A sizzling jobs report mixed with still-dovish Fedspeak lifted the rate-sensitive software program sector.

Software program leaders ServiceNow (NOW 3.04%), Snowflake (SNOW 3.85%), and UiPath (PATH 4.52%) rallied on Friday, up 3.1%, 3.7%, and 4.4%, respectively, within the day’s buying and selling.

There wasn’t any company-specific information at the moment on these three enterprise software program leaders. Nonetheless, at the moment’s strong jobs report, together with still-dovish commentary from Federal Reserve officers, despatched every inventory hovering.

Software program shares to learn from a gentle touchdown

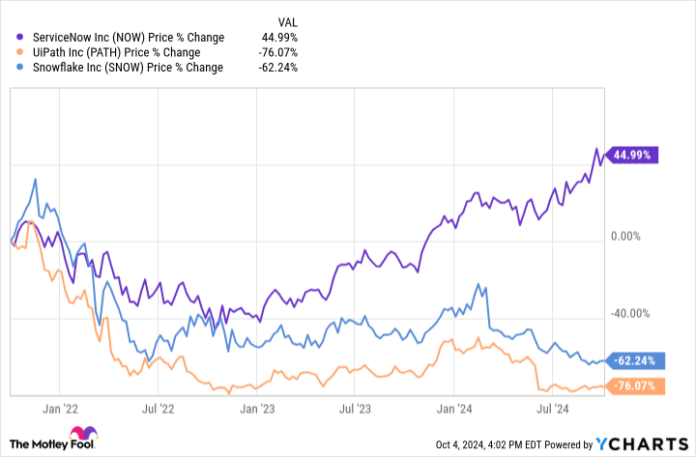

The previous few years of rising rates of interest have usually been troublesome for software program shares. Whereas ServiceNow has impressively managed to buck the pattern and recuperate strongly after 2022’s downturn, Snowflake and UiPath are nonetheless down 62% and 76% over the previous three years, respectively.

Rates of interest have had lots to do with it. When the post-pandemic inflation took off and the Federal Reserve raised rates of interest, it hit software program shares in quite a lot of methods.

First, quickly elevating rates of interest brought on firms, fearing a downturn, to tug again on software program spending, particularly since there had been an enormous quantity of software program adoption throughout the pandemic. Second, rising charges additionally disproportionally harm software program inventory valuations, as software program shares tended to commerce at very excessive multiples of earnings or gross sales. Rising charges decrease the current worth of earnings far out sooner or later, which harm high-multiple shares like software program. So, software program shares have been hit by a “double whammy” of slowing progress and sharply discounted valuations.

What might reverse the pattern? Effectively, a “gentle touchdown” wherein inflation and rates of interest come down with out a recession can be the perfect state of affairs. Elevated confidence and hiring might spur extra software program “seat” subscriptions or, within the case of Snowflake’s pay-as-you-go mannequin, extra consumption of computing. In the meantime, decrease rates of interest would carry valuations.

Inflation has been coming down not too long ago, which spurred the Federal Reserve to chop the federal funds charge by 50 foundation factors final month on Sept. 18. But whereas some had thought decrease inflation may go hand in hand with a slowing financial system, at the moment’s September jobs report blew away expectations, with 254,000 jobs added, far above the 150,000 forecast and up from a revised 159,000 jobs added in August.

Strong job progress and decrease rates of interest is the perfect setting for shares usually, however particularly the rate-sensitive software program sector.

In fact, the new jobs report might imply that inflation will not be subdued but, and will maintain charges excessive. However Federal Reserve governor Austan Goolsbee, showing on Bloomberg TV at the moment, stated the robust jobs report does not imply inflation goes up. He nonetheless sees inflation getting again to the Fed’s 2% goal and likewise declared no change within the outlook for continued rate of interest cuts over the subsequent 12 to 18 months.

The subsequent challenge for software program: AI disruption

Whereas the rate of interest and financial image seems to be terrific for software program shares now, there are nonetheless a couple of points to think about. First, whereas rates of interest are prone to get again to a “impartial” charge quickly, they don’t seem to be probably going all the best way again to pandemic-era low ranges. So, one should not count on software program firms to reattain the inflated valuations they noticed in 2020 and 2021.

Moreover, the AI revolution has the potential to learn or disrupt sure software program firms. ServiceNow has finished fairly effectively because it serves on the nexus of firms’ personal on-premises knowledge and the skin cloud, and might subsequently function a supervisor of enterprises’ AI whereas additionally incorporating outdoors LLMs. Curiously, UiPath and Snowflake are extra cloud-based, and whereas they’ve been posting progress, they have not been benefiting as a lot from AI — a minimum of not but.

So whereas the rate of interest image is getting a lot better for software program, buyers must be picky on which shares may have AI as a value-add and which could see elevated competitors from the AI revolution.

Billy Duberstein and/or his shoppers haven’t any positions in any of the shares talked about. The Motley Idiot has positions in and recommends ServiceNow, Snowflake, and UiPath. The Motley Idiot has a disclosure coverage.