Disillusioned development buyers are beginning to get excited.

Shares of software program firm Adobe (ADBE 14.39%) skyrocketed on Friday after the corporate reported monetary outcomes for its fiscal second quarter of 2024. As of 10:30 a.m. ET, Adobe inventory was up 14% — that is an enormous deal for a corporation that is valued at nicely over $200 billion.

Beating expectations and calming nerves

Adobe generated Q2 income of $5.31 billion, which was up 10% yr over yr. This beat the excessive finish of administration’s steerage by a hair. And on the underside line, administration stated it was going to have earnings per share (EPS) of $3.35 to $3.40. However right here, too, the corporate’s monetary outcomes exceeded expectations by reporting EPS of $3.49.

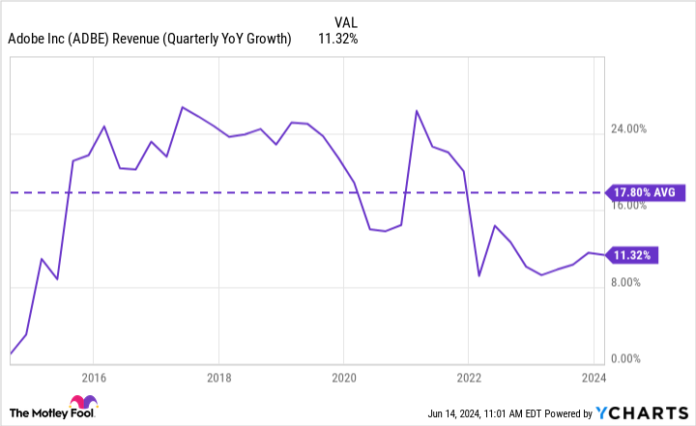

J.P. Morgan analyst Mark Murphy gave some context in his be aware to buyers, saying that Adobe buyers have been within the “trough of disillusionment,” in accordance with The Fly. To Murphy’s level, the corporate’s top-line development has been extra modest lately in comparison with what buyers are extra used to, because the chart beneath exhibits.

ADBE Income (Quarterly YoY Development) information by YCharts. Observe that chart doesn’t mirror Adobe’s Q2 monetary outcomes.

Traders have been disenchanted however Adobe’s Q2 outperformance lifted spirits. Furthermore, analysts (together with Murphy) are elevating their value targets for the inventory, with many citing coming catalysts from synthetic intelligence (AI) purposes.

Are tailwinds about to blow?

Adobe is a robust enterprise and it is doing nice. However I am somewhat stunned to see analysts anticipating stronger development within the again half of its fiscal 2024 because of AI. The midpoint of the corporate’s full-year 2024 income steerage is $21.45 billion, implying income of virtually $11 billion within the second half of the yr. That is solely a ten% enhance from the second half of its fiscal 2023.

Do not misunderstand: 10% development is nice for Adobe. However this does not symbolize an AI-boosted acceleration to development — it is virtually precisely the identical as its development within the first half of the yr.

Subsequently, Adobe shareholders ought to be comfortable that the enterprise remains to be fairly sturdy. However I would attempt to hold expectations on development grounded.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Adobe. The Motley Idiot has a disclosure coverage.