Intel confirmed it is nonetheless a damaged firm.

Shares of Intel (INTC -8.80%) took a dive final month primarily on account of a disastrous second-quarter earnings report that included subpar outcomes, disappointing steering, the elimination of its dividend, and a restructuring plan that features shedding not less than 15% of its workforce.

The information undermined any hope that Intel was making progress on what was already presupposed to be a turnaround. Later within the month, the corporate misplaced a key director, who dismissed the corporate’s slow-footed method to the chip sector and stated the corporate was unwilling to take dangers. On the final day of the month, Intel obtained a reprieve after Bloomberg reported that the corporate was trying into potential strategic choices, together with separating the manufacturing enterprise from the core chip-design operation.

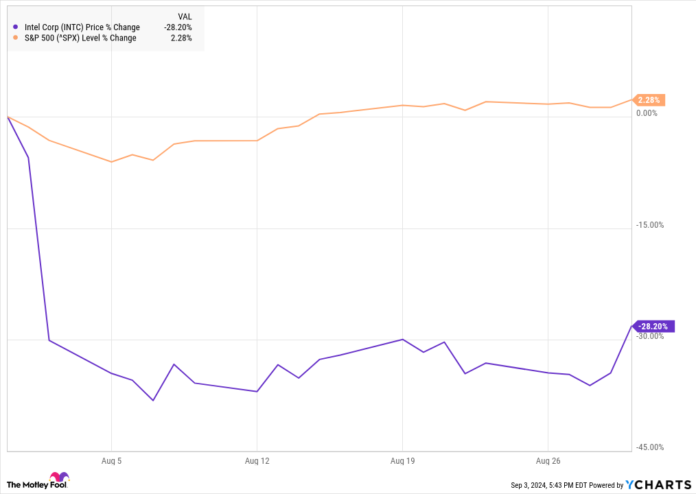

In line with knowledge from S&P World Market Intelligence, the inventory completed August down 28.2%. You possibly can see its efficiency within the chart beneath.

Intel shocks traders

It is arduous for a supposed blue-chip inventory like Intel to ship as a lot unhealthy information because the chipmaker did in a single quarter, and the upshot of the report is that the corporate is floundering at a key second in its trade with AI demand hovering.

First, the corporate’s second-quarter outcomes missed the mark because it continues to be hamstrung on the underside line by losses in its foundry division, and progress stays sluggish in core enterprise segments.

Income within the quarter fell 1% to $12.8 billion, and adjusted earnings per share got here in simply $0.02, down from $0.13 within the quarter a 12 months in the past.

Third-quarter steering was additionally underwhelming, with income of $12.5 billion to $13.5 billion, implying a decline of 8% on the midpoint. It additionally forecast an adjusted loss per share of $0.03.

Along with the weak outcomes and steering, the choice to eradicate its dividend turned off traders, although it is smart for money conservation causes. Lastly, layoffs can typically please Wall Road, however on this case, the information that it was slicing 15% of staff was simply one other signal that the enterprise is in disarray.

Picture supply: Getty Photos.

Intel wants assist

Later within the month, the corporate delayed its Intel Innovation convention and it additionally misplaced a key director. Buyers appear inspired that the corporate is contemplating a possible break-up plan or slicing again on capital expenditures, however no announcement has come from the corporate on that, so it appears speculative proper now.

Moreover, the prospects of the inventory being faraway from the Dow Jones Industrial Common have considerably elevated. At this level, it should take loads of work to show across the enterprise and rehabilitate the inventory, and traders may simply run out of persistence once more.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot recommends Intel and recommends the next choices: quick November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.