Walgreens has agreed to be taken personal, however the settlement is a bit advanced. There is a cause to purchase the inventory regardless of the deal.

Walgreens Boots Alliance (WBA 0.29%) has been a troublesome inventory to like for just a few years, because of a number of company missteps. It obtained so unhealthy that the board determined the very best plan of action was to impact a turnaround beneath personal palms. That deal implies that Walgreens will not be a publicly traded firm a yr from now. However that is not the complete story, and extra aggressive buyers may nonetheless have an interest within the inventory due to a singular nuance of the take-private transaction. This is what it’s essential to know.

From trade big to going personal

There are solely a handful of huge pharmacy retailers, and Walgreens is one among them. For a few years it was a development enterprise, however finally the market grew to become saturated. Usually there was a Walgreens on one nook and one among its rivals simply throughout the road. It is not stunning that development stalled out all through the sector.

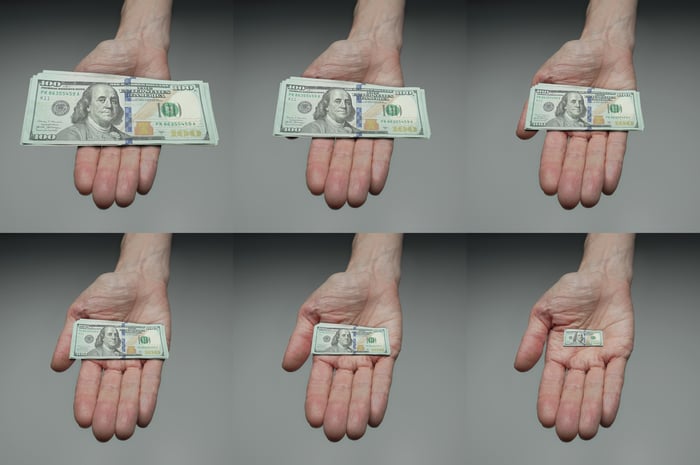

Picture supply: Getty Photographs.

What occurred subsequent was that Walgreens regarded for different methods to continue to grow its enterprise. It tried to purchase into the pharmacy advantages administration enterprise, however that did not go in addition to hoped. After which it began to construct out a healthcare clinic operation, however that did not go in addition to hoped. This firm, which was on observe to grow to be a Dividend King, ended up slicing after which eliminating its dividend (the elimination got here after the take-private settlement happened).

Walgreens had not too long ago been working to right-size its enterprise, together with closing places. Nevertheless, the revamp is prone to be a big endeavor that might be troublesome to impact within the public markets. Buyers do not prefer it when firms shrink, and that is precisely what Walgreens is within the means of doing. So, in early March, it agreed to be taken personal by Sycamore Companions Administration for $11.45 per share. The transaction is prone to shut someday within the second half of 2025.

Why is Walgreens buying and selling for greater than the deal value?

Usually in a takeover state of affairs, the inventory of the corporate being acquired trades for barely lower than the takeover value. That is as a result of there’s all the time a danger that the deal falls aside. Nevertheless, Walgreens’ shares are buying and selling palms for barely greater than the takeover value, which means that there’s something odd occurring right here.

The wrinkle is that Sycamore Companions is planning on promoting Walgreens’ medical clinic enterprise. And it’ll give Walgreens shareholders a discount that could possibly be value as much as $3 per share, relying on the gross sales value it will get for the clinic enterprise. So buyers which can be paying over $11.45 per share for Walgreens proper now are, primarily, shopping for that chit, since they’re locking in a loss on the Walgreens shares.

There’s only one downside. There isn’t any timeline for the sale of the clinic enterprise. And there’s no assure on the worth that Sycamore Companions will extract from the customer. So the $3 chit could possibly be nugatory or, conversely, the size of time it takes to see any cash could possibly be very lengthy, lowering the time worth of the potential revenue. There’s simply no option to inform what the result might be.

And, as such, shopping for Walgreens right now isn’t one thing that almost all buyers ought to do, notably if they’re conservative by nature. Extra aggressive sorts that like particular conditions could prefer it, because the clinic enterprise in all probability does have some worth. However it’s nonetheless a high-risk play that has a most upside of round 25%. That seems like loads, and it’s, however provided that the money arrives shortly.

Walgreens might be gone in a yr, however not forgotten

In a single yr, Walgreens will not be a public firm. However it would linger within the minds of buyers due to the $3 chit tied to the sale of the medical clinic enterprise. That stated, in the long run, it appears extremely doubtless that Walgreens will finally go public once more — with utterly totally different shares — hopefully with a greater trade place. Nevertheless, solely aggressive buyers must be Walgreens proper now.