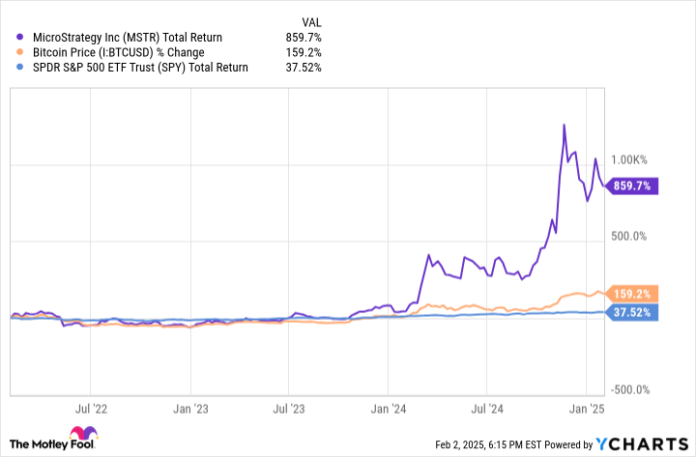

Bitcoin has performed nicely for buyers through the previous three years, just lately hitting an all-time excessive. MicroStrategy (MSTR 3.67%), which has gone all in on shopping for Bitcoin, has performed even higher. In the course of the previous three years, the S&P 500 index is up 38%, Bitcoin is up 159%, and MicroStrategy is up virtually 860% as of this writing. These are unimaginable returns in just some quick years, lifting MicroStrategy’s market cap to virtually $90 billion.

MicroStrategy’s Bitcoin shopping for has led to immense wealth technology for its shareholders. Is the social gathering set to proceed for the remainder of the last decade? Let’s lay out some situations for MicroStrategy, and the place the inventory may head in 5 years.

Aggressive Bitcoin shopping for technique

MicroStrategy is a software program firm that began to make use of its stability sheet to purchase Bitcoin a number of years in the past. This easy technique for how you can handle treasury reserves has morphed the corporate right into a Bitcoin-buying behemoth that has benefited mightily from the hovering value of Bitcoin. In the course of the previous 5 years, MicroStrategy’s inventory is up 2,100%.

As of its newest replace in November, MicroStrategy owned 279,420 bitcoins. Utilizing right now’s value of about $102,000, these Bitcoin holdings are at the moment value roughly $28.5 billion. How did a small software program firm finance these purchases? Easy: With debt and fairness choices. MicroStrategy has levered its stability sheet and diluted current shareholders with a view to purchase Bitcoin.

Its shares excellent are up 122% through the previous 5 years, as the corporate used widespread inventory choices to lift funds for Bitcoin purchases. On the finish of final quarter, MicroStrategy had $4.2 billion in debt on its stability sheet. It has taken on a lot of this debt to load up on extra Bitcoin. That is solely the start of MicroStrategy’s Bitcoin shopping for plan, not less than based on administration. It needs to promote $21 billion in fairness by promoting shares to the general public and $21 billion in debt to purchase extra Bitcoin.

This technique has labored splendidly up to now. However what occurs in a market downturn?

How will issues go in a bear market?

Bitcoin has gone by way of loads of downturns since its inception roughly 15 years in the past. There have been two declines of greater than 50% through the previous 10 years, with loads extra within the 25% to 30% vary.

A chronic decline — and even simply value stagnation — can be a big concern for MicroStrategy. It has convertible notes on its stability sheet which can be due within the years 2025-2032. Convertible notes are a kind of debt with decrease rates of interest, however they will also be transformed to inventory if the share value is above a sure degree. Nevertheless, if the value is beneath the convert degree, the corporate has to repay the principal on this debt on the due date.

MicroStrategy may get hit with a double whammy if the value of Bitcoin goes down (which it has loads of occasions). This could trigger a decline in MicroStrategy’s share value, which might deliver it beneath the conversion value for its convertible notes. Then, it must receive money to repay this debt, with the one belongings accessible being the Bitcoin it has on the stability sheet. This might trigger the corporate to promote its Bitcoin at a reduction to repay its debt.

Lengthy story quick: MicroStrategy wants the value of Bitcoin to maintain rising for its Bitcoin shopping for technique to work.

MSTR Complete Return Stage information by YCharts.

The valuation math is lower than ultimate

Even when the value of Bitcoin retains rising, the mathematics round MicroStrategy’s valuation makes little sense.

Immediately, MicroStrategy has a market capitalization of virtually $90 billion. It has Bitcoin holdings value about $28.5 billion. Subtract out its $4.2 billion in long-term debt, and you’ve got a web asset worth (NAV) of $24.3 billion. The market cap of $90 billion is near 4 occasions its Bitcoin holdings. The underlying software program enterprise is not value a lot on this equation.

MicroStrategy’s inventory value has indifferent from the belongings on its stability sheet. You would not purchase a greenback for 4 {dollars}, so why would you purchase MicroStrategy at 4 occasions its Bitcoin holdings? If you would like publicity to Bitcoin, purchase the asset instantly as a substitute.

Keep away from shopping for MicroStrategy inventory in your portfolio proper now. Maybe the inventory will probably be larger in 5 years if Bitcoin retains surging, however given the detachment from the underlying Bitcoin value, I believe it is possible that the inventory will underperform the efficiency of precise Bitcoin through the subsequent 5 years. Bitcoin shouldn’t be assured to rise, both.

Although the inventory has performed phenomenally nicely through the previous 5 years, it seems to be like a nasty wager for buyers to make proper now.