The enterprise is in a “transitional” yr, in keeping with administration.

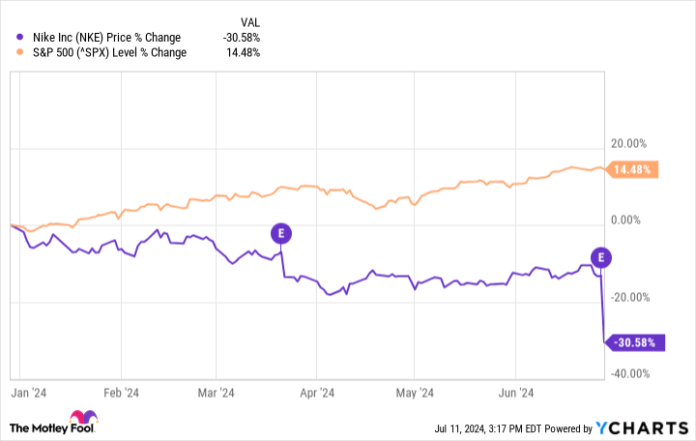

Shares of athletic attire firm Nike (NKE 1.17%) plunged 30.6% within the first half of 2024, in keeping with information offered by S&P International Market Intelligence. When taking out simply two days of buying and selling, the inventory would have been roughly flat for the six-month interval. Nevertheless it reported monetary outcomes twice. And the inventory took a success each occasions, dropping it beneath the 14.5% return for the S&P 500.

Nike’s fiscal calendar differs from conventional calendars — its fiscal 2024 resulted in Could. On March 21, the corporate reported monetary outcomes for its fiscal third quarter of 2024. And it reported for its fiscal fourth quarter on June 27. Whereas the inventory was already down yr to this point, the drop after its This autumn report was extra pronounced.

Nike’s headline numbers for fiscal 2024 aren’t alarming in isolation. Full-year revenues have been modestly up, gross margin improved, and internet earnings was up 12% yr over yr to $5.7 billion. And but one thing alarmed traders.

For perspective, at the start of the yr there have been 20 analysts recommending that traders purchase Nike inventory, in keeping with TipRanks. Now there are solely 13.

Headwinds began blowing more durable towards Nike’s enterprise in This autumn. And now administration expects a difficult fiscal 2025. For the yr, it expects income to be down and sure bills to be up, which may result in a drop in internet revenue as effectively.

Direct demand is drying up

It is an fascinating scenario for Nike. Lately, shoe shares have finished effectively as shoppers purchase extra straight from the businesses on-line as a substitute of buying at different retailers. However in This autumn, Nike noticed declines in direct income, whereas its wholesale income was up.

The profit from wholesale income, nonetheless, was solely non permanent — retailers merely restocked cabinets. Within the upcoming fiscal first quarter of 2025, Nike will not have that wholesale income profit, so administration expects income to drop 10% yr over yr.

In different phrases, Nike’s near-term outlook is not nice. And administration appears to assume gross sales can bounce again as soon as it begins launching newer merchandise later within the yr. Based mostly on the inventory value, I would say traders aren’t prepared to purchase into that optimism but.

What ought to traders do now?

From a price-to-earnings (P/E) perspective, Nike inventory hasn’t been this low-cost since 2012. This once-in-a-decade valuation must be acknowledged.

NKE PE Ratio information by YCharts

Some analysts marvel if Nike is an older model that is beginning to lose its luster in comparison with youthful, trendier manufacturers. That could be a frequent danger for attire shares — style might be fickle. If the Nike model is declining, it seemingly does not matter that the inventory is reasonable.

Nonetheless, for traders with a extra optimistic outlook for Nike’s enterprise, it may very well be price a place right here. Simply bear in mind that endurance is important — administration has already known as fiscal 2025 a “transitional” yr, so higher days are seemingly nonetheless greater than a yr away.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.