The once-loved inventory retains falling decrease and decrease. Will the ache ever finish?

It will be arduous to examine three years in the past. But, as we sit right here as we speak, shares of Peloton Interactive (PTON 10.51%) are down 98% from all-time highs set again in 2021. The at-home health large has seen its fortunes dwindle, with the share worth all the way down to a measly $3 as of this writing. It has seen stagnating subscriber progress, continues to lose cash, and has a teetering steadiness sheet that simply bought refinanced.

What occurred to Peloton inventory? And what can buyers be taught from it? Let’s take a more in-depth look and discover out.

Again to progress, however extra losses abound

Final quarter, Peloton’s financials appeared much like the previous few years, which isn’t an excellent factor. Subscriber numbers are stagnating, with paid-fitness subscriptions at barely over 3 million, flat yr over yr and up 2% quarter over quarter. With gear income dropping, Peloton’s total gross sales fell but once more within the quarter, down 4% yr over yr to $717 million.

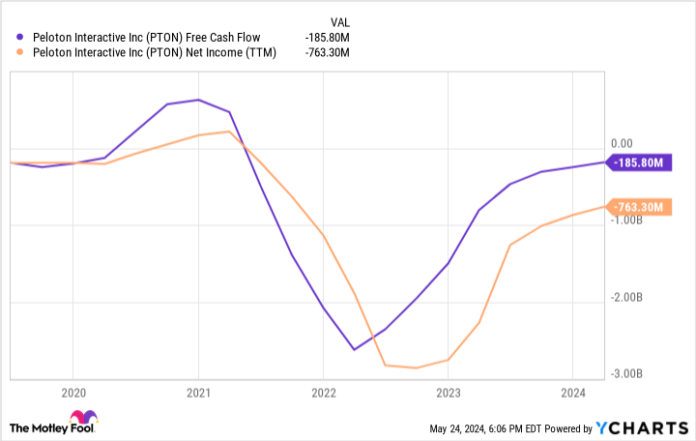

Issues worsen as you progress down the revenue assertion. With over $450 million in working bills in addition to curiosity bills on its debt, the corporate had one other interval of web losses. It misplaced $166.7 million within the quarter, which no investor ought to be completely satisfied about. The corporate has posted unfavorable free money circulation and web revenue each trailing-12-month interval for the reason that finish of 2021, which reveals how impaired Peloton’s enterprise is.

Health gear is a troublesome trade, going by way of main booms and busts for a lot of manufacturers. Individuals who love exercising additionally love attempting new fads after they come into recognition. Peloton was standard for a couple of years however has since misplaced its luster amongst prospects. This continues to indicate up in its monetary statements.

Remember steadiness sheet troubles

Even perhaps worse than Peloton’s revenue assertion — if that is even attainable — is its steadiness sheet. It has a unfavorable stockholder’s fairness, that means it has extra liabilities than belongings. This should not be stunning given all the cash it has misplaced over the previous few years.

On the finish of final quarter, Peloton had round $800 million in money. Nevertheless, it additionally had $1 billion in convertible bonds and $692 million in time period loans. After the quarter ended, the corporate refinanced its debt by doing a 5.5% rate of interest convertible bond price $300 million. It used this and money readily available to pay again its current convertible bond.

Its previous convertible bond had a 0% rate of interest. Now, it will likely be paying 5.5% annual curiosity on this new debt, elevating its complete annual-interest expense. This will probably be an additional headwind to Peloton producing any form of earnings within the coming years, which it must do with a purpose to pay again these loans or danger working out of money.

It’s no surprise that CEO Barry McCarthy simply resigned his function on the firm. Peloton has actual liquidity points that is probably not solvable.

PTON Free Money Stream information by YCharts.

Must you purchase the dip?

To maintain it easy: No, you shouldn’t purchase the dip on Peloton inventory. It has a nasty steadiness sheet, has no indicators of progress, and may’t generate a revenue. There aren’t any redeeming qualities to Peloton’s enterprise proper now, and it may simply file for chapter inside a couple of years, if not sooner.

What can buyers be taught from the Peloton inventory story? I feel it’s crucial that buyers do not fall in love with new, fast-growing manufacturers within the health house. Traders have been pricing in Peloton like it will hit 30 million subscribers by 2024, and it has 10% of these numbers as we speak. It is also a warning to keep away from shares with dangerous steadiness sheets, particularly ones which are burning money.

As a substitute, buyers should purchase blue chips for his or her portfolios. Do not fiddle with Peloton inventory — this firm just isn’t headed in the best route anytime quickly.

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Peloton Interactive. The Motley Idiot has a disclosure coverage.