Crypto isn’t nearly shopping for, promoting, or investing. It’s additionally about taking part within the ecosystems and platforms that you simply imagine in. On the earth of decentralized finance and blockchain-based initiatives on the whole, customers can play main roles in shaping the way forward for protocols and platforms themselves. That’s the place governance tokens are available.

These distinctive tokens give their holders the flexibility to vote on proposals, affect protocol upgrades and modifications, and assist information the course of decentralized initiatives.On this information, we’ll break down what governance tokens are, how they work, and why they matter.

What Is a Governance Token?

Governance tokens are a significant a part of how choices are made in lots of decentralized crypto initiatives. As an alternative of centralizing the entire energy within the palms of some builders or workforce members, governance tokens give the group a voice.

In easy phrases, a governance token is a kind of cryptocurrency that grants the holder voting rights. Governance token holders can vote on modifications to a protocol, resolve the place funds within the treasury are allotted, and even weigh in on new options or upgrades.

Governance tokens are sometimes linked to decentralized autonomous organizations (DAOs). Decentralized autonomous organizations are like community-run initiatives that haven’t any central management. In a DAO, the principles are enforced utilizing sensible contracts, and the members (token holders) steer the course of the challenge by casting votes.

Governance tokens are frequent in decentralized finance (DeFi), blockchain gaming, NFT initiatives, and even some metaverse worlds. They play an important position to make sure that the platforms keep decentralized, giving customers a direct say in how platforms evolve.

What Makes Governance Tokens Beneficial?

At first look, a governance token may not appear particularly helpful. Not like utility tokens, they don’t at all times grant entry to providers, yield rewards, or different fast performance. So, why are they invaluable?

In a phrase: affect. Holding a governance token provides you the ability to assist form the way forward for a challenge. You’ll be able to vote on integral protocol upgrades, payment modifications, and even vote on main treasury allocations. In some instances, this affect is tied to billions of {dollars} of property.

Take Uniswap’s UNI token for instance. Uniswap gave UNI holders the flexibility to vote on how protocol’s treasury, which holds over $3 billion of {dollars} in property as of early 2025, is managed. This sort of decision-making energy can carry main weight.

One other notable instance is Compound Finance’s governance token, COMP. Launched in 2020, COMP was one of many first main governance tokens, permitting the group to form rate of interest fashions, protocol upgrades, and supported property. The extra COMP you maintain, the extra affect you may wield. Right here is an instance of a profitable, executed proposal on Compound, using the voting energy of the vast majority of governance token holders.

Even when tokens don’t generate direct revenue or utility, they will admire in worth if the protocol is profitable and group engagement is robust. Many crypto traders prefer to speculate on these tokens after they anticipate the protocol to develop and succeed sooner or later, even when they haven’t any motive to solid votes. That is very true for tokens in initiatives with giant treasuries and future money flows, like widespread DeFi protocols.

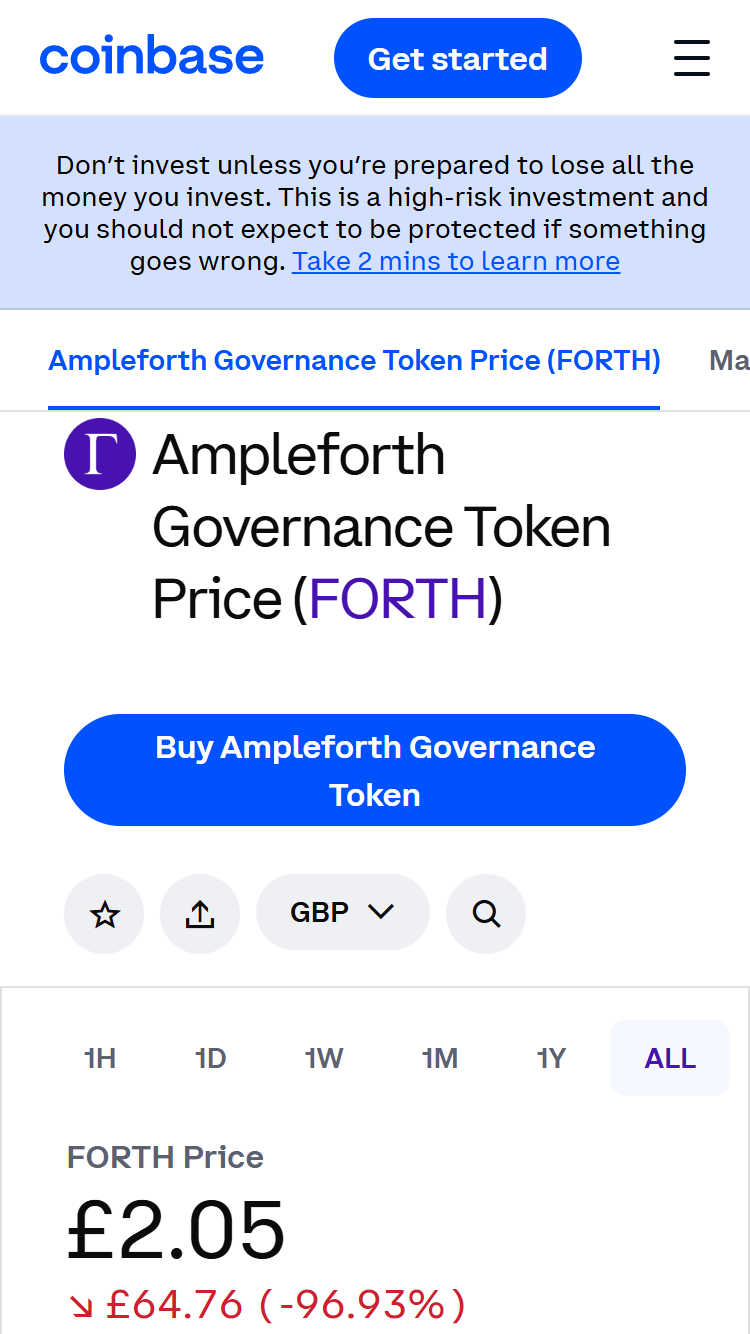

It’s essential to do not forget that governance tokens, like all cryptocurrencies, should not with out danger. Their worth could be extraordinarily risky and pushed extra by hype than fundamentals. If the governance system is taken over by a handful of whales or if voter turnout is low, the token’s worth can crash rapidly.

Ultimately, governance tokens are sometimes carefully tied to the well being, credibility, hype, and potential of the challenge they govern.

Governance Tokens vs. Utility Tokens Defined

Not each crypto token is designed to do the identical job. The 2 most typical varieties within the business are utility tokens and governance tokens. Whereas the 2 generally overlap, they really serve essentially totally different core roles within the blockchain ecosystem.

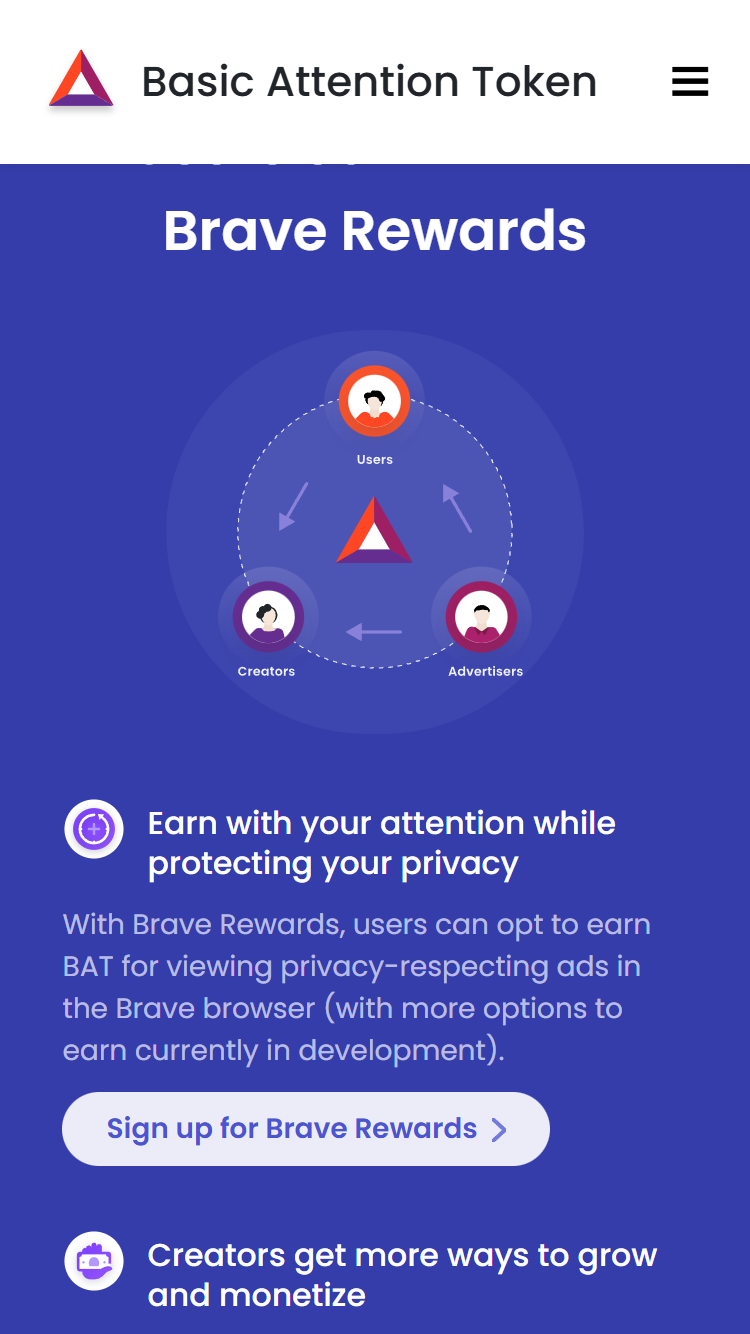

A utility token is especially used to entry a services or products inside a blockchain-based platform. Consider it as a key that unlocks options. For example, the Primary Consideration Token (BAT) is used within the Courageous browser to reward customers for viewing advertisements and supporting content material creators. Token holders don’t get voting rights – it’s all about performance.

Governance tokens, then again, are all about participation and management. Whenever you maintain a governance token, you assist information the challenge’s course via voting. You would possibly vote on whether or not a brand new function needs to be added, how charges are dealt with, and the way funds are distributed. The MakerDAO challenge, as an example, makes use of the MKR token to manipulate the DAI stablecoin protocol. Determination-making is left to MKR token holders, who govern the DAI stablecoin protocols.

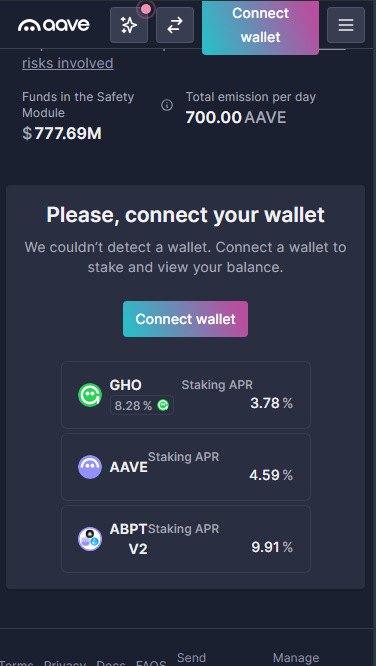

The road between governance and utility tokens can get blurry. It’s because some tokens do double responsibility. For example, AAVE is a governance token that enables holders to vote on protocol choices, but it surely additionally capabilities as a utility token. Holders can stake AAVE to earn rewards and assist safe the lending system.

Within the early days of crypto, most tokens cleanly match into both the governance or utility field, however these days many new initiatives give their tokens each governance rights and another type of utility or staking reward. Just like AAVE, Balancer’s BAL can be utilized for each liquidity and governance incentives.

So, whereas the phrases “governance” and “utility” describe totally different ideas, in observe, many tokens will put on each hats. The essential factor right here is to grasp how the token capabilities in context and whether or not it provides you energy, entry, or each.

How Governance Tokens Work

Governance tokens aren’t simply collectibles or speculative property. They’re central to decentralized governance and the way initiatives make choices.

However how precisely do these tokens operate inside the governance processes? Listed below are the principle fashions of governance that crypto initiatives use to form their future.

The Major Fashions of Governance

There are a couple of important methods governance tokens are used throughout platforms (with some variations relying on the challenge’s distinctive wants).

1. One Token, One Vote (Direct Democracy)

That is essentially the most easy and customary mannequin. Every token represents one vote, so the extra tokens you maintain, the extra voting energy you will have. In direct democracy, choices like protocol upgrades are made primarily based on the bulk vote of token holders.

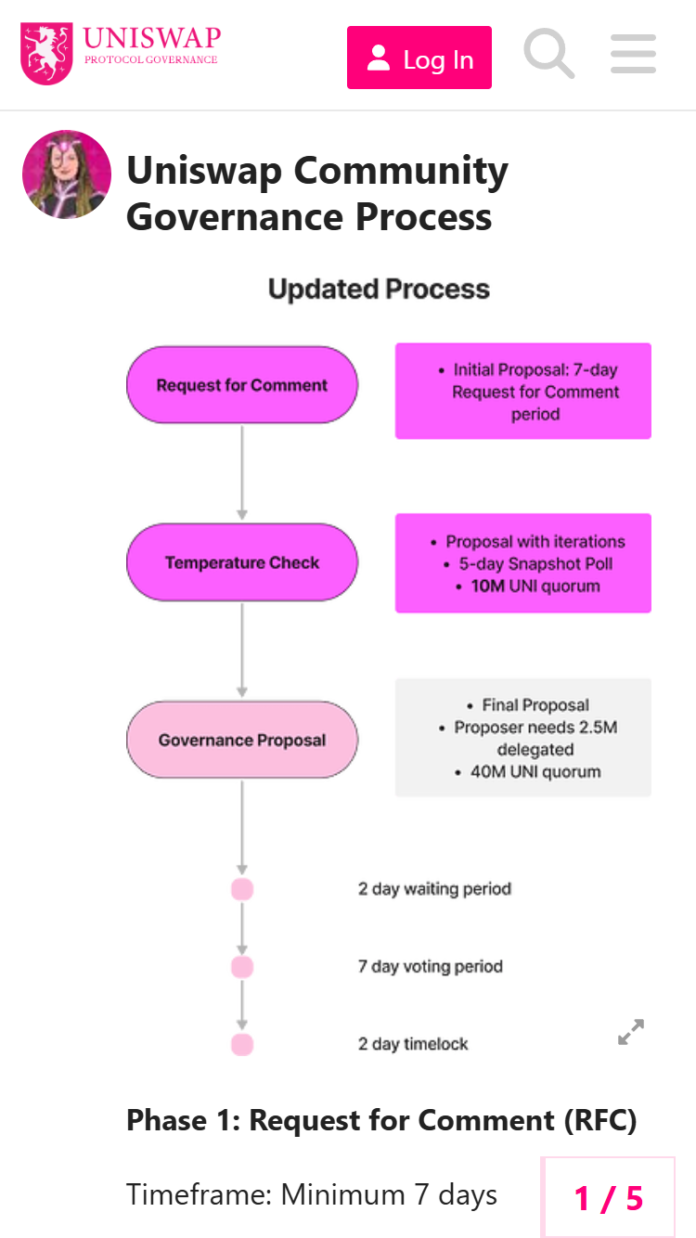

Instance: Uniswap, the favored decentralized trade, makes use of this mannequin. UNI token holders vote on governance proposals that have an effect on the course of the platform. The extra tokens you personal, the larger your affect in voting.

2. Quadratic Voting

Quadratic voting, popularized by Ethereum cofounder Vitalik Buterin, is a mannequin designed to cut back the dominance of huge token holders. On this system, the price of extra votes will increase quadratically. For instance, casting 4 votes would possibly require 16 tokens, not simply 4.

Instance: Gitcoin makes use of quadratic voting to fund open-source initiatives. This method provides smaller holders extra significant affect and prevents whales from taking up the complete course of.

3. Delegated Voting

Delegated voting, also called liquid democracy, is a mannequin that enables token holders to delegate their votes to a trusted consultant, just like how a democratic republic capabilities. This fashion, the holders don’t must take the time to evaluation and vote on proposals themselves and might go on their rights to somebody extra educated on the subject.

Instance: Aragon makes use of a delegated voting mannequin the place customers can delegate their votes to trusted brokers to vote on their behalf.

The selection of a governance mannequin will rely on the challenge and its objectives. Extra centralized initiatives would possibly use a easy one-token-one-vote system. Others would possibly go for quadratic or delegated voting to cut back the centralization of energy.

Learn how to Get Governance Tokens

Now that you know the way governance tokens work, it’s time to learn to really get your palms on them. There are a couple of totally different strategies, every with its personal set of benefits.

1. Shopping for Them on an Trade

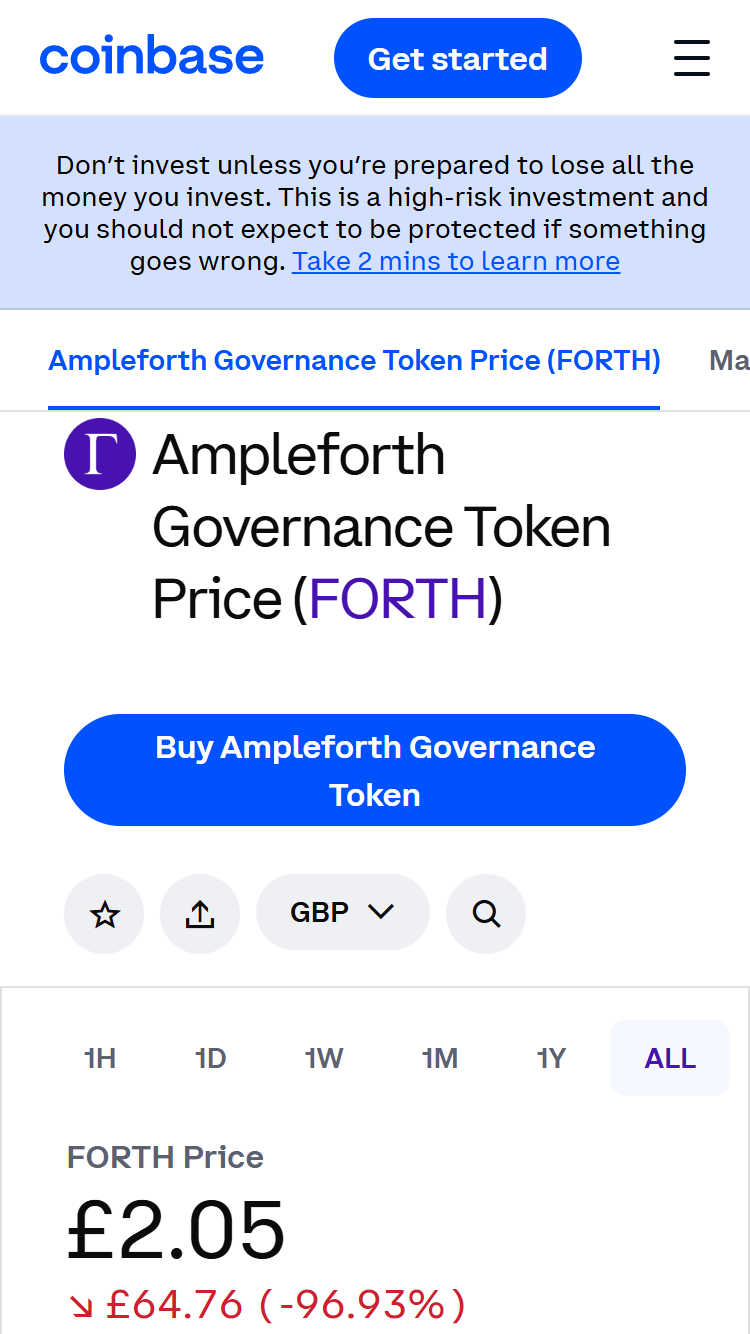

One of the crucial easy methods to amass governance tokens is by buying them on a crypto trade. Main platforms like Binance, Coinbase, and Uniswap listing tons of governance tokens for direct buy.

Centralized exchanges like Coinbase and Binance permit you to buy governance tokens with fiat currencies, although they could not provide smaller tokens. Decentralized exchanges like Uniswap and Raydium provide many extra tokens, although you’ll have to buy some cryptocurrency and arrange a crypto pockets earlier than you need to use them.

2. Incomes Tokens By means of Staking

Some initiatives launch governance tokens as rewards for staking different tokens. On this mannequin, you may lock up a certain quantity of cryptocurrency in a protocol for a interval, and in return, you’ll obtain governance tokens.

This can be a frequent observe in DeFi platforms the place customers can stake tokens like DAI or ETH and earn governance tokens like AAVE or SUSHI in return. For instance, AAVE staking returns simply over 4.5% on the time of writing (although it will probably fluctuate over time).

3. Airdrops

Maybe among the finest methods of getting governance tokens is thru token airdrops, although it’s not often a simple process. They’ve change into a highly regarded methodology for initiatives to reward early adopters and distribute their tokens. If you happen to meet sure standards like holding a particular token at a selected time or interacting with a particular protocol, the challenge will ship your pockets tackle free tokens.

For example, Uniswap famously airdropped 400 UNI tokens to anybody who had used the platform earlier than a sure date, even when they didn’t maintain any UNI tokens on the time. 400 UNI was value practically $18,000 on the token’s all-time excessive, making it a particularly profitable airdrop. Sadly, protocols by no means reveal the precise necessities earlier than the cutoff for eligibility, which may make securing airdrops tough. Most don’t even let it slip that they’re planning an airdrop earlier than the cutoff.

4. Taking part in DAO Voting

Some initiatives will distribute governance tokens as rewards for participation in governance or group engagement. If you happen to have interaction with group members, vote on proposals, and take part in boards, you is likely to be rewarded with governance tokens.

By doing this, the initiatives encourage energetic participation and governance involvement. DAOstack is one instance of this. It provides out governance tokens to customers who have interaction in group choices.

5. Liquidity Mining

One other methodology to earn governance tokens is thru liquidity mining. On this setup, you present liquidity to a decentralized trade (DEX) or lending platform in trade for governance tokens.

The thought right here is that, by including liquidity, you assist keep the operations of the platform. In return, the platform rewards you with governance tokens. Numerous DeFi apps, together with Curve Finance and Balancer, use this methodology as a result of it’s an effective way to incentivize liquidity provision.

Learn how to Vote With Governance Tokens

All (professional) governance tokens give their holders some sort of voting energy. Nonetheless, the voting course of can differ dramatically relying on which token or platform you’re utilizing. Let’s take MakerDAO for instance. It is among the most essential platforms in DeFi that makes use of its MKR token for governance choices associated to its DAI stablecoin. Right here is how the method works:

-

- First, you need to maintain MKR tokens in your pockets (and never an trade). Keep in mind – the extra you maintain, the larger your voting energy!

-

- Entry the voting platform. MakerDAO makes use of Oasis, a platform the place you may view ongoing proposals and vote on them.

-

- Vote on proposals. These can embrace modifications to the DAI stability payment, changes to the danger parameters of sure collateral varieties, or choices about MakerDAO’s treasury. As a token holder, you may vote by deciding on “approve” or “reject” on the proposals.

As soon as the proposal reaches the mandatory threshold of approval, the modifications will likely be applied on the Maker protocol. For a extra in-depth clarification of the way to vote on MakerDAO, try their step-by-step video information.

The Execs and Cons of Governance Tokens

Governance tokens are essential in decentralized finance and blockchain initiatives. Nonetheless, like some other system, they arrive with a set of benefits and downsides.

| Benefits | Disadvantages |

| Decentralized choice making: The group could make choices with out counting on a government. | Centralization dangers: Giant token holders (whales) can disproportionately affect choices. |

| Elevated group engagement: Holders usually tend to actively take part within the challenge’s future. | Voter apathy: Low voter turnout can result in choices being made by a small set of token holders. |

| Transparency: Proposals and votes are sometimes public. | Complexity: The voting course of could be technical and hard for non-expert customers. |

| Incentives for participation: Many initiatives reward energetic individuals with tokens. | Safety dangers: Voting programs and proposals could be exploited if the platform isn’t well-secured. |

| Revenue potential: If the challenge grows and succeeds, the worth of governance tokens might improve. | Lack of utility: In lots of instances, governance tokens provide little fast utility past voting. |

Most Widespread Governance Tokens

Listed below are a few of the hottest governance tokens in use in the present day by market capitalization and basic recognition:

Uniswap (UNI)

Market cap: $7.5 billion as of April 2025

Governance overview: UNI holders can vote on proposals similar to altering liquidity supplier charges or governance mannequin changes. Uniswap follows a one-token, one-vote mannequin.

MakerDAO (MKR)

Market cap: $5.4 billion as of April 2025

Governance overview: MKR holders can vote on essential choices similar to changes to the system’s danger parameters and updates to the DAI stablecoin. MakerDAO additionally makes use of a one-token, one-vote mannequin however entails numerous ranges of governance.

Aave (AAVE)

Market cap: $6.9 billion as of April 2025

Governance overview: AAVE holders can vote on protocol upgrades, treasury administration, and different essential choices. They’ll additionally stake AAVE to assist safe the community. Aave has a liquidity mining program the place holders not solely govern however may also earn rewards by taking part within the platform.

SushiSwap (SUSHI)

Market cap: $2.1 billion as of April 2025

Governance overview: SUSHI holders vote on points like protocol upgrades and payment distribution. The platform additionally has liquidity incentives.

Compound (COMP)

Market cap: $2.8 billion as of April 2025

Governance overview: COMP holders vote on protocol modifications, together with including and eradicating property from the platform. The protocol is ruled by liquidity suppliers who obtain tokens as rewards for his or her participation.

Conclusion

Governance tokens have performed a significant position in shaping the way forward for cryptocurrency for a few years. They’re the muse of the decentralized governance mannequin, the place choices are made by the communities quite than CEOs or centralized groups.

Because the crypto market continues to evolve, on-chain governance will probably change into much more essential. Initiatives are slowly leaning into transparency and decentralization, shifting increasingly of their decision-making onto the blockchain, the place all the things is traceable and community-oriented. Nonetheless, it is very important do not forget that not all tokens are created equal. Some are simply rewards or funds, whereas others are separate governance tokens – used strictly for voting.

In actuality, decentralized governance is way from good proper now. Now we have voter apathy, whale dominance, and quite a few technical boundaries that also pose main issues. Just a few supposedly decentralized initiatives even disregard their governance fashions fully after they disagree, rendering the complete system moot. Nonetheless, the thought of constructing a community-led ecosystem stays highly effective and, when it’s applied effectively, it’ll assist create extra user-focused and resilient platforms sooner or later.

FAQs

What are governance tokens?

Governance tokens are a central a part of the decentralized finance ecosystem, giving holders voting rights to affect the selections and way forward for a decentralized challenge.

Is Aave a governance token?

Sure, AAVE is a governance token that offers holders the suitable to vote on proposals. Nonetheless, it is usually a utility token with numerous makes use of within the Aave platform.

Is Solana a governance token?

Sure, Solana is a governance token, permitting holders to vote on on-chain proposals that influence the blockchain’s future, although it’s primarily used for transaction charges, staking, and funds.

References