Likelihood is, it is going to be larger and higher.

Nu Holdings (NU -2.38%) continues to wow buyers with its unimaginable development. The Brazil-based digital banking platform is including clients at a quick tempo, producing excessive income, and it has turn into firmly worthwhile. Nu inventory gained 104% final yr, and it is already up 46% in 2024.

That’s, little question, joyful information for shareholders — amongst them Warren Buffett-led Berkshire Hathaway, which holds the inventory in its fairness portfolio. So the place may the shares be a yr from now? And will buyers think about shopping for at present?

Extra clients

Nu has been including clients at a fast tempo. That is not shocking because it gives an all-digital, easy-to-use monetary companies platform. In its residence nation of Brazil, the banking market has traditionally been dominated by 5 massive banks. Nu targets the lower-income inhabitants, who could not want all of the bells and whistles of a big financial institution, with low charges and excessive financial savings charges.

However because it soars in reputation among the many lots, it has been going after the high-income inhabitants as nicely. As of the tip of the 2024 first quarter, it counts 54% of the grownup inhabitants of Brazil as clients. It added 5.5 million new clients within the quarter in all of its markets, together with Mexico and Brazil.

It launched a high-yield financial savings account in Mexico final yr, and buyer depend in Mexico elevated 106% yr over yr within the first quarter, and it just lately launched the same account in Colombia.

Nu ended the primary quarter with 99.3 million clients, a rise of greater than 20 million from the yr earlier than. Anticipate that quantity to be loads greater in a yr from now, with contributions from all of its markets.

Extra gross sales

Nu’s technique is to draw clients with its low charges and excessive charges and cross-sell new merchandise. It makes cash from each new accounts and extra product adoptions, and one among its essential top-line metrics is common income per energetic person (ARPAC).

Each income and ARPAC are rising at excessive charges. Income elevated 64% yr over yr (foreign money impartial) within the first quarter, and ARPAC elevated from $8.60 to $11.40. These traits, with extra clients and better product adoption resulting in robust double-digit income development, are more likely to proceed at regular charges by means of subsequent yr.

Extra income

Nu operates an asset-light mannequin as an all-digital app with no bodily branches. Its technique of upselling merchandise is resulting in greater income with out greater buyer acquisition prices, and the fee to serve has remained pretty regular at $0.90.

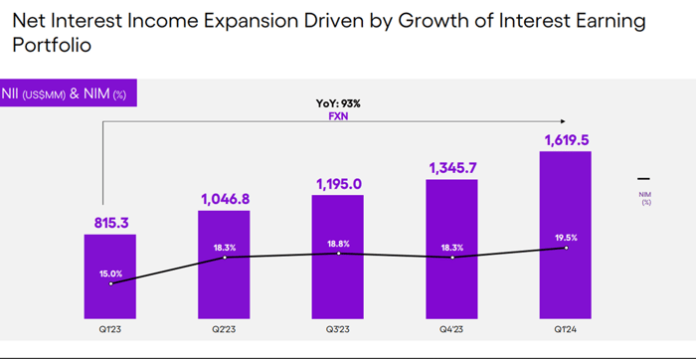

It additionally operates a sturdy credit score enterprise with growing web curiosity revenue, which provides to complete web revenue.

Picture supply: Nu Holdings.

The Mexican and Colombian markets, nonetheless, are each nonetheless unprofitable. In the intervening time, administration sees it in Nu’s curiosity to function in these markets unprofitably to achieve a foothold, generate curiosity, and set up its model. Brazil, its extra mature market, is worthwhile sufficient to maintain the enterprise worthwhile as a complete whereas it will get into these markets.

Internet revenue ought to hold growing by means of subsequent yr, but it surely’s unclear how lengthy Mexico and Colombia will stay unprofitable. Administration sees the identical trajectory as for these nations that Brazil went by means of, ultimately attaining profitability at scale. Nonetheless, it nonetheless considers them to be in an funding stage, and profitability could also be a methods off.

Extra inventory positive aspects

Nu inventory stays at an inexpensive worth for what it provides, and it might be undervalued. It trades at a ahead price-to-earnings ratio of 18, suggesting that there is loads of room for it to maintain climbing with out turning into overvalued.

It is not with out danger. If it would not turn into worthwhile quickly in Mexico and Colombia, that would affect general profitability. It is going through powerful competitors in some markets, and it is nonetheless constructing its enterprise with new markets in Brazil. In a yr from now, although, it must be larger and extra worthwhile, and the inventory worth ought to mirror that development.

Jennifer Saibil has positions in Nu Holdings. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot recommends Nu Holdings. The Motley Idiot has a disclosure coverage.