Discovering decade-defining investments is each investor’s dream. There have been a number of examples of shares which were high performers for a very long time, giving early traders incredible returns.

One inventory that may very well be a high chip funding of the last decade is Taiwan Semiconductor Manufacturing (TSM 3.68%). TSMC, because it’s generally recognized, is already on the high of the chip fabrication meals chain, however its jaw-dropping progress projection over the following few years will make it among the finest inventory picks of the approaching decade.

Taiwan Semiconductor is a vital a part of massive tech

Taiwan Semiconductor is in a dominant place in its business as a consequence of its consumer base. Not one of the high massive tech firms, like Nvidia or Apple, has the power to provide its personal chips. As a substitute, they design them in-house after which ship these designs to TSMC to be manufactured. As a result of TSMC is barely a fabrication facility and is not attempting to compete towards any of its shoppers, its shoppers can relaxation assured that the competitors is not stealing their designs.

Moreover, TSMC has the perfect manufacturing capabilities within the business, and never utilizing TSMC has confirmed to be a mistake. Taiwan Semiconductor has the power to provide 3 nanometer (nm) chips proper now, however is slated to launch 2 nm and 1.6 nm chips within the second half of 2025 and 2026, respectively. No person else presently has these capabilities, so this new expertise shall be vital to staying on high.

If you would like essentially the most superior chip expertise obtainable, you will need to work with TSMC. This alone makes TSMC an intriguing inventory.

Nonetheless, some bears could level out that almost all of Taiwan Semi’s manufacturing is in Taiwan, making it topic to China takeover fears and U.S. tariffs. Whereas it is a legitimate argument, tariffs presently do not affect semiconductors, and a China takeover would trigger important geopolitical battle that might probably destroy the broader market.

Taiwan Semi can be pouring $100 billion into new services within the U.S., together with three manufacturing services, two packaging facilities, and one analysis and growth (R&D) heart. Whereas TSMC’s administration and the president of Taiwan have denied that President Donald Trump precipitated this enlargement, the result’s precisely what Trump needs.

Whereas all of this stuff make for a powerful funding pitch, why will Taiwan Semiconductor be the perfect chip funding of the last decade?

The inventory is dust low cost for its sturdy progress projection

As a result of Taiwan Semiconductor is extraordinarily well-connected within the chip business, it has entry to info that no one else does. That is very true as a result of most shoppers place chip orders years prematurely, which is why TSMC’s present U.S. chip manufacturing capability has offered out demand via 2027.

When administration speaks about sturdy progress, traders ought to hear. Over the following 5 years, Taiwan Semi’s administration sees synthetic intelligence (AI)-related chips increasing at a forty five% compound annual progress charge (CAGR) and general income progress approaching a 20% CAGR. That is extremely fast progress, and if it comes true, it might point out that Taiwan Semi’s income would rise almost 150% over the following 5 years.

Few firms can match that progress, and that steerage makes the inventory a powerful purchase, so long as the inventory worth is affordable. Following the marketwide sell-off, TSMC’s inventory is now extremely low cost and has a ton of progress potential simply from its valuation returning to a standard stage.

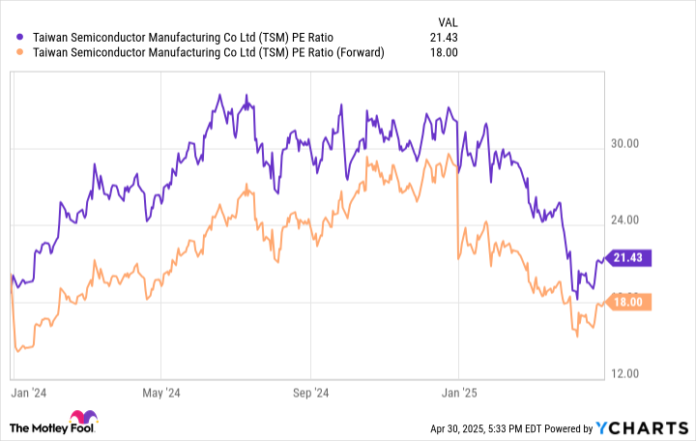

TSM PE Ratio knowledge by YCharts

Contemplating that the broader inventory market, as measured by the S&P 500, trades for 22.1 occasions trailing earnings and 20.5 occasions ahead earnings, Taiwan Semiconductor trades at a reduction to the market regardless of projections that it’ll develop at a a lot faster-than-market tempo.

This can be a clear indication that the inventory is a powerful purchase and can probably be a high funding over the following decade. Taiwan Semiconductor is considered one of my high shares to purchase proper now, as its progress and low cost price ticket ought to propel it to market-crushing standing.

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.