Given how a lot information is swirling about this month concerning tariffs, you’ve got possible heard in regards to the 25% tariffs that the Trump administration slapped on all imported automobiles that started final week. On high of these steep import taxes, subsequent month is scheduled to deliver one other 25% tariff on all automotive elements shipped in from outdoors the U.S. market.

It is an enormous transfer, and doubtlessly a really expensive one for the automotive firms and for his or her clients. It has shaken the trade and despatched many automotive shares spiraling downward. Nicely, all aside from one or two, together with the often-overlooked Ferrari (RACE -0.01%).

How’s it trying?

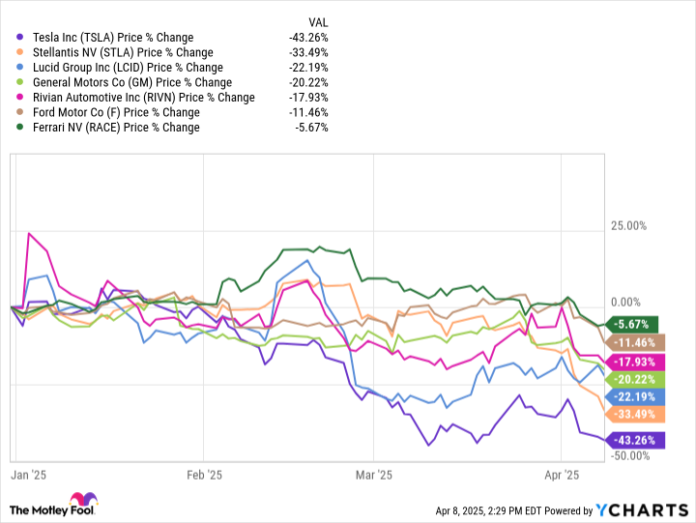

It takes solely a look at year-to-date inventory costs to see how devastating the tariff bulletins have been.

Knowledge by YCharts.

Traders might need thought Ferrari can be one of many hardest hit for the reason that 25% tariff slapped on its imported ultra-luxury automobiles can be a a lot larger chunk than, say, a mean mainstream $40,000 automobile. In any case, that is the automobile firm that produces the F80, which retails at a staggering $3.9 million earlier than choices!

Whereas that is true, traders even have to think about context. That context is that Ferrari’s typical client would not actually have cash points. It is the driving drive behind the inventory’s resiliency throughout a recession, since these shoppers are much less affected by such downturns and proceed shopping for Ferraris whatever the financial outlook.

Additionally weighing in its favor is that the corporate focuses on very strict exclusivity, going as far to restrict the variety of automobiles it sells to maintain demand excessive and costs sturdy. You may see the pricing energy as not too long ago because the fourth quarter when the variety of Ferraris bought elevated a modest 2% however its income jumped 14%. The common automobile bought value greater than $500,000.

Extra excellent news

Even higher, Ferrari’s excellent pricing energy filters all the way down to the underside line as effectively. Working revenue jumped 26% yr over yr throughout the fourth quarter whereas earnings per share jumped a big 32%. Ferrari is a cash-printing machine, but it surely’s additionally extremely according to income positive aspects over time, as you possibly can see under.

Knowledge by YCharts.

Even the slight dip brought on by the pandemic did not final for lengthy. Ferrari traditionally trades at a premium, and barely will traders get a chance to purchase at a reduction. Besides, the corporate launched a $2 billion share-buyback program in 2022, which suggests administration believes it might nonetheless be undervalued.

To place in perspective how highly effective Ferrari’s pricing and margins are, merely examine them to mainstream automakers.

Knowledge by YCharts; TTM = trailing 12 months.

To place it bluntly, not solely is Ferrari arguably one of the best automotive inventory to personal, it is doubtlessly top-of-the-line shares to personal, interval. Over the past 10 years, the inventory worth has zoomed 627% larger and left the S&P 500‘s 151% acquire within the rearview mirror.

So, in the case of automotive tariffs, do not be shocked if the automaker as soon as once more reveals its resiliency and pricing energy, because it nearly actually can and can move the fee on to its profitable audience. It is simply another reason proudly owning Ferrari is a great funding, and even a small 6% dip yr up to now is likely to be an entry level.

Daniel Miller has positions in Ford Motor Firm and Basic Motors. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot recommends Basic Motors and Stellantis. The Motley Idiot has a disclosure coverage.