Cryptocurrencies fell this weekend and into in the present day, as traders grappled with a probably extra hawkish Federal Reserve, which might result in fewer charge cuts than hoped for in 2025.

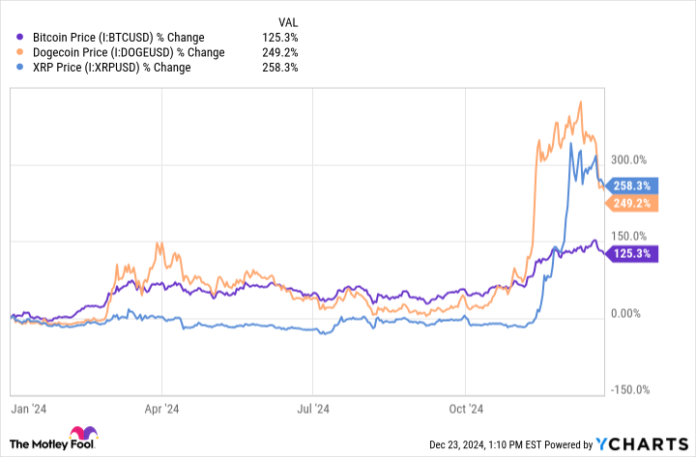

The value of Bitcoin (CRYPTO: BTC), the world’s largest cryptocurrency, traded about 4% decrease from late afternoon but in addition fell considerably over the weekend. As of 1:29 p.m. ET on Monday, Bitcoin traded round $93,260 after topping $102,000 final Thursday. The value of Dogecoin (CRYPTO: DOGE) traded 3.2% decrease, whereas XRP (CRYPTO: XRP) had fallen 3.1%.

The macro outlook is necessary proper now

The Federal Reserve despatched the market decrease after concluding its ultimate assembly of the 12 months final week. The Fed additionally disclosed that it expects solely two charge cuts subsequent 12 months as a substitute of the 4 it projected at its September assembly. Whereas many traders and market pundits appeared to anticipate this heading into the Fed’s assembly, the information stunned the broader market.

Crypto stakeholders acquired extra excellent news this morning after President-elect Donald Trump appointed Stephen Miran, an economist and former U.S. Treasury Division official, to chair the president’s influential Council of Financial Advisers. Moran is pro-crypto.

Nonetheless, traders appeared extra targeted on the broader macro outlook. Regardless of sturdy items orders in November coming in under expectations, Treasury yields moved increased, usually a bearish indicator for Bitcoin and crypto general.

Many assume Bitcoin can hedge inflation. Nonetheless, the cryptocurrency is impacted by greater than Treasury yields, and gold additionally moved decrease in the present day. The greenback continued to strengthen, and Bitcoin, as a substitute forex, tends to have an inverse relationship with the greenback.

Bitcoin value information by YCharts.

Merchants betting on 30-day Fed funds future costs are more and more relying on the company reducing charges fewer occasions than beforehand anticipated in 2025. Greater than 91% of merchants assume it’s set to pause charge cuts at its January assembly, and 37.5% of merchants see the Fed doing just one charge minimize subsequent 12 months.

Only a week in the past, most merchants anticipated two cuts from the Fed subsequent 12 months, though remember the fact that these chances can change rapidly.

I did not see a lot token-specific information this morning, though Michael Saylor’s firm, MicroStrategy, continues to purchase Bitcoin. Final week, the corporate bought one other 5,262 tokens for $561 million at a mean value of $106,662. Saylor has publicly predicted Bitcoin can soar to $13 million by 2045.

Anticipate some turbulence heading into the brand new 12 months

Bitcoin has risen considerably this 12 months, so it is extra prone to pullbacks. I anticipate the token to stay risky because the market appears for hints about inflation and the trajectory of rates of interest.

Most merchants now assume inflation can be sticky and keep above the Fed’s most popular 2% goal. Buyers and the Fed are additionally bracing for the potential inflationary impression of Trump’s proposed tax cuts and tariffs.

Nonetheless, all of this might change route on a dime with a weak studying of the December jobs report or the Shopper Worth Index in early January, which is why I anticipate volatility to start subsequent 12 months. XRP and Dogecoin are extra risky than Bitcoin, so the 2 tokens ought to expertise increased beneficial properties and worse losses than Bitcoin.

I like Bitcoin and assume XRP warrants a smaller, speculative place. I don’t presently have any curiosity in Dogecoin.