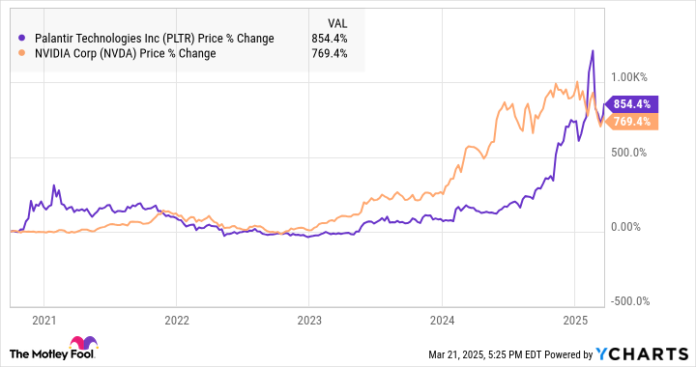

From its launch in late 2020 to March 24, 2025, Palantir Applied sciences (PLTR 6.43%) inventory has returned a formidable 952%. That signifies that if you happen to invested $10,000 at its IPO, you’d now have a whopping $105,200. This instance highlights the life-changing potential of inventory market investing and the significance of getting a long-term perspective.

That stated, Palantir’s previous efficiency would not assure its future efficiency — particularly as challenges like authorities downsizing and doable overvaluation chip away at its progress thesis. Let’s dig deeper to seek out out what the following half decade might have in retailer for the corporate.

Palantir’s progress is not as spectacular as you would possibly assume

Whereas Palantir’s inventory efficiency makes it seem like an unstoppable expertise monster, the truth is a bit more sophisticated. Whereas the corporate posts respectable progress, it is not improbable. Palantir’s fourth-quarter gross sales jumped 36% 12 months over 12 months, pushed by the rising adoption of its AI knowledge analytic instruments by the federal government and business purchasers, whereas its internet earnings fell 21% 12 months over 12 months to $76.9 million.

To place this efficiency in context, Nvidia (one other top-performing AI inventory) noticed its fourth-quarter gross sales leap by 78% 12 months over 12 months to $39.3 billion, whereas internet earnings soared by 80% to $22.1 billion. The chipmaker enjoys a considerably increased progress charge than Palantir, although each equities have comparable efficiency. The distinction is valuation.

Whereas Nvidia inventory trades for a comparatively modest price-to-earnings (P/E) of 40, Palantir trades for a whopping 460 occasions its earnings over the trailing 12 months, making it probably some of the overvalued corporations out there. Sadly, there’s little or no to justify this dynamic.

Trump-related hype appears overblown

Shares can appeal to premium valuations when the market expects their progress to speed up sooner or later. And Palantir’s latest rally will be linked to optimism surrounding Donald Trump’s election victory. The corporate’s co-founder, Peter Thiel, is an outspoken supporter of the president and Vice President, JD Vance, who labored for him at Mithril Capital.

Nonetheless, buyers ought to method politics with warning. Whereas Palantir is a authorities contractor, having associates in excessive locations may not really create shareholder worth. In keeping with CEO Alex Karp, Thiel’s outspoken political involvement made it more durable for Palantir to get issues achieved through the first Trump administration. The corporate confronted worker backlash over its work with Immigration and Customs Enforcement (ICE).

Picture supply: Getty Photos.

Different examples, like Tesla, Disney, and Anheuser-Busch, spotlight the model danger that may happen when companies seem to take sides in controversial and politically partisan points.

Moreover, Trump’s insurance policies might not really profit Palantir’s enterprise. The brand new administration (with assist from the Division of Authorities Effectivity) has labored to downsize the general public sector. Most notably, the Pentagon plans to slash its finances by 8% over the following 5 years in a transfer that would jeopardize a big supply of Palantir’s gross sales.

The place will Palantir inventory be in 5 years?

Palantir’s present valuation appears to cost in a dramatic improve in prime and bottom-line progress. And it is exhausting to see this occurring. The U.S. authorities is downsizing, and the corporate faces competitors within the non-public sector from comparable rivals like Snowflake and Microsoft Cloth. Its founder’s political affiliations might introduce much more danger.

With all this in thoughts, Palantir’s inventory is unlikely to copy the unbelievable returns it loved over the earlier 5 years. And buyers ought to keep far-off till its inflated price ticket comes again right down to earth.

Will Ebiefung has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Microsoft, Nvidia, Palantir Applied sciences, Snowflake, Tesla, and Walt Disney. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.