This trade nonetheless has a variety of upside.

I have not had cable or satellite tv for pc TV in years. I solely stream video content material on demand from the web as of late. Hundreds of thousands of individuals are similar to me, after all. And since adoption charges of streaming TV are so excessive, it is easy to miss simply how briskly this house remains to be rising.

Over-the-top (OTT) refers to streaming video no matter what sort of machine one makes use of to stream it. In accordance with MarketsandMarkets, from 2022 by means of the top of 2027, international income for the OTT market is predicted to greater than double, an unimaginable enlargement fee.

Linked TV (CTV) refers simply to TVs that may connect with the web. Analysis group eMarketer expects the U.S. CTV market to develop by 10% yearly by means of 2027 and doubtlessly even quicker in worldwide markets.

These aren’t essentially authoritative research on the topic, and forecasts are normally considerably off. However different research and analysts agree: Streaming video, significantly CTV, remains to be rising at a unprecedented fee, and development is predicted to proceed for years to come back. Consider it or not, Roku (ROKU -3.83%) owns virtually half the house.

What is going on on with Roku?

In its letter to shareholders within the second quarter of 2024, Roku’s administration cited knowledge from Comscore CTV Intelligence knowledge. The information for Could 2024 confirmed that 47% of time spent on a CTV machine was spent on a Roku machine. That is 3 times bigger than the second-place CTV model, Amazon.

Simply how a lot time are folks spending on Roku’s platform? In Q2 alone, the practically 84 million households with Roku gadgets streamed over 30 billion hours of video content material. That was up 20% yr over yr, far greater than its person development, displaying simply how way more individuals are streaming video now.

That is nice information from a enterprise perspective. Roku generates a big portion of its income from promoting. Extra individuals are utilizing its gadgets and spending extra time streaming, which ends up in the next variety of promoting alternatives.

Roku’s income per person ought to logically go up as customers spend extra time streaming on the corporate’s gadgets. However this is not taking place proper now. Its common income per person over the previous yr is $40.68 in contrast with a median of $40.67 per person right now final yr. One would have anticipated it to develop at the least 20% — consistent with the expansion in hours customers spent on the platform.

One downside is that worldwide markets are a big and rising part of Roku’s income, and worldwide markets have decrease monetization charges. Nevertheless, that is not a long-term concern. Over time, greater competitors from advertisers in these markets may enhance how a lot the corporate is paid per advert.

The opposite downside is with monetization. Roku says its monetization fee largely grew quicker than the general market. However promoting spend within the media and leisure classes dropped in Q2.

Whereas regarding at first look, this may not be too large of a deal both. Contemplate that media and leisure manufacturers have spent closely lately to construct their streaming platforms. A lot of that promoting spend went to Roku because it’s the biggest participant within the house. Now that streaming platforms are targeted on higher income, they’ve pulled again on spending, which hurts Roku.

Nevertheless, if the remainder of Roku’s promoting enterprise is rising quicker than the general market, that may recommend it is nonetheless taking promoting market share.

Is Roku inventory a very good funding?

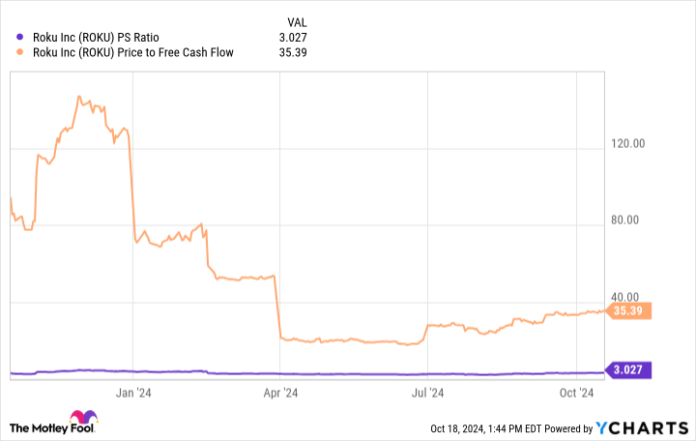

Buying and selling at about 3 instances gross sales and 35 instances its free money move, Roku inventory is fairly priced if it will possibly develop long run.

ROKU PS Ratio knowledge by YCharts. PS Ratio = price-to-sales ratio.

Concerning competitors, Roku has virtually half the market — that does not simply occur. The corporate evidently made sensible strikes to outcompete up till now, and I will give it the advantage of the doubt going ahead. Third-party analysis says the house will develop by leaps and bounds. If it holds on to a big share of the market, Roku will likely be an enormous beneficiary of the trade tailwind.

One recurring situation for Roku has been working leverage with scale — because it has grown, profitability hasn’t improved. Over the past three years, each its gross revenue margin and working revenue margin have gone down, despite the fact that income is method up.

ROKU Gross Revenue Margin knowledge by YCharts. TTM = trailing 12 months.

This chart is not what buyers wish to see. However aside from this, Roku is aptly positioned in a rising market, and its valuation is cheap. It wants its profitability to enhance, and buyers might want to watch that. Within the meantime, the comfort is that it is worthwhile from a free-cash-flow perspective.

I imagine that if Roku’s revenue margins enhance, it is set as much as be a terrific funding.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jon Quast has positions in Roku. The Motley Idiot has positions in and recommends Amazon and Roku. The Motley Idiot has a disclosure coverage.