A stable earnings report and hopes for decrease rates of interest lifted the inventory.

Shares of Lyft (LYFT 6.30%) had been shifting greater final month after the No. 2 ride-sharing firm delivered a stable second-quarter earnings report and benefited from elevated expectations that rates of interest would quickly go down.

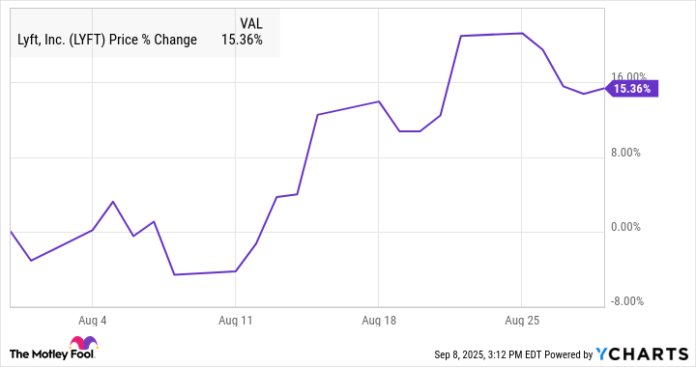

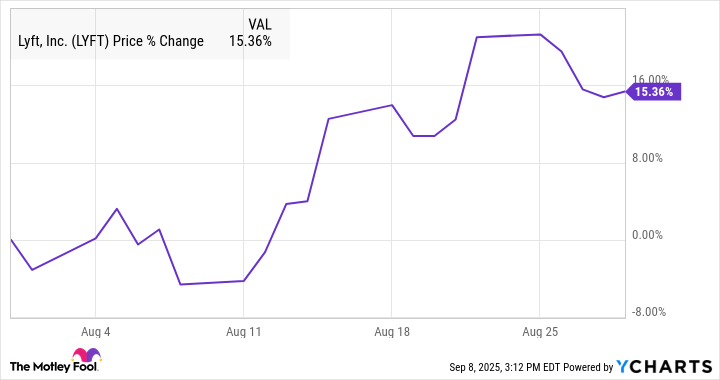

Lyft additionally obtained usually optimistic commentary from Wall Avenue analysts through the quarter, a response to the momentum constructing within the enterprise. In keeping with S&P World Market Intelligence, the inventory gained 15% in August.

As you’ll be able to see from the chart, it was a unstable month for the corporate, however Lyft took a number of steps greater throughout August.

Lyft is on secure floor

Lyft rose on its second-quarter earnings report final month, however the response was muted, because the inventory gained simply 1.6% in response to the information.

Nonetheless, the outcomes had been robust and customarily forward of expectations. Gross bookings had been up 12% to $4.5 billion, driving income up 11% to $1.59 billion, which was barely beneath estimates at $1.61 billion.

The corporate reported stable development in each rides and lively riders, and initiatives like Lyft Silver, which focuses on seniors, are outperforming expectations, with an 80% income charge.

On the underside line, margins proceed to enhance, with adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) up 26% to $129.4 million, and customarily accepted accounting ideas (GAAP) earnings per share leaping from $0.01 to $0.10, forward of the consensus at $0.04.

Roth Capital upgraded Lyft to purchase in response to the report, calling out its accelerating development and bettering bottom-line metrics.

The corporate obtained another optimistic notes through the month as analysts commented on its robotaxi partnerships, robust third-quarter steerage, and potential development from its Free Now acquisition, giving it publicity to Europe for the primary time.

The inventory additionally jumped 8% on Aug. 22 after Fed Chair Jerome Powell signaled that the central financial institution was prepared to begin decreasing charges, which might assist shares like Lyft.

Picture supply: Getty Photos.

What’s subsequent for Lyft?

Trying forward, the corporate sees stable development within the third quarter, which incorporates two months of profit from its Free Now acquisition. It expects gross bookings up 13%-17% and mid-teens development in rides. It additionally known as for adjusted EBITDA of $125 million-$145 million.

Not too way back, there have been severe issues about Lyft’s capacity to be secure and worthwhile, and defend its market share in opposition to Uber. It is now confirmed that it could, and there are nonetheless a variety of upsides for the corporate forward because the market expands, and it rolls out new merchandise.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Uber Applied sciences. The Motley Idiot recommends Lyft. The Motley Idiot has a disclosure coverage.