The trade is realizing that Bitcoin was intentionally designed to prioritize easy, deterministic validation over complicated on-chain execution. This design alternative minimizes useful resource necessities, preserves decentralization, and reduces systemic threat even when it means pushing complicated logic, programmability, and heavy computation to greater layers or exterior methods.

How Bitcoin Avoids Complicated State Transitions

The elemental limitation of Bitcoin is its incapability to run heavy verification logic at a low value, a core constraint that each BitVM-based bridge should navigate. In line with the GOAT Community put up on X, to handle these points, they’re introducing a BitVM2 design that may guarantee disputes are inexpensive sufficient to be executed underneath actual charge situations. The safety mechanism is addressed by means of optimistic verification utilizing garbled circuits (GC).

Associated Studying

This operator, which is ready to launch quickly, publishes the garbled-circuit artifacts off-chain, whereas committing solely the related labels on-chain. If the computation is right, no on-chain motion will probably be required. In the meantime, if one thing is flawed, a challenger doesn’t have to replay an costly computation on-chain.

As an alternative, they produce a minimal fraud-proof to disclose the output “0” label that contradicts the operator’s claimed outcome. At that time, the on-chain step is about demonstrating a contradiction, which is able to cut back the price of disputes and alter the economics of safety.

A sensible element in BitVM designs is that the garbled circuit dimension issues, and pairing heavy verification could cause bloated circuits. To keep away from this, BitVM2 integrates a designated-verifier SNARK, which reduces verifier complexity in order that the garbled circuits stay inside reasonable dimension limits. For finish customers, the implication is that the cheaper, extra dependable depute paths make it more durable for the bridge to stall when the charges spike.

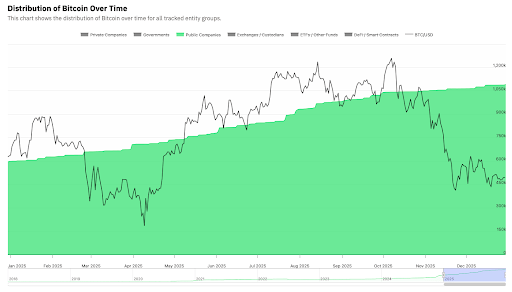

Public Firms Are Turning into Bitcoin’s Strongest Patrons

Whereas a number of initiatives are being launched to enhance the effectivity of Bitcoin, seasoned crypto knowledgeable and the founding father of the Wealth Mastery Newspaper, Lark Davis, has revealed that many public corporations are aggressively accumulating BTC. Presently, public corporations collectively maintain 1.09 million BTC, representing 5.1% of the whole BTC provide, which is a brand new all-time excessive.

Associated Studying

Nonetheless, the most recent main aggressive purchases have come from MicroStrategy and Metaplanet. Technique simply introduced one other 1,200 BTC buy, pushing its complete holdings to 672,000 BTC. Asia-based agency Metaplanet additionally purchased a further 4,200 BTC in December, bringing its complete holdings to 35,000 BTC.

Davis identified that different latest purchases have come from Cango Inc., Bitdeer Applied sciences, and Anap Holdings. Whereas retail traders are demonstrating weakening sentiment, public corporations or institutional traders proceed to stack whatever the ongoing market.

Featured picture from Pixabay, chart from Tradingview.com