These two corporations supply dividend yields which are greater than 3x to 5x the S&P 500 common.

Dividends are the unsung heroes on the subject of earning profits and constructing wealth within the inventory market. They might not be as attractive or draw the eye that high-flying development shares do, however they are often simply as rewarding, particularly over time.

If you happen to’re on the lookout for dividend shares so as to add to your portfolio, you may need to think about the next two corporations. Every has a excessive dividend yield and every is a pacesetter in industries which are prone to be round for the lengthy haul. Investing $500 into every might internet you about $65 in annual revenue at their present yields.

1. Altria Group

Tobacco large Altria Group (MO -1.11%) has been one of many highest-yielding dividend shares within the S&P 500 for fairly some time. Its quarterly dividend is $1.02 per share and it provides a ahead yield of over 8%. For perspective, the typical dividend yield of the S&P 500 stands simply above 1.3%.

When Altria introduced a dividend enhance in August, it marked the fifty fifth straight yr the corporate has raised its payout. It’s certainly one of solely 54 corporations on the inventory market that has reached the Dividend King standing, placing it in elite firm when contemplating the 1000’s of corporations on U.S. inventory exchanges.

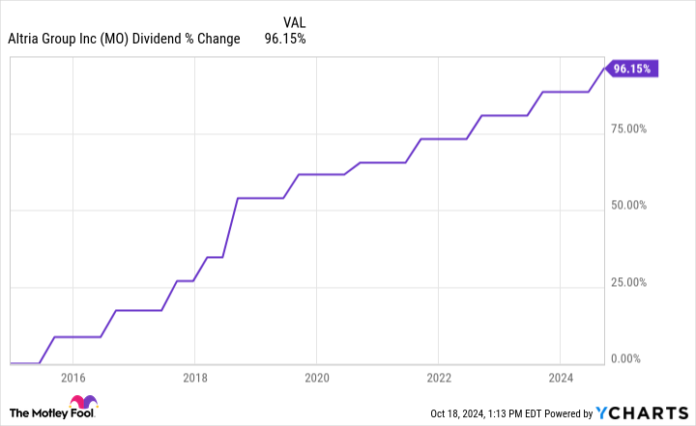

It is one factor to have a horny dividend. But it surely’s much more spectacular while you handle to maintain growing a horny dividend, which Altria has carried out — nearly doubling it previously decade.

MO dividend information by YCharts.

Altria has maintained a stronghold within the cigarette business for some time. Smoking charges have been steadily declining within the U.S., affecting quantity, however the pricing energy that it might exert has allowed it to offset this decline and maintain its financials wholesome.

The corporate has to search out viable smoke-free choices to take care of its management place in the long run. It failed with its $12.8 billion Juul funding (placing it flippantly), however its latest vaping enterprise, NJOY, has been making optimistic strides. Within the second quarter, NJOY consumables cargo volumes elevated by 14.7% to 12.5 million items, and NJOY gadgets’ cargo quantity jumped by 80% to 1.8 million items. This introduced the totals to 23.4 million and a couple of.8 million, respectively, within the first half of 2024.

Cigarettes would be the mainstay of Altria’s enterprise for the foreseeable future. Nevertheless, it is encouraging to see it making the investments wanted for long-term success. Within the meantime, buyers can benefit from the firm’s profitable dividend, which ought to proceed growing for a number of years to return.

2. AT&T

AT&T (T -0.87%) is getting accolades from buyers for its improved monetary image after some turbulent years brought on by a misguided resolution to get entangled within the media and leisure business. The corporate took its lumps, offered off its underperforming property, and returned to its telecom roots, and the outcomes have been paying off. The inventory is up over 26% this yr (as of Oct. 21), marking its greatest stretch shortly.

Even after slashing its dividend by almost half within the spring of 2022, AT&T stays one of many extra enticing dividends within the S&P 500. Its quarterly payout is $0.28, with a ahead yield of simply over 5%.

Due to its excessive payout, buyers have had issues that AT&T may need stretched itself too skinny to take care of its dividend. Nevertheless, latest monetary efficiency reveals these issues might have been overblown.

Not solely has AT&T managed to knock off an enormous chunk of its long-term debt over the previous few years, nevertheless it has additionally generated encouraging free money movement (which is the place dividend payouts ought to ideally come from).

T whole long-term debt (quarterly); information by YCharts.

In its final quarter, AT&T generated $4.6 billion in free money movement whereas paying out round $2.1 billion in dividends. That payout ratio is decrease than what the corporate has traditionally had.

For development, the corporate will lean on its fiber enterprise. It will not generate the income its postpaid telephone enterprise will, nevertheless it’s an space that’s nonetheless underpenetrated and represents the following part in offering high-speed web and broadband connectivity.

AT&T hasn’t elevated its dividend because it minimize it a few years again, however on the firm’s present tempo, I am positive it is not off the desk within the comparatively close to future. When (or if) this occurs stays to be seen, however its present dividend continues to be one which buyers can respect.

Stefon Walters has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.