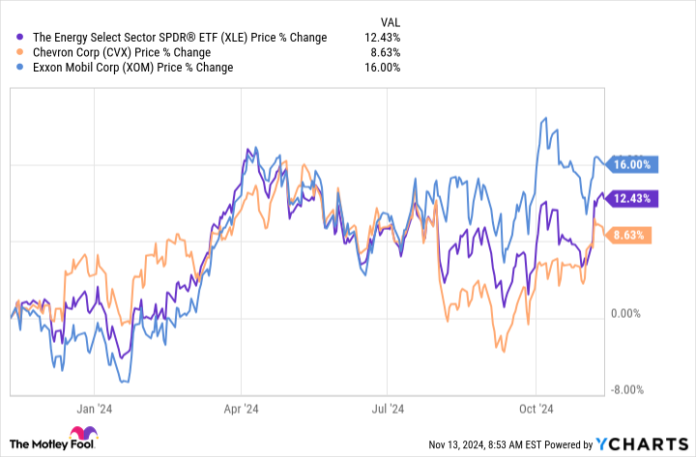

The inventory market has been roaring this yr. Most sectors have rallied, together with power. The common power inventory within the S&P 500 is up greater than 10% this yr.

Regardless of that rally, a number of power shares nonetheless seem like compelling buys. Chevron (CVX -0.23%), MPLX (MPLX 1.34%), and Occidental Petroleum (OXY -1.38%) stand out to a couple Idiot.com contributors as nice buys proper now. This is why they assume these power shares might provide traders with high-octane whole returns from right here.

Chevron comes with baggage

Reuben Gregg Brewer (Chevron): In terms of built-in power majors, Chevron is definitely one of many elite group main the pack. It’s giant, with a market cap of $275 billion. It’s diversified throughout the upstream (manufacturing), midstream (pipelines), and downstream (chemical compounds and refining). It’s financially robust, with a debt-to-equity ratio of solely round 0.17 occasions (one of many lowest of its closest peer group). And it has an over three-decade historical past of annual dividend will increase.

And but, it has lagged behind the power rally over the previous yr and is properly behind ExxonMobil, its closest U.S. comparability level. The issue is a bit distinctive since Chevron is in the course of attempting to purchase Hess, and Exxon seems to be standing in the way in which. Exxon’s partnership with Hess in a significant oil challenge is what’s holding issues up and will even scuttle the deal. Traders are possible treading rigorously with Chevron proper now, apprehensive that the deal falling by would end in slower progress for Chevron. That is not unrealistic.

However Chevron is not a inventory you have a look at for the brief time period however one you purchase for the long run. Even when Exxon throws a wrench within the Hess deal, Chevron can merely shift gears and discover one other acquisition goal. Perhaps that takes a little bit time, however shedding Hess will not derail Chevron; it is going to simply gradual it down quickly. Thus, the laggard inventory efficiency right this moment might find yourself being a shopping for alternative. And you will get a beautiful 4.2% dividend yield when you await all this to get sorted out.

The whole bundle

Matt DiLallo (MPLX): Items of MPLX have gained about 25% up to now this yr. Even with that surge, the grasp restricted partnership (MLP) nonetheless seems to be like a beautiful funding.

Regardless of the MLP’s roaring rally this yr, it nonetheless provides a excessive yield of greater than 8%. That is resulting from a mixture of valuation (which continues to be comparatively low at about 10 occasions earnings) and continued distribution progress. MPLX not too long ago elevated its distribution by one other 12.5%, marking its third straight yr of double-digit distribution will increase.

MPLX is in a wonderful place to proceed growing its distribution at a wholesome charge. It produces a lot of steady money and has a conservative payout ratio. It generated roughly sufficient money by the primary 9 months of this yr to cowl its distribution, capital spending, and a few acquisitions. And it has a cash-rich steadiness sheet with a low 3.4 occasions leverage ratio (properly under the 4.0 occasions its steady money flows might assist).

The MLP is investing to proceed increasing its midstream footprint, which is rising its capability and money circulation. The corporate has a number of tasks underway, giving it visibility into its progress by 2026.

MPLX is the entire bundle for traders. It provides a beautiful mixture of revenue and progress at an inexpensive valuation. Due to that, it nonetheless seems to be like an awesome purchase proper now for these snug with investing in an MLP, which sends traders a Schedule Ok-1 federal tax kind every year.

Occidental’s acquisition is paying off

Neha Chamaria (Occidental Petroleum): Shares of Occidental Petroleum have been a giant laggard this yr, buying and selling 15% decrease in 2024 as of this writing. Traders might have been apprehensive in regards to the influence of the latest fall in oil costs on an organization saddled with debt, however they’re maybe overlooking Occidental Petroleum’s newest transfer. The oil and fuel big is doing what it ought to — boosting money flows and repaying debt, making Occidental inventory the type you’d wish to purchase whereas the chance lasts.

Occidental simply reported robust income for its third quarter regardless of a drop in commodity costs, thanks partly to larger manufacturing pushed by a latest acquisition. Occidental acquired CrownRock in August for roughly $12 billion, together with debt, and anticipated the acquisition to be instantly accretive to its money flows. In Q3, Occidental delivered its highest working money circulation up to now this yr.

Extra importantly, Occidental dedicated to divesting property and repaying debt price round $4.5 billion inside a yr of buying CrownRock. The corporate is off to an awesome begin, repaying debt price $4 billion within the third quarter alone, inside simply two months of closing the acquisition.

Because of CrownRock, Occidental raised its full-year manufacturing steerage for the Permian Basin, so I anticipate the corporate to proceed to generate robust money flows and pare down debt. A powerful steadiness sheet is probably the largest forte for a commodity inventory, and Occidental is slowly however certainly getting there.

Matt DiLallo has positions in Chevron. Neha Chamaria has no place in any of the shares talked about. Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chevron. The Motley Idiot recommends Occidental Petroleum. The Motley Idiot has a disclosure coverage.