Development shares have taken a success out there thus far this yr as traders have entered risk-off mode, because of the financial uncertainty brought on by the continuing tariff-fueled commerce struggle. Nonetheless, the great half is that the inventory market sell-off has introduced the valuations of some fast-growing firms all the way down to engaging ranges.

C3.ai (AI 2.45%), as an example, has witnessed a considerable pullback of 44% in its inventory value this yr and is now buying and selling at just below $20. The enterprise synthetic intelligence (AI) software program supplier trades at a considerable low cost when in comparison with the place it was on the finish of 2024. On the similar time, C3.ai has been rising at a pleasant clip, including new prospects and touchdown greater offers with current ones.

The corporate is in a stable place to profit from the enterprise AI software program market in the long term. That is why somebody trying to put $20 right into a progress inventory proper now ought to positively think about taking a more in-depth take a look at C3.ai.

Under, I will present you why a $20 funding in C3.ai might turn into a sensible long-term transfer.

C3.ai’s accelerating progress is right here to remain

The demand for enterprise AI software program is selecting up, which explains why C3.ai’s progress charge has been bettering, as properly. Within the third quarter of fiscal 2025 (which ended on Jan. 31), the corporate reported a 26% year-over-year leap in income to $99 million. That was larger than the 18% income progress it reported within the prior-year interval.

C3.ai’s enterprise AI functions serve a number of verticals, corresponding to buyer relationship administration (CRM), monetary companies, protection and intelligence, and supply-chain administration, amongst others. It additionally affords an agentic AI platform by which prospects can construct, deploy, and function AI brokers. These choices are actually being utilized by a number of companies and authorities organizations.

In its February earnings launch, C3.ai administration identified that its AI software program instruments are being deployed by the likes of Sanofi, ExxonMobil, Nucor, the U.S. Division of Protection, the U.S. Air Power, and a number of state authorities businesses. Importantly, C3.ai’s buyer record is prone to get longer as the corporate has been signing extra agreements and conducting pilot tasks with potential purchasers.

C3.ai closed 66 agreements in fiscal Q3, a rise of 72% from the year-ago interval. These included 50 pilot tasks with prospects of varied sizes. An vital factor to notice is that C3.ai has adopted a sensible technique of partnering with main cloud service suppliers, corresponding to Amazon, Microsoft, and Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) Google, to supply its AI software program instruments on their platforms.

C3.ai has been targeted on strengthening its partnerships with these cloud giants, and that transfer is reaping wealthy rewards for the corporate. For instance, C3.ai is now providing its complete suite of enterprise AI utility software program on Microsoft’s business cloud platform after the 2 firms bolstered their partnership final yr.

The expanded settlement led to a 460% improve within the agreements closed by C3.ai on Microsoft’s cloud platform. Even higher, C3.ai is providing its AI options by Microsoft’s world gross sales infrastructure, and this transfer has allowed it to boost its certified gross sales pipeline by a whopping 244% from the year-ago interval.

C3.ai believes that it might probably collectively pursue 621 new buyer accounts with Microsoft, which might assist the corporate seize an even bigger share of the generative AI software program market sooner or later. Because of this, there is a good likelihood that the corporate’s progress might turn into higher than Wall Road is anticipating.

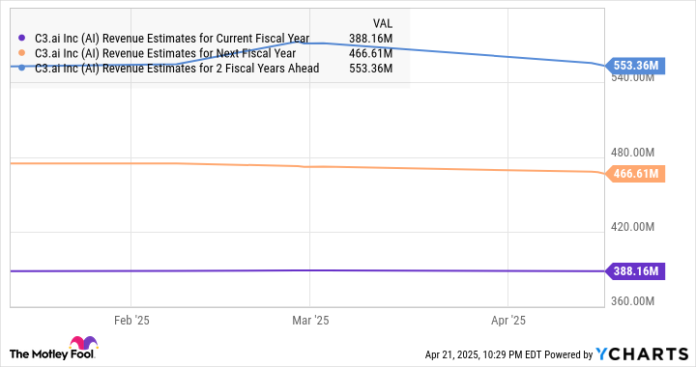

AI income estimates for present fiscal yr knowledge by YCharts.

The chart above tells us that C3.ai’s income might develop 20% in fiscal 2026 and 18% in fiscal 2027. That is decrease than the 25% progress that the corporate is anticipated to ship within the present fiscal yr. Nonetheless, the increasing gross sales pipeline, the profitable addressable alternative in AI software program, and a sensible go-to-market technique of providing its instruments by widespread cloud service suppliers might assist it exceed consensus expectations sooner or later.

A stable stability sheet and valuation make the inventory price shopping for

C3.ai is now buying and selling at simply 6.7 occasions gross sales, which is considerably decrease than its price-to-sales ratio of 11.2 on the finish of 2024. The inventory’s gross sales a number of is nearly consistent with the U.S. know-how sector’s price-to-sales ratio, which makes it price shopping for contemplating the potential progress on provide.

Moreover, C3.ai has a stable stability sheet with simply $4.5 million in debt and $724 million in money. This places the corporate in a pleasant place to aggressively put money into product growth and gross sales and advertising and marketing to profit from the end-market alternative on provide. Furthermore, C3.ai’s money place ought to give it the power to make acquisitions to strengthen its presence within the AI software program market.

All this makes C3.ai a pretty AI inventory to purchase with $20 proper now, particularly contemplating that its one-year value goal of $29 factors towards potential positive aspects of over 50% from present ranges, a goal it could possibly obtain because the dialogue above signifies.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Idiot recommends C3.ai and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.