Enterprise is best than anticipated and analysts are beginning to take discover.

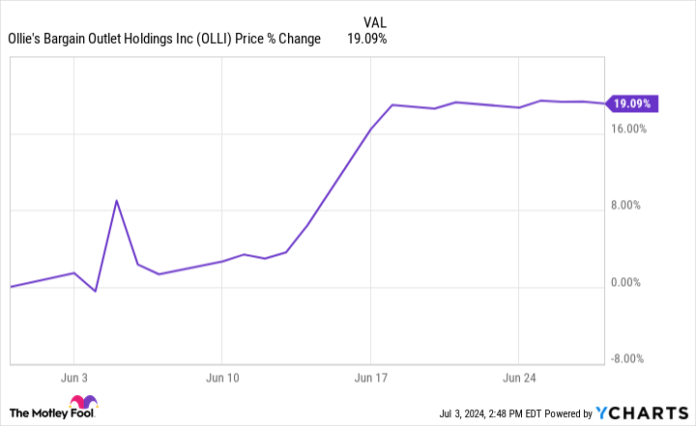

Shares of closeout retailer Ollie’s Cut price Outlet (OLLI -1.42%) jumped 19.1% in June, in line with knowledge supplied by S&P International Market Intelligence. The corporate reported monetary outcomes that turned traders’ heads. Then a distinguished analyst raised their outlook for the enterprise, giving traders extra confidence on this comeback story.

Gross sales for Ollie’s might be up and down. And gross sales (and revenue margins) took a step again in 2022 earlier than bouncing again in 2023. On June 5, the corporate reported monetary outcomes for the primary quarter of 2024 that set a constructive tone for the upcoming 12 months. Q1 web gross sales had been up almost 11% 12 months over 12 months whereas web earnings jumped by virtually 50%.

With its Q1 report, administration for Ollie’s modestly boosted its monetary steerage for the remainder of the 12 months. And the inventory did pattern greater following the report. Nevertheless, the larger bounce in inventory value got here on June 17 when J.P. Morgan analyst Matthew Boss upgraded his outlook for the inventory, as seen on the chart under.

In accordance with The Fly, Boss primarily identified that Ollie’s inventory is cheaper than it was a number of years in the past regardless that its progress prospects could also be higher now. That motivated him to offer the inventory a value goal of $105 per share. And it seems to have boosted investor confidence.

Ollie’s is successful the place others are stumbling

To Boss’ level, Ollie’s has raised its outlook for the long-term potential of its model in recent times. Within the fourth quarter of 2023, administration mentioned it believes the market will help 1,300 areas sometime in comparison with the 518 areas it had in Q1. For perspective, its long-term objective was simply 950 areas a couple of years in the past.

It isn’t simply that Ollie’s believes its long-term alternative is bettering. It is also that different retailers are struggling and Ollie’s can rapidly gobble up market share because of their missteps. A superb instance got here in late Could when it purchased 11 areas for 99 Cents Solely Shops out of chapter. It permits Ollie’s to maneuver into new markets faster than it anticipated.

What’s subsequent for Ollie’s inventory?

Ollie’s expects to earn not less than $250 million in working earnings this 12 months. In comparison with its market capitalization of simply lower than $6 billion, I consider shares are nonetheless fairly priced, even after the run-up throughout June.

Ollie’s undoubtedly is not an organization that may blow traders away with progress. And it is nonetheless potential for gross sales and revenue margins to ebb and move in coming years. However it’s a enterprise that may nonetheless produce sufficient progress to supply good inventory returns for affected person traders. Due to this fact, I feel it is nonetheless a inventory value contemplating immediately.

JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot recommends Ollie’s Cut price Outlet. The Motley Idiot has a disclosure coverage.