The net dealer makes more cash when rates of interest are excessive and/or rising.

As anticipated, on Wednesday, the Federal Reserve lower the U.S.’s baseline rate of interest. The Fed Funds charge was lowered by 50 foundation factors, pulling most different rates of interest decrease with it. The Fed committee answerable for such choices additionally suggests extra charge cuts are within the near-term playing cards, which ought to stimulate the financial system with out reigniting inflation. That is why traders are celebrating the transfer, and the rhetoric.

Not each firm is healthier off with decrease rates of interest on this specific financial surroundings, nonetheless. Brokerage agency Charles Schwab (SCHW 0.97%) arguably has extra to lose than acquire for the foreseeable future. Buyers could be clever to maintain their expectations in test. This is why.

Schwab’s prime moneymaker is pressured, and shall be for some time

Charles Schwab as a number one on-line dealer, however buying and selling does not really drive most of its income. Neither does funding administration or retirement plan administration. Ditto for its banking enterprise. Slightly, Schwab’s single greatest income is curiosity revenue, accounting for practically half of the corporate’s prime line. And that is after paying its personal curiosity bills on this income, to be clear.

Shocked? Loads of individuals are, given the character of its enterprise. Furthermore, it is a cyclical downside that might persist for some time.

Charles Schwab makes extra internet curiosity revenue when charges are larger than it does once they’re decrease, for the reason that spreads — the distinction between curiosity earned and curiosity paid — are larger when charges are elevated.

We’re already seeing this phenomenon, in truth, however this strain on profitability can also be simply getting began if extra rate of interest cuts are in retailer.

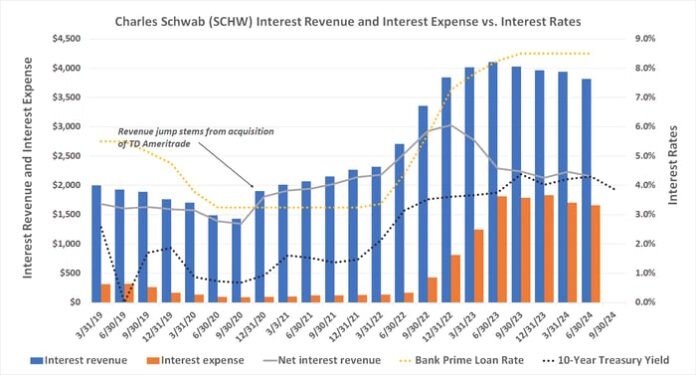

The picture under tells half of the story, evaluating Schwab’s curiosity income to its curiosity expense to find out its internet curiosity income. As you possibly can see, internet curiosity income peaked in late 2022, even earlier than rates of interest themselves did. As you too can see, Schwab’s internet curiosity income has continued to dwindle, whereas total rates of interest have flattened, if not fallen themselves. Most alarming, nonetheless, is that market-based rates of interest had been already falling earlier than Wednesday’s resolution. They’re apt to proceed falling too, because the Federal Reserve suggests that’s within the playing cards.

Knowledge supply: Charles Schwab Corp. Chart by writer. Greenback figures are in tens of millions.

This is why it issues: As of the second quarter of this yr, 46% of Schwab’s complete income is internet curiosity income pushed by choices comparable to margin loans, money holdings (together with cash market funds), and the like. That quarter’s internet curiosity income of $2.16 billion is sort of 30% under Q2 2022’s determine of over $3 billion, when this income accounted for over half of Schwab’s prime line.

Knowledge supply: Charles Schwab Corp. Chart by writer. Figures are in tens of millions.

This quantity is sort of definitely going to get smaller going ahead, as rates of interest proceed to fall. It is already taking place, in truth. Though margin mortgage balances are up since then, Schwab’s common stage of curiosity earnings property is close to the primary quarter’s multi-year low, which is greater than 16% under 2023’s peak.

Picture supply: Charles Schwab Corp. Q2 2024 udpate.

In different phrases, Schwab’s shoppers are presently holding comparatively few investments that generate money stream for the dealer. They’re holding extra shares and bonds, which (at finest) solely generate one fee cost or bid/ask spread-based acquire at that commerce’s entry.

Proper inventory, flawed time

It is not all dangerous. On the very least, Schwab is profitable new prospects, and gathering more cash in consequence. As of the tip of August, it was holding a surprising $9.74 trillion price of consumer property, up 20% yr over yr. Even when solely a comparatively small portion of those holdings generate recurring income, these holdings are nonetheless being held by the dealer. Will probably be capable of monetize them when the time is correct.

The present financial backdrop is not one which favors Schwab, nonetheless, or every other dealer for that matter.

Even when borrowing prices are coming down, cash remains to be tight because of inflation… one of many causes company bankruptcies at the moment are above pre-pandemic ranges. There’s not a number of must-have inventory buying and selling exercise ready within the wings both, with the general financial system set to be merely ho-hum for some time because the post-pandemic results wind down. New investor cash inflows are prone to sluggish going ahead as development shares proceed cooling off. Schwab’s prime and backside strains are apt to mirror this slowdown.

Backside line? Schwab’s nonetheless a stable long-term holding. The close to time period does not look so brilliant, although. Much less affected person traders would possibly wish to take into account different, extra promising choices within the meantime.

Charles Schwab is an promoting companion of The Ascent, a Motley Idiot firm. James Brumley has no place in any of the shares talked about. The Motley Idiot recommends Charles Schwab and recommends the next choices: quick September 2024 $77.50 calls on Charles Schwab. The Motley Idiot has a disclosure coverage.