This unbelievable worth inventory has a large moat and trades for an amazing value proper now.

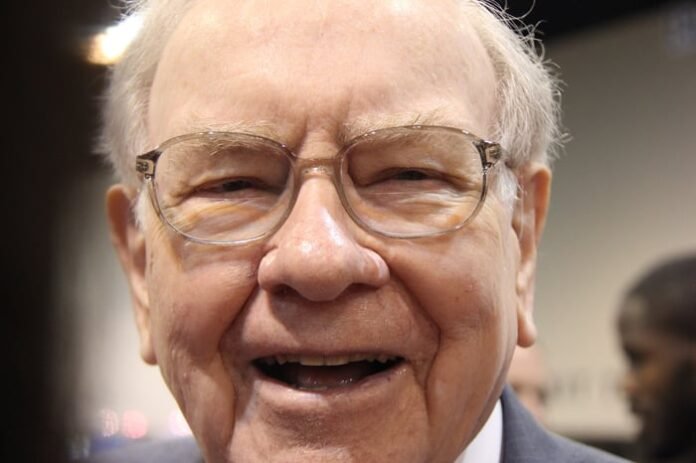

Warren Buffett hasn’t seen very many compelling alternatives within the inventory market over the previous yr. In 2024, he and his fellow portfolio managers at Berkshire Hathaway (BRK.A 0.64%) (BRK.B 0.63%) offered over $143 billion value of equities. The holding firm divested huge parts of its stakes in family names together with Apple and Financial institution of America.

The overwhelming majority of the proceeds from these inventory gross sales went to pay a document tax invoice and add to a rising pile of money and Treasury payments. However Buffett made one factor clear in his letter to shareholders in February: “Berkshire won’t ever desire possession of cash-equivalent belongings over the possession of fine companies, whether or not managed or solely partially owned.”

To that finish, Buffett was capable of make investments about $2.6 billion of Berkshire’s belongings in six publicly traded equities within the fourth quarter. Here is what buyers have to know and which one presents the most effective alternative proper now.

Picture supply: The Motley Idiot.

Listed below are all six shares Buffett simply purchased for Berkshire

Berkshire Hathaway reported a web improve in inventory purchases of about $3.4 billion within the fourth quarter. However not each fairness buy Berkshire makes is a publicly traded U.S. firm. Buffett stated it additionally elevated its Japanese investments within the quarter, and it could have purchased different non-marketable equities.

Listed below are the six publicly traded U.S. shares Buffett and his staff added to in Berkshire Hathaway’s portfolio and the way a lot they spent shopping for shares.

- Occidental Petroleum, $409.1 million.

- VeriSign, $89.9 million.

- Sirius XM, $296.8 million.

- Pool Corp., estimated $70 million.

- Domino’s Pizza, estimated $470 million.

- Constellation Manufacturers (STZ -1.32%), estimated $1.3 billion.

The six publicly traded shares Berkshire added to its portfolio within the fourth quarter all have one notable factor in widespread. None of them have significantly massive market capitalizations. The largest of the bunch, Occidental, has a market worth of $43.7 billion as of this writing. Sirius XM has a market cap of simply $7.7 billion.

Berkshire Hathaway notably already holds substantial parts of Occidental, Sirius XM, and VeriSign, which has a $22.1 billion market worth. And with the comparatively small market caps of the opposite interesting investments, Buffett has struggled to speculate very a lot money not too long ago. There’s merely not sufficient room out there for these shares for Buffett and his staff to make a giant acquisition, contemplating they’re managing over $600 billion in complete investable belongings.

That speaks to Buffett’s insistence on worth and the challenges going through Berkshire’s sizable portfolio. “There stay solely a handful of firms on this nation able to really transferring the needle at Berkshire,” Buffett wrote in his 2023 letter to shareholders. “Some we will worth; some we won’t. And, if we will, they need to be attractively priced.”

The excellent news for particular person buyers is that they usually do not handle practically as a lot cash as Buffett. Meaning a small or mid-cap inventory just like the six above can change into a considerable portion of your portfolio if you’d like. And one in every of Berkshire’s six buys from final quarter stands out as a sexy choice proper now.

Here is the most effective of the bunch

All six of the shares above current interesting worth for his or her shares, and the businesses all have sturdy aggressive moats. They’re fairly typical Buffett shares. However the latest addition to the portfolio, Constellation Manufacturers, is perhaps the most effective worth inventory of the group.

Constellation Manufacturers is the biggest brewer of Mexican beer. Its manufacturers, Corona and Modelo, dominate the U.S. marketplace for Mexican lagers. It additionally owns a wine and spirits enterprise, nevertheless it does not have vital model energy in these classes. Its the beer enterprise that runs the present at Constellation, and it accounts for over 80% of gross sales and working revenue.

The alcohol trade has confronted a number of headwinds not too long ago. The U.S. surgeon common has proposed placing well being warning labels on alcohol. Gen Z does not drink as a lot as earlier generations at their age. And beer, particularly, faces the problem of competing with ready-to-drink cocktails.

Nonetheless, Constellation has managed to steadily develop its beer gross sales, forecasting 4% to 7% gross sales development for fiscal 2025, which simply resulted in February. What’s extra, it expects its working margin to develop because of its premiumization technique.

It is positioning its beer manufacturers as extra premium choices, successfully utilizing its huge promoting funds. Its scale has performed an essential position in that regard, because it offers it a a lot larger promoting funds than competing Mexican breweries. That creates a virtuous cycle the place it is capable of spend extra on reinforcing its model messaging and subsequently capable of preserve premium pricing whereas dominating the market.

Buffett purchased shares of Constellation earlier than it reported third quarter earnings. These outcomes have been disappointing, with a 14% drop in wine and spirits gross sales fully offsetting the expansion of the beer enterprise. Administration lowered its full-year outlook consequently. The inventory has additional been overwhelmed down by the brand new 25% tariff in opposition to Mexico, which might damage gross sales and revenue margins.

Nonetheless, the underlying enterprise appears sturdy for the long term and it presents nice worth for buyers. After the drop in share value, the inventory trades for simply 12.4 occasions ahead earnings estimates, as of this writing. Contemplating the long-term aggressive benefits of Constellation’s beer enterprise, that makes it stand out as probably the greatest Buffet shares to purchase proper now.

Financial institution of America is an promoting associate of Motley Idiot Cash. Adam Levy has positions in Apple. The Motley Idiot has positions in and recommends Apple, Financial institution of America, Berkshire Hathaway, Domino’s Pizza, and VeriSign. The Motley Idiot recommends Constellation Manufacturers and Occidental Petroleum. The Motley Idiot has a disclosure coverage.