Shares of Coca-Cola (KO 1.38%) rose 12.1% in February 2025, in keeping with knowledge from S&P World Market Intelligence. The mushy drink big revealed a tasty fourth-quarter earnings report on Feb. 11, adopted by a crowd-pleasing dividend improve on the twentieth. The earnings occasion offered many of the gasoline for final month’s worth features. Buyers would have been extra shocked if Coke did not enhance its quarterly payouts for the primary time in ceaselessly.

Coca-Cola’s recipe for This fall success

This fall gross sales rose 6.4% yr over yr to $11.5 billion. Your common analyst would have settled for $10.7 billion.

Coca-Cola additionally stories a novel metric referred to as natural revenues. This determine will not be associated to the acquisition of health-focused drinks by shoppers however to core enterprise gross sales, backing out the results of foreign money trade fluctuations, acquisitions, and divestitures. Foreign money traits and better ingredient prices constituted modest headwinds in This fall. Alternatively, a large-scale refranchising of bottling operations gave Coca-Cola a income enhance. With out these places and takes, natural gross sales rose 14% yr over yr.

On the underside line, adjusted earnings rose 12% to $0.55 per share. Right here, the analyst consensus stopped at $0.52.

The corporate generated $3.2 billion of free money flows on this quarter and paid out 64% of those money earnings as dividend checks. Calendar quirks end in two dividend payouts falling in Coca-Cola’s This fall with no dividend bills in Q1, nevertheless it’s simple sufficient to do the maths to ignore this impact.

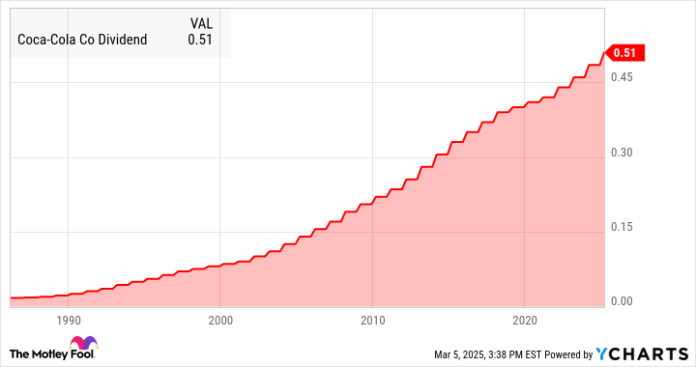

On that word, Coca-Cola boosted its subsequent quarterly dividend payout from $0.485 to $0.51 per share. Payable on April 1 (proper after closing the books for Q1), the brand new full-year payout works out to $2.04 per share. The unbroken streak of annual dividend will increase began in 1962.

KO Dividend knowledge by YCharts.

Coca-Cola buyers have come to count on these dependable dividend bumps and can be sorely disillusioned in the event that they stopped coming. Grasp buyers Warren Buffett’s portfolio collected $704 million of Coca-Cola dividends in 2022, and the payouts continue to grow.

No alarms and no surprises

So Coca-Cola’s enterprise is faring effectively as traditional, greater than making up for foreign money results with a strong product gallery and a world-class distribution community. The corporate is at the moment increasing its chilly drink gear by 250,000 internet new shops and virtually 600,000 new beverage coolers. Administration sees this enlargement as a key enterprise benefit, setting Coca-Cola other than international and native rivals with much less subtle bottling and distribution programs.

When you’re considering including some Coke inventory to your portfolio, the shares are neither costly nor low cost. Coca-Cola inventory trades in a Goldilocks zone of 28 instances trailing earnings and 6.5 instances gross sales. The inventory is probably not a cut price bin deal, however you may lock in that juicy 2.9% dividend yield at an inexpensive share worth.

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.