Not all growth-oriented exchange-traded funds are constructed the identical.

Are you discouraged by the adage “it takes cash to make cash”? It would not be odd for those who had been. There’s some extent of fact to the premise, in any case — even for those who’re an amazing inventory picker, your returns are nonetheless restricted by the whole sum of money you are capable of put to work. Should you’ve received a couple of hundred bucks to start out with, it may be troublesome to purchase a significant variety of shares of anyone firm and in addition construct a diversified portfolio.

Thankfully, there is a resolution to the issue: Simply purchase a single exchange-traded fund (ETF) that already holds all the expansion shares you’d need to personal anyway. You may personal as a lot or as little of a specific ETF as your price range will permit. Higher nonetheless, you may simply add to this holding as extra funds turns into out there.

In that context, one of the best progress ETF so that you can take into account proper now’s the iShares Russell 1000 Progress ETF (IWF 0.84%).

Why the iShares Russell 1000 ETF is your greatest wager

There are definitely greater and better-known growth-oriented exchange-traded funds on the market. Take the Vanguard Progress ETF for example, which boasts $136 billion in whole belongings. And whereas it is not a progress ETF per se, the Invesco QQQ Belief could be handled as one given it holds a lot of the market’s prime progress names.

For the common long-term investor who’s seeking to keep away from extra volatility, although, the iShares Russell 1000 Progress ETF matches the invoice for a few key causes.

The Russell 1000 Progress fund is constructed to reflect the collective efficiency of all the expansion shares among the many U.S. inventory market’s greatest 1,000 corporations. As of this writing, practically 400 shares qualify to be one of many ETF’s market cap-weighted holdings.

And that nuance creates this fund’s first distinguishing issue. Whereas the iShares fund is about as top-heavy because the QQQ Belief and the Vanguard Progress ETF (because of market-crushing performances from names like Microsoft, Apple, and Nvidia), the rest of its $97 billion portfolio is much better balanced and extra consultant of the general market.

For perspective, the iShares ETF’s Tenth-biggest place — Tesla — accounts for round 2.5% of the fund’s whole worth, whereas Vanguard’s Tenth-largest holding solely makes up 1.6% of its portfolio. That disparity widens the additional away you get from both ETF’s greatest holdings and transfer towards their smaller ones. The iShares Russell 1000 Progress ETF additionally owns NYSE-listed drugmaker Eli Lilly as a top-10 place, which is not held by the Invesco QQQ Belief in any respect.

Maybe the even-better cause to purchase a stake within the iShares progress fund (notably for those who’re beginning out with a comparatively small sum of money), nevertheless, is that it gives publicity to an neglected sliver of the market you in all probability did not even know you needed: mid-cap shares.

Though the majority of the ETF’s worth comes from the big caps in its portfolio, the Russell 1000 Progress fund additionally holds a bunch of shares that are not discovered within the S&P 500 large-cap index.

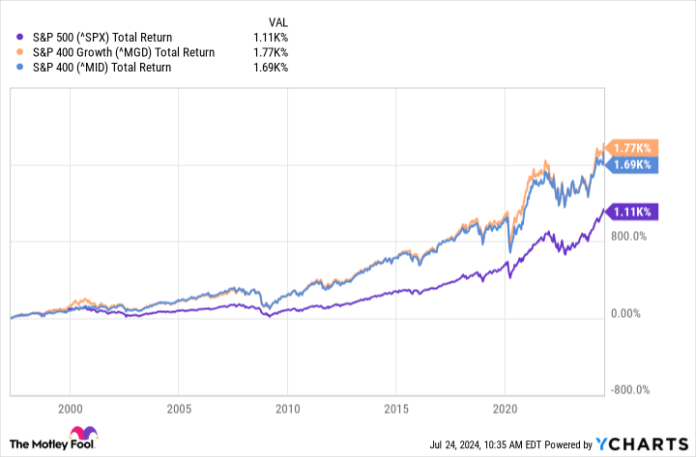

That is no small matter, both. The S&P 400 Mid-Cap Index has traditionally outperformed giant caps, whereas the S&P 400 Mid-Cap Progress Index traditionally fared even higher.

Information by YCharts.

Why? It is largely as a result of most mid-cap shares are within the candy spot of their existence, after they’ve grown past their wobbly start-up years however earlier than sheer dimension turns into a progress obstacle.

You also needs to know the Russell 1000 Progress ETF’s expense ratio is a modest 0.19%. You are not going to be considerably crimping your internet returns only for shopping for and holding this fund for the lengthy haul.

Less complicated, safer, and decrease stress

Once more, this explicit ETF is not the one growth-minded selection on the market. Both of the opposite funds could be strong progress holdings as nicely, to not point out the various different choices out there. It is not unsuitable to personal a couple of ETF, both.

For long-term progress buyers who aren’t beginning out with a ton of cash or who desire a easy holding that may be added to over time, the iShares Russell 1000 Progress ETF is a superb low-worry selection.

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Microsoft, Nvidia, Tesla, and Vanguard Index Funds – Vanguard Progress ETF. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.