Shares of web site firm GoDaddy (GDDY -14.17%) crashed on Friday after the corporate launched its monetary outcomes for the fourth quarter of 2024. As of 12:50 p.m. ET, GoDaddy inventory was down about 13%.

GoDaddy comes up simply wanting expectations

For This fall, GoDaddy anticipated to develop income by solely about 7% yr over yr, however it wound up rising by 8% to $1.2 billion. And for 2025, the corporate expects to develop by one other 7%, which is not unhealthy contemplating its present progress price and measurement. Furthermore, its 2024 income beat analysts’ expectations.

Nonetheless, GoDaddy had full-year earnings per share (EPS) of $6.45. Whereas that was down considerably yr over yr, 2023 had an enormous tax profit that boosted earnings. So the year-over-year decline wasn’t the issue. The issue was that buyers had anticipated EPS only a tad larger.

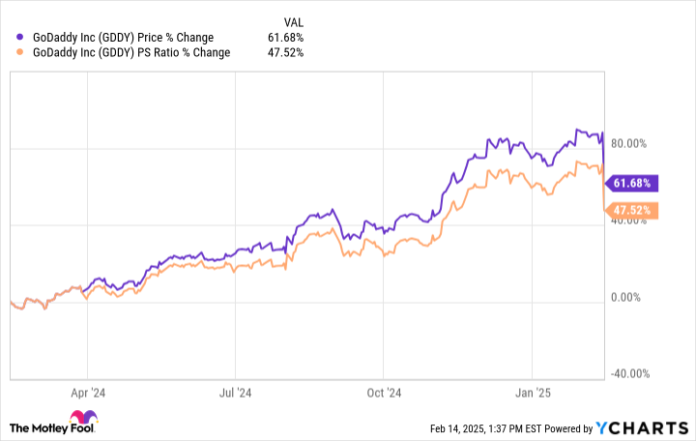

Because the chart beneath reveals, GoDaddy inventory is up 62% over the previous yr, however its price-to-sales (P/S) valuation is up by 48%. In different phrases, most of its beneficial properties are as a result of a better valuation, reflecting heightened investor expectations. Since a few of these expectations went unmet at this time, GoDaddy inventory crashed.

No purpose for GoDaddy’s shareholders to panic

For my part, GoDaddy inventory simply acquired slightly forward of itself, however it appears to be extra fairly valued now. For 2025, administration expects free money movement of about $1.5 billion, which means it trades at about 17 instances these expectations proper now. That is not a nasty valuation in any respect if the enterprise can proceed to search out progress over the long run.

GoDaddy’s administration thinks it might muster 6% to eight% top-line annual progress over the subsequent couple of years and make further enhancements to profitability. And people appear to be affordable expectations to me given the corporate’s model recognition and management within the website-building house. Briefly, at this time’s pullback seems like nothing greater than a wholesome pace bump for shareholders.

Jon Quast has no place in any of the shares talked about. The Motley Idiot recommends GoDaddy. The Motley Idiot has a disclosure coverage.