Broadcom inventory is getting a carry from information about Apple’s upcoming iPhone 16 {hardware}.

Broadcom (AVGO 5.51%) inventory is climbing larger in Tuesday’s buying and selling. The corporate’s share value was up 5.2% as of two p.m. ET, in response to information from S&P World Market Intelligence.

Broadcom inventory is gaining floor in the present day following Apple‘s presentation of recent cell and wearable {hardware} yesterday. Following the occasion, KeyBanc revealed a report that listed Broadcom as one of many probably parts winners from the launch of Apple’s upcoming iPhone 16 strains.

Is Broadcom poised to attain new wins within the iPhone 16?

At its “Glowtime” occasion yesterday, Apple unveiled 4 new telephones: iPhone 16, iPhone 16 Plus, iPhone 16 Professional, and iPhone 16 Professional Max. The cell {hardware} chief additionally unveiled new AirPods, two new Apple Watch gadgets, equipment, and software program, nevertheless it’s the cell {hardware} line that is most important for Broadcom.

Every of the brand new iPhone 16 gadgets will help Wi-Fi 7, which is able to permit the {hardware} to ship and obtain information quicker and with extra dependable connectivity. KeyBanc expects that Broadcom might be offering key {hardware} that facilitates the connectivity improve, and that appears to be a probable state of affairs.

What’s subsequent for Broadcom inventory?

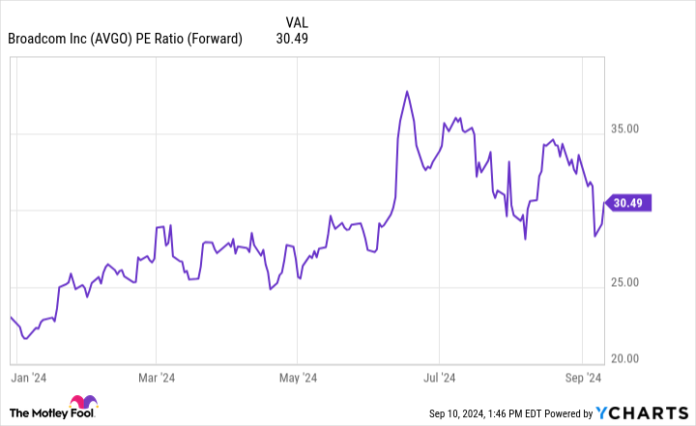

Broadcom inventory has seen unstable buying and selling currently. Along with an uptick in cautiousness about valuations for synthetic intelligence (AI) shares, the corporate’s most up-to-date quarterly report arrived with ahead steerage that disenchanted Wall Avenue and spurred huge sell-offs. The corporate’s share value is down roughly 19% from the excessive it reached earlier this yr, nevertheless it’s additionally up roughly 32% throughout 2024’s buying and selling.

AVGO PE Ratio (Ahead) information by YCharts

Following in the present day’s beneficial properties, Broadcom is now valued at roughly 30.5 occasions this yr’s anticipated earnings. The corporate’s growth-dependent valuation may set the stage for extra volatility within the close to time period, however the know-how specialist has sturdy positioning in connectivity {hardware} and software program classes that look poised to learn from sturdy development developments. For risk-tolerant traders in search of long-term performs within the AI house, Broadcom deserves a detailed look.

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.