Investing in progress shares is a tried and examined means of beating the broader market’s positive aspects, as fast-growing corporations are able to growing their revenues and earnings at a quicker tempo than the market. Their above-average progress results in wholesome inventory worth increments, making buyers richer within the course of.

So, in case your objective is to beat the broader market’s positive aspects and you’ve got simply $15 in investable money proper now, you’ll be able to contemplate shopping for one share of SoundHound AI (SOUN -1.80%) with that cash. The voice synthetic intelligence (AI) options supplier has misplaced 35% of its worth to this point in 2025, and every share of the corporate is now buying and selling at beneath $15.

Let us take a look at the the explanation why SoundHound could possibly be the neatest progress inventory which you could purchase with simply $15.

Picture supply: Getty Photos.

SoundHound AI is rising at a panoramic tempo

SoundHound AI’s voice AI platform permits its purchasers to construct varied kinds of options similar to voice-enabled AI brokers, good ordering programs for eating places, good answering programs, AI-enabled chatbots for automobiles, and customized voice AI merchandise. It is a fast-growing area of interest, which was price simply over $3 billion final 12 months however is predicted to generate $47.5 billion in income by 2034.

SoundHound AI is already making a pleasant dent on this house by constructing a strong and diversified buyer base that is unfold throughout eating places, journey and hospitality, automotive, healthcare, monetary companies, and others. From common carmakers similar to Stellantis and Hyundai to tech corporations similar to Qualcomm and Snap to good TV producer Vizio, the record of SoundHound’s clients is lengthy.

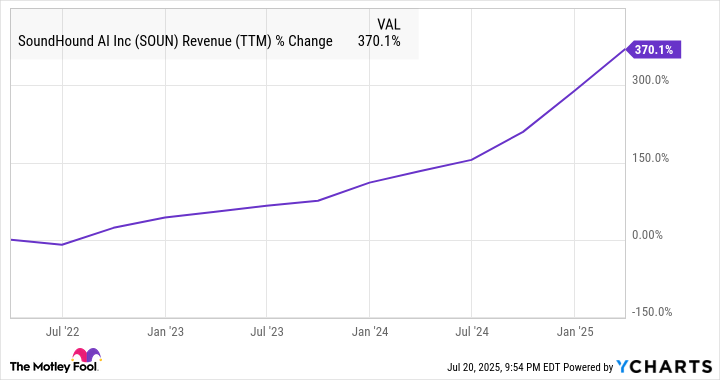

This huge and various buyer base explains why SoundHound’s progress has been unimaginable for the reason that firm went public simply over three years in the past.

SOUN Income (TTM) information by YCharts

Importantly, the corporate has been taking steps to make sure that it stays one of many prime gamers within the voice AI market by buying new corporations and introducing new merchandise. This technique has allowed SoundHound to create a wholesome income pipeline that ought to be sufficient for it to maintain spectacular progress ranges in the long term.

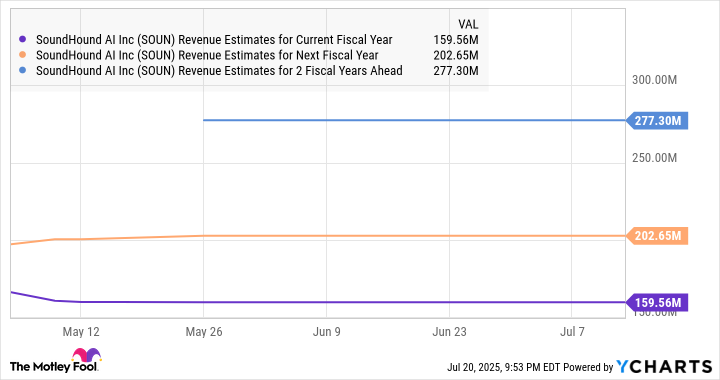

Administration identified in December 2024 that SoundHound was sitting on a cumulative subscriptions and bookings backlog price a whopping $1.2 billion. That determine is increased than the mixed income that SoundHound is predicted to generate within the present and the following two years.

SOUN Income Estimates for Present Fiscal Yr information by YCharts

After all, SoundHound does level out that this metric refers to “present estimates of future efficiency based mostly on varied assumptions, which can or could not show to be right.” Nevertheless, the scale of the backlog appears strong sufficient to gasoline sturdy progress sooner or later even when it is not capable of convert all of its potential pipeline into precise income.

Furthermore, SoundHound estimates that its complete addressable market stands at an amazing $140 billion. So, there’s a good likelihood that the scale of its backlog might proceed to extend, because the secular progress of the voice AI market ought to assist it appeal to extra clients towards its platform and in addition encourage present ones to spend extra on its choices.

That is exactly why the earlier chart factors towards a possible acceleration in SoundHound AI’s progress fee. Buyers, nonetheless, is likely to be questioning why SoundHound AI has taken a beating this 12 months regardless of its excellent progress and sunny prospects.

Development buyers ought to look past valuation issues

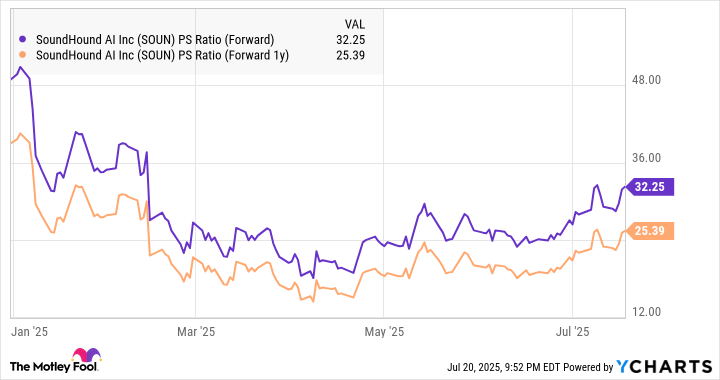

SoundHound inventory multiplied buyers’ wealth dramatically final 12 months. In consequence, its price-to-sales ratio shot as much as greater than 90 on the finish of 2024. The turmoil in tech shares earlier this 12 months weighed on SoundHound, as buyers booked earnings in costly shares in a bid to protect their capital amid the inventory market uncertainty attributable to tariffs and conflicts.

SoundHound’s gross sales a number of is now right down to 46. Although that’s nonetheless costly, buyers have to remember the fact that the corporate is on observe to just about double its income in 2025 based mostly on the midpoint of its income steering vary of $157 million to $167 million. As SoundHound is predicted to maintain sturdy progress ranges over the following two years, its ahead gross sales multiples are decrease.

SOUN PS Ratio (Ahead) information by YCharts

The costly valuation might expose SoundHound to volatility, however the firm is able to justify the premium due to its spectacular progress and the scale of its addressable market. All this makes SoundHound AI a wise progress inventory to purchase with simply $15 as a result of it has the power to continue to grow at above-average charges in the long term.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Qualcomm. The Motley Idiot recommends Stellantis. The Motley Idiot has a disclosure coverage.