfaced. The Wall Avenue Journal‘s report steered Frontier Airways was contemplating making a proposal for the distressed rival airline that hasn’t turned a quarterly revenue for the reason that center of 2020.

SAVE Income (Quarterly) knowledge by YCharts

Closely indebted Spirit Airways is not merely ready for companions and potential suitors to resolve its issues, nevertheless. It is taking motion within the meantime to give you desperately wanted money. Following Thursday’s shut the corporate disclosed it will be promoting 23 of its passenger jets for a complete of just below $520 million. It added that the corresponding discount in its workforce would cull one other $80 million price of annualized working bills.

This information rekindled good points made by the inventory earlier this week, reversing Thursday’s lull.

Too far gone to salvage now

Kudos to Spirit for taking swift and sizable motion. Many corporations would have achieved much less, and achieved it slower, merely hoping enterprise would flip round. CEO Ted Christie acknowledges it is higher for a corporation to resolve issues on its phrases fairly than a creditor’s or chapter courtroom’s phrases.

Sadly, Spirit is just too far underwater for any such effort to matter sufficient now.

Certain, the aforementioned sale of a few of its plane will take away $225 million price of debt from its steadiness sheet along with producing $520 million in proceeds. The corporate may also save a further $80 million per 12 months because of the sale.

Spirit Airways is repeatedly shedding between $100 million and $200 million per quarter although, without end. Certainly, the sale of 23 of its roughly 215 passenger jets will solely make it tougher to generate income, and subsequently earnings. In the meantime, the airline‘s steadiness sheet is slowed down by roughly $7 billion in long-term debt and lease obligations. Reduction of $225 million is not going to make a dent in that burden.

The very best final result for Spirit Airways remains to be arguably chapter, or an acquisition by one other airline that desires its model title and routes and would not thoughts taking over Spirit’s money owed and different obligations. In fact, any such supply goes to be a lowball bid.

No matter’s within the playing cards, there’s an excessive amount of danger and never sufficient reward to develop into a shareholder right here.

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends U.S. Bancorp. The Motley Idiot has a disclosure coverage.