It is a key level that buyers appear to have forgotten, which is why that is such alternative.

With roughly 1,400 places, Ulta Magnificence (ULTA -1.31%) is without doubt one of the largest cosmetics retailers on the planet. This 12 months, administration expects the corporate to generate internet gross sales of at the least $11.5 billion, which is big.

Along with promoting merchandise which are extensively accessible, Ulta Magnificence sells unique merchandise that may solely be bought at its shops. And past promoting beauty merchandise, it additionally provides in-store providers equivalent to hair and nail salons. This mixture of services and products differentiates it from a few of its rivals and retains prospects coming in.

I will readily admit that I am not a buyer and may’t supply any private anecdotes to clarify Ulta Magnificence’s success. That stated, I can acknowledge one thing particular after I see it from the sidelines. As of the primary quarter of 2024, the corporate had over 43 million lively loyalty members — that does not simply occur out of the blue.

To be clear, the time period “loyal” is not simply an empty label for Ulta Magnificence’s members. These prospects are really loyal to the model. In 2023, a whopping 95% of the corporate’s gross sales got here from these 43 million consumers.

In different phrases, anybody can drive up and store at an Ulta Magnificence retailer. However a lot of the firm’s gross sales come from only a single supply: its loyalty members. And that is important to an funding thesis in the present day.

Why purchase Ulta Magnificence inventory?

For these unaware, many buyers appear scared to purchase Ulta Magnificence inventory proper now as a result of occasions are robust from a aggressive standpoint.

At the beginning of this 12 months, Ulta Magnificence’s administration predicted internet gross sales of $11.7 billion to $11.8 billion in 2024. That will have represented solely about 4% to five% top-line development from 2023. However in Q1, administration lowered its full-year steerage to $11.5 billion-$11.6 billion, which is much more modest development.

In the cosmetics area, there is a comparatively low barrier to entry. Celebrities can (and infrequently do) launch their very own product traces, which shortly catch on with followers. And wonder merchandise lend themselves to viral social-media advertising and marketing. Merely put, newcomers can are available in and shortly steal gross sales away from Ulta Magnificence.

On high of this risk to its market share, Ulta Magnificence’s administration notes that 2024 is a gradual 12 months for development within the area general. In brief, there isn’t any rising tide to raise its boat, and different gamers are actively attempting to sink it.

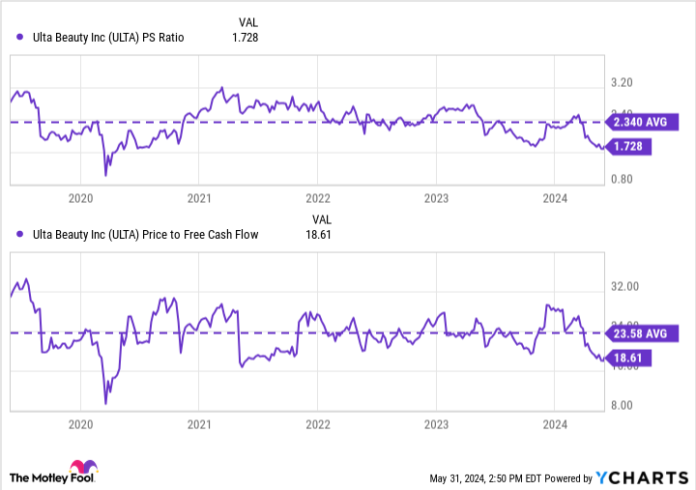

This contributes to buyers’ hesitancy to purchase Ulta Magnificence inventory. Because of this, shares have dropped to uncharacteristically low cost ranges, because the chart beneath exhibits.

ULTA PS Ratio knowledge by YCharts

If Ulta Magnificence have been on the cusp of irreversibly dropping market share to rising stars within the cosmetics area, then there could be good cause to keep away from investing within the inventory regardless that it is low cost. Low-cost shares aren’t good buys when the enterprise is in decline.

Nonetheless, buyers ought to bear in mind that the majority of Ulta Magnificence’s gross sales come from its loyalty members. Subsequently, it is cheap to anticipate the corporate to at the least retain a lot of the enterprise that it has. If that is so, then Ulta Magnificence is an inexpensive inventory to significantly contemplate shopping for now.

For its half, Ulta Magnificence’s administration is shortly profiting from a budget inventory value. The corporate spent virtually $300 million repurchasing shares in Q1, which was probably the most it had spent in a single quarter in a 12 months. And administration is permitted to spend $1.8 billion extra at its discretion. Contemplating the inventory remains to be low cost, I would not be shocked to see administration hold shifting quick.

That is nice for shareholders. In his 2022 letter to Berkshire Hathaway shareholders, investing nice Warren Buffett stated, “When an organization overpays for repurchases, the persevering with shareholders lose.” There was far more to Buffett’s level right here in that letter. However suffice it to say that share repurchases typically work out higher when the inventory is reasonable, as within the case of Ulta Magnificence.

Ulta Magnificence’s gross sales are extra resilient than one would possibly assume because of its 43 million loyalty members. Traders appear to have forgotten this level, which has dropped the inventory to low cost ranges. That is truly good for shareholders, since administration can repurchase shares at these low cost ranges. But it surely’s additionally a possibility for retail buyers to purchase shares of Ulta Magnificence in the present day at engaging costs for the lengthy haul.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and Ulta Magnificence. The Motley Idiot has a disclosure coverage.